Gold as Proxy: What does it mean for my 401k?

Gold Repatriation, Market Rotation, and Basel III: A Structural Shift

Authored by GoldFix, ZH Edit Unlocked

Introduction

The financial markets are undergoing a noticeable shift, driven by macroeconomic factors, capital rotation, and policy changes. The ongoing discussion about gold repatriation and its impact on GDP, combined with Basel III regulatory requirements, underscores the evolving nature of global financial positioning. This short essay will explore recent market trends, the implications of gold’s role in trade and monetary policy, and the regulatory landscape ahead.

The following current events will be touched upon in context of Trump’s first two months:

- Gold repatriation as indication of world-view shift

- Germany’s increased deficit spending

- Tariffs

- Gold’s hidden effect on GDP

- Fed policy and the USD

Rotation from Equities to Commodities

A key market trend emerging is the rotation from equities into hard assets. Gold, silver, and copper are outperforming stocks, a reversal from previous risk-on market conditions. The S&P 500 saw strength late last year, but equities have since backed off their highs. In contrast, gold has firmed up, suggesting capital is reallocating into safer, inflation-resistant assets. But its not just about inflation risk. it’s about a slight return to sanity.

Metals Over Stocks For the last Year...

In this way, institutional investors (like pensions and firms like Blackrock), and banks are positioning ahead of anticipated changes. A typical result would be:

- Take profits in Tech, buy dividend stocks

- Sell US companies, buy foreign companies

Specifically this time it is:

- Sell Tech, buy dividend stocks, buy bonds, buy some gold, buy some mining stocks- this last part is very new

- Sell US, buy EU, China, and Japan equities- for different economic reasons, but for one unified reason— Given the global monetary changes in play, they will benefit.

Rebalancing happens all the time with these types, but this time it is aligning with secular changes discussed here many times involving gold, mercantilism (protectionism/tariffs), and a lessened dependence on the USD for global trade.

US Stocks Middle of the Road for the Last Year...

If you are old enough to remember what happened to global markets when the Berlin wall fell and how good that was for stocks; This is not unlike the Berlin wall going up.

In this sense we believe these moves, while not necessarily explosive, are not temporary and will manifest in fits and starts. When this rebalancing is over, the new equilibrium levels between nations and amongst different asset classes will be permanently altered. The evidence to this is Gold, Silver, and Copper’s price changes over the last year as compared to stocks.These last rallies pictured occurred during a decrease of inflationary pressures.

The “Magnificent 7” basket since inception versus Gold miners....

Metals garnered hardly any headlines, yet have outperformed everything the US has to offer. Further— Gold has retaken its status as a leading indicator of change beyond it’s inflation-hedge status. Gold predicts economic policy once again, as it did before the 1990s. Which brings us to the Dollar.

The Role of Currency and Global Capital Flows in Stock

The weakening U.S. dollar further supports this. While the exact mechanism driving the dollar’s decline remains unclear, one possible explanation is market anticipation of future interest rate cuts. A weaker dollar aligns with broader macroeconomic expectations that rates will need to be lowered at some point to stem the stock market outflow by lessening opportunity cost. That’s the macro rationale, yet it’s not even half the story this time. Secular changes are driving this bus.

Stocks prefer a weaker dollar despite “American exceptionalism”. This will become even more important going forward...

Internationally, currency dynamics play a role. Right now, the euro is strengthening as Europe drives some global equity market flows. Germany has raised its spending cap to allocate more funds toward infrastructure and defense. This has led to a repatriation of capital into euros, as investors shift allocations from U.S. assets to European equities.

Germany's new financial positioning echoes previous periods of capital realignment. Some parallels exist with the post-Cold War era when German infrastructure spending created a realignment of global capital flows. Today, European monetary policy and increased fiscal activity are altering the structure of international investment. This is all in response to Trump’s Tariffs and the US anticipated withdraw from providing the bulk of European military protection under NATO.

Global dislocations are inevitable during events like these; Hence the rise in Gold as a touchstone of safety and globally recognized tool of trade in an increasingly mistrusting world.

Gold Repatriation and Its (fake)Impact on US GDP

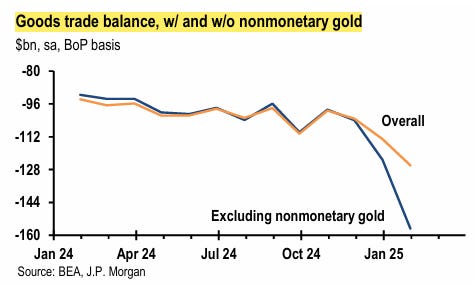

One of the more recent discussions revolves around the implications of gold repatriation. Large-scale gold imports into the U.S. have widened the trade deficit. However, because non-monetary gold is excluded from GDP calculations, these transactions do not contribute positively to economic output.

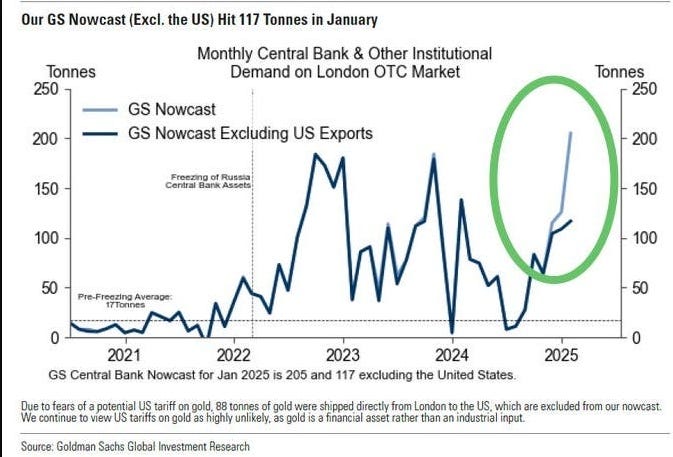

The US (light Blue) Joins China et al, Starts to Buy and Repatriate European Gold...

Goldman Sachs has addressed this issue twice, emphasizing that rising gold imports are expanding the trade deficit but not benefiting GDP. The exclusion of gold from economic output stems from its classification as a non-productive asset under traditional economic frameworks.

JP Morgan has also highlighted this effect, referencing gold imports as a factor reducing first-quarter GDP estimates to 1%. Their analysis incorporates Bureau of Economic Analysis (BEA) trade data, which categorizes imported gold as “non-monetary” unless refined into standard 400-ounce bars. The classification loophole impacts how gold transactions are reflected in economic reports.

This distinction between monetary and non-monetary gold adn its resultant GDP effect introduces another layer of complexity. We aim to now simplify.

If gold enters the country in a non-standard form, it does not count toward GDP. However, once refined and classified as monetary, it becomes part of financial reserves, changing its economic treatment. All that gold (2,000 tonnes) will be refined, after which it will be suitable for something economic even by their own biased data standards. Essentially, All Gold is Monetary Gold after it is remelted.

Why Is the U.S. Repatriating Gold?

The growing volume of repatriated gold raises fundamental questions about U.S. monetary positioning. Theories regarding the purpose of these transactions include:

Continues here unlocked

Free Posts To Your Mailbox

Stay tuned.