Gold Breaks New ATHs as Tariffs Drive Market Shifts

Market Reaction to Tariff Announcements

Authored by GoldFix for Scottsdale

Between 10:00 and 11:00 a.m., Treasury Secretary Scott Bessent spoke on CNBC regarding tariffs, the economy, and their impact on the stock market. Around the same time, Donald Trump made similar comments. The focus here is on Bessent’s remarks and the subsequent market reaction.

The key takeaway: Bessent reaffirmed the administration’s commitment to tariffs and signaled that additional measures were on the table.

Bessent’s Comments: Tariffs are here to stay

Bessent stated that aside from metals and likely autos, everything else is up for grabs for tariff negotiations. This followed the implementation of aluminum and steel tariffs, as well as auto tariffs that took effect the previous day.

While precious metals were not explicitly mentioned, the implication was clear: tariffs will continue to expand incrementally.

In effect, Bessent indicated that:

- Aluminum and steel tariffs are non-negotiable.

- Auto tariffs are largely locked in, with some flexibility.

- Further tariffs will be applied unless other nations come to the table for negotiations.

Upon hearing this, we posted on social media at 10:09 a.m., stating: "All systems are go for copper, silver, and by proxy, gold."

Market Reaction: Gold and Silver Surge, Stocks Decline

Shortly after 10:15 a.m., a sharp rally began in gold, silver, and copper, accelerating every 15 minutes.

- S&P 500: Initially spiked but then began a steady decline.

- Gold: Rallied from $2,950 to $2,980, adding $30.

- Silver: Rose from $33.25 to $33.85.

- Copper: Climbed from $4.81 to $4.86 ½.

- Oil: Briefly surged to $67.40, before reversing lower.

Why Did Metals Rally?

The metals rally was driven by tariff speculation.

- Aluminum and steel tariffs raise concerns about potential tariffs on other metals, including copper and silver.

- Copper, already up before the announcement, surged further.

- Gold and silver followed due to perceived tariff risk, despite gold being highly unlikely to face direct tariffs.

Historically, gold is rarely targeted, and silver is somewhat more exposed due to its industrial use. Copper, however, is highly likely to be tariffed.

While a detailed discussion on specific metal markets is beyond the scope here, the broader theme is clear: tariffs are being used aggressively, and the market is pricing in further trade disruptions.

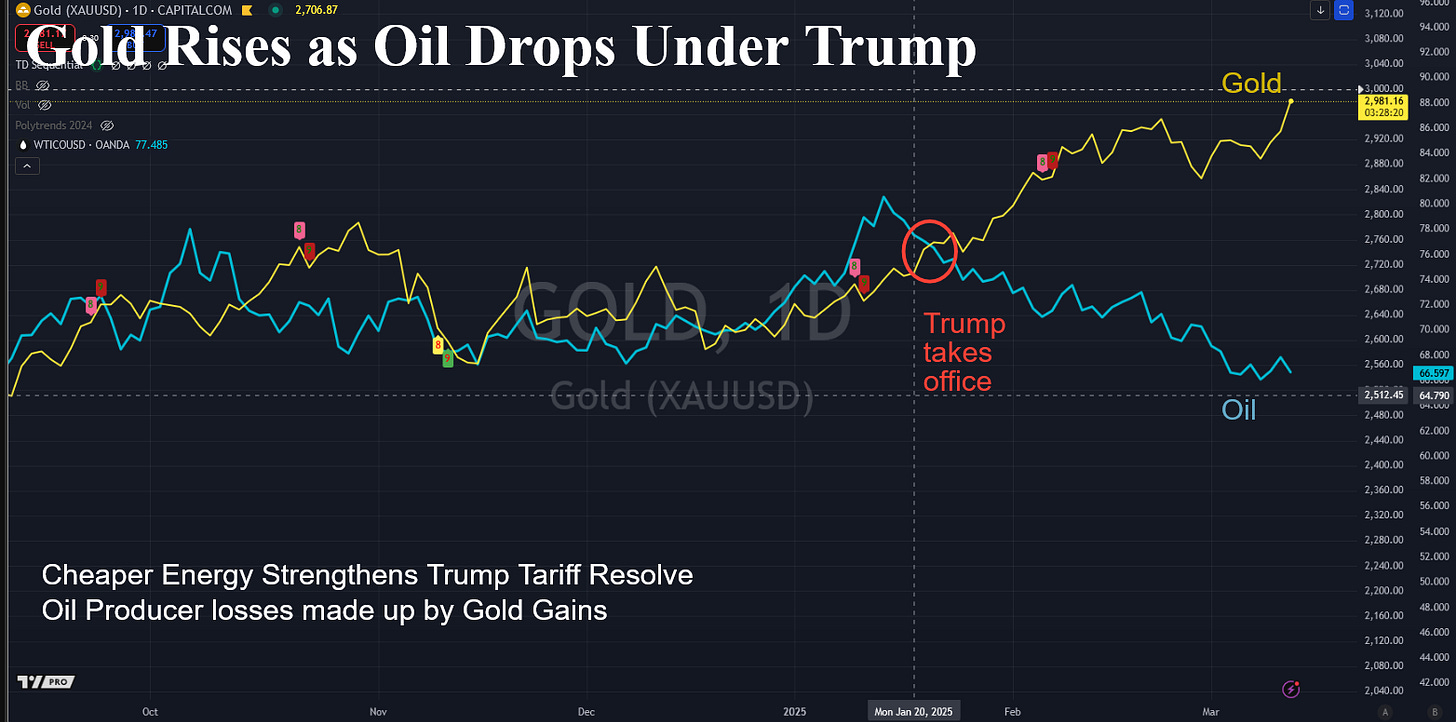

Weaker Oil means Stronger Gold Under Tariff Threats

After the initial spike, the stock market began digesting the full impact of Bessent’s statement.

- S&P 500 dropped from 5,585 to 5,530, shedding 55 handles.

- Gold strengthened as investors rotated into hard assets.

Trump’s tariff strategy correlates with energy prices—as long as oil remains low, his resolve to use tariffs remains high.

- Lower oil prices give Trump more flexibility to impose tariffs.

- A falling dollar supports gold, reinforcing its upward move.

Bottom Line: Gold Breaks New ATHs as Tariffs Drive Market Shifts

Gold made new all-time highs after Trump reinforced his tariff stance.

Silver followed higher, acting more like gold than an industrial metal.

Copper surged, pricing in potential tariffs.

Stocks dropped, reflecting market uncertainty.

Oil Slipped once again

The market reaction suggests tariffs are here to stay, with broad implications across commodities and equities. Trump's trade policy is reshaping capital flows—and gold is the primary beneficiary.

///end///

Free Posts To Your Mailbox