precious-metals

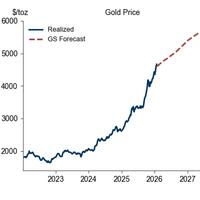

With no end of American wars and spending sprees in sight, the US dollar’s role as world reserve currency could well be in jeopardy...

Bian stands to make a net profit of around 1 billion yuan...

The gold euphoria should be tempered by an uncomfortable recognition...

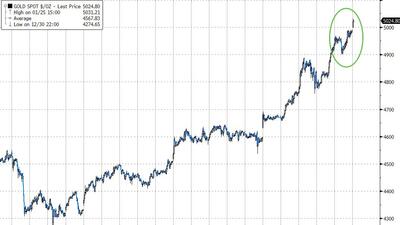

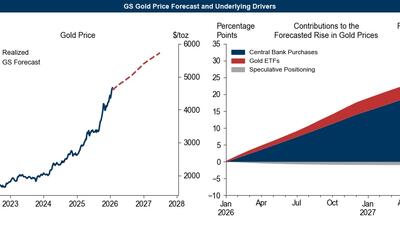

...while the air is getting thinner the higher we go in gold prices, we are not yet close to a place where the structural rally in gold is at risk...

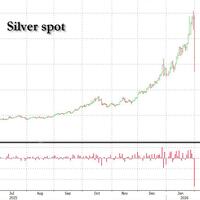

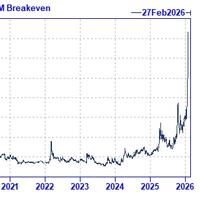

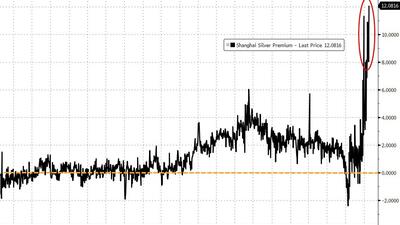

On Friday, January 30, 2026, the world learned (or rediscovered) just how grotesquely rigged the paper gold and silver markets truly are...

Estimate your earnings

oz

Calculate earnings

"I came to buy because the price of gold dropped today..."

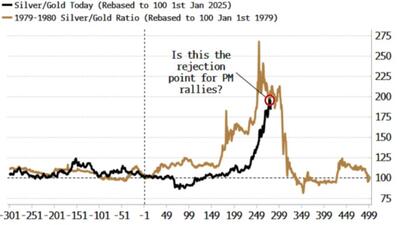

The parabolic rise of gold and silver partly reflected a growing fear that we’re losing our balance.

Goldman traders expose the numbers behind a quite extraordinary day...

"$3.5bn to sell in SLV and ~$650mm to sell in GLD today on QDS estimates"

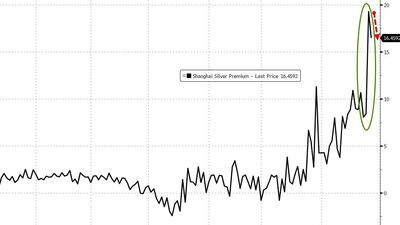

The silver/gold ratio has climbed almost as much as it did in the late 1970s, and today’s dramatic moves show that might have marked a rejection point...

... gold is "logically a safer asset than any national currency."

"A failure to deliver in gold will immediately spill over to the credit markets because gold is truly the anti-dollar or the anti-US Treasury..."

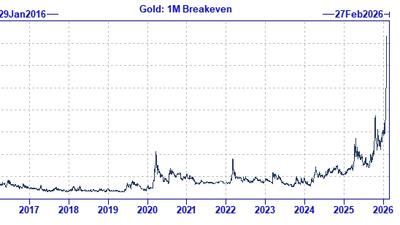

...whether bullish or bearish from here, consider selling short-dated to buy longer-dated options.

Silver (SLV) has officially become the new epicenter of retail fervor...

"This time, any selling that is attempted by bullion banks fails..."

...the options market is “positioning for more than just a short-term price jump, consistent with gold carrying a geopolitical and confidence premium,”

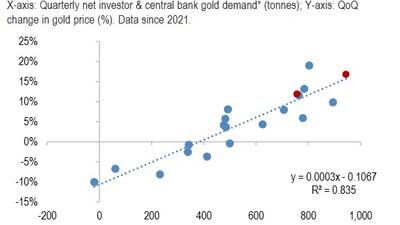

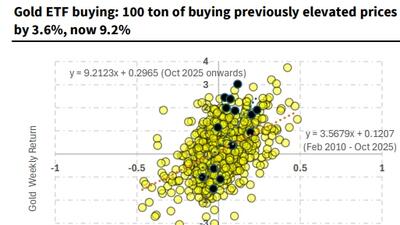

...the key upside risk Goldman had flagged - private sector diversification into gold - has started to realize...

Shift in relations and unpredictability of Donald Trump make it ‘risky to store so much gold in the US’, say experts...

...despite record highs prices, Goldman's commodity trading desk notes that spec positioning in New York and Shanghai remains close to the lows.

...three key questions (answered)