markets

Dow record high, gold green on the week, tech wrecked but S&P unch, crypto dump-and-pump...

"This week’s tape can only be categorized as adult swim... and then some..."

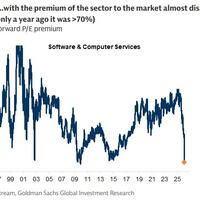

...expect it will take 2-3 quarters of stable fundamentals for investor sentiment to improve.

Estimate your earnings

oz

Calculate earnings

HGP Intelligent Energy is partnering with the Shaw Group to deploy U.S. Navy submarine and aircraft carrier nuclear reactors at the DOE's Paducah, Kentucky facility.

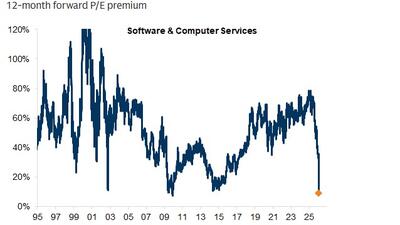

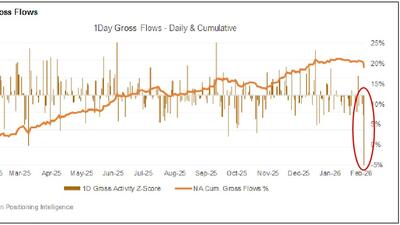

...one could argue that much of the risk is already reflected.

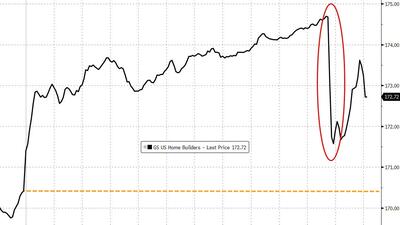

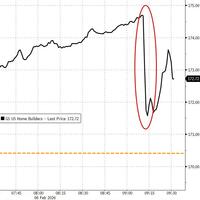

Trump admin is exploring opening an antitrust investigation into US homebuilders as the White House sharpens its focus on tackling the country’s housing affordability crisis...

“Now do we suffer the evils of prolonged peace; luxury, more ruthless than the sword, broods over us and avenges a conquered world.”

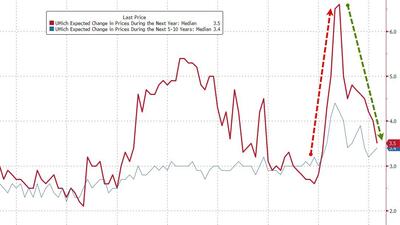

...as Democrats and Independents come to their senses.

Remember, Canadian Warren Buffett was panic-buying the stock last month...

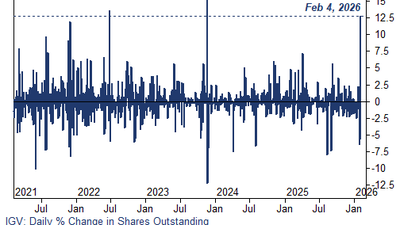

"This feels like a culmination of outright purchasers trying to find a bottom and potentially participants covering shorts." - Goldman ETF desk

...moves felt different yesterday

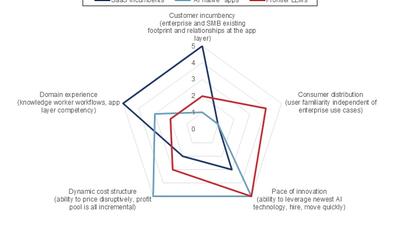

“What we’re seeing in the marketplace is fear, because nobody understands really who the winners and losers will be

HIMS is certainly FAFO-ing around in GLP-1 space.

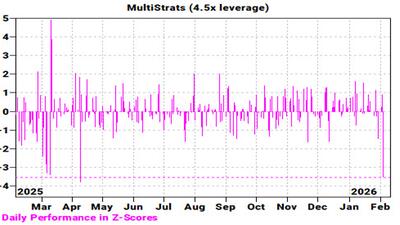

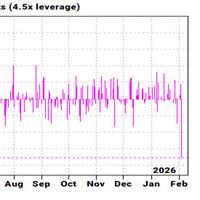

Amidst market volatility in the US, uncorrelated global trades can help diversify portfolios in addition to generating alpha...

"The reset we have announced today is part of the decisive process..."

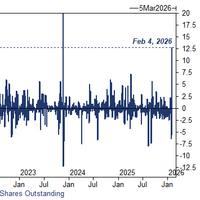

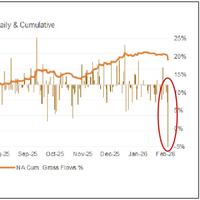

"Cracks Appearing": Another Catastrophic Day For Multi-Strats Means Basis Trade Suddenly In Jeopardy

"early signs of deleveraging underway. Balance sheet uncertainty and expected vol uptick playing into unwinds…"