Stock Buybacks Hit All-Time High In November, But Enter "Blackout Period" This Friday

One month ago, when stocks were still just shy of the 5 month low hit in late October and when sentiment was borderline apocalyptic (just days after Morgan Stanley's Mike Wilson said you can forget a year-end rally... oops), we took the other side of the trade and siding with BofA's Michael Hartnett, laid out the reasons for a tactical face-ripper of a rally among which we said that "Here Comes The Surge In Stock Buybacks " citing data from Goldman according to which there was roughly $5B worth of daily VWAP demand during this open window and with November and December the best two month period for executions of the year.

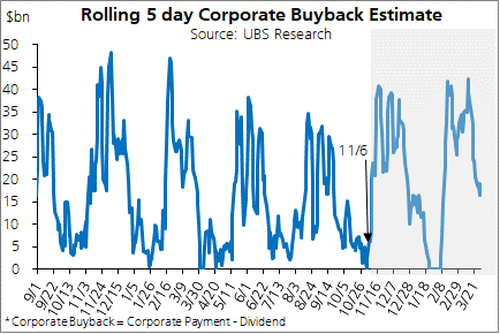

We also cited a report from the UBS trading desk which showed that the 5-day rolling buyback average is expected to soar from virtually nothing on Monday to nearly $40 billion by next week.