Sponsored Content

Oil Crashes, Commodities Crack — What Happens When the System Buckles

The warning signs are flashing red across the global commodities market, with oil plunging to its lowest level since 2021. The reason? Tariffs, recession fears, and an unraveling global order.

Oil’s Meltdown: Just the Beginning?

Crude prices have now dropped to levels not seen in nearly four years. This isn’t just about Trump’s tariffs (though they triggered it). It’s the world worried about what tariffs mean: inflation, falling demand, and a potential global recession.

Add in a surprise production hike from OPEC+—three times larger than expected—and you get a perfect storm. More supply, less demand, and a market teetering on the edge.

Commodities Are Cracking

• Copper, the barometer of industrial health, recently experienced its largest drop since the COVID panic.

• Natural gas prices are sinking fast in Europe.

• Corn, coffee, cocoa, and sugar? All down in recent weeks.

The commodity complex isn’t just signaling weakness—it’s flashing a systemic warning. When demand for energy and raw materials falls, you’re not looking at a soft landing. You’re looking at hard brakes.

The Message Is Clear

Tariffs are testing the limits of the machine. Trust in the system is crumbling. The answer? Hard assets like gold.

When commodities like oil collapse, it’s not just about energy—it’s about growth, trade, and faith in the fiat system. When that faith breaks, where do people turn?

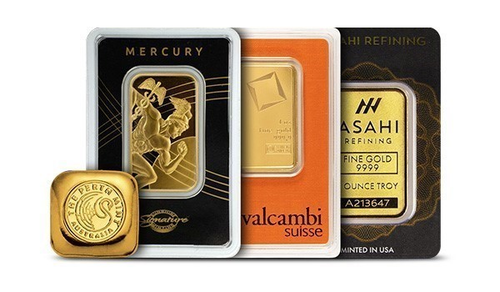

Build Your Own Reserve

Energy shocks, geopolitical flare-ups, and uncertain policy—all reasons to hedge with metals. The Gold Starter Pack from JM Bullion offers a simple way to own physical assets now.

The Gold Starter Pack, available exclusively at JM Bullion, ZeroHedge’s preferred bullion dealer, offers investors an accessible entry into the gold market. Each pack includes a curated selection of .9999 pure gold products, providing a tangible asset to diversify and strengthen your investment portfolio.

Don’t wait for the next commodities crunch to make your move. Start stacking before the headlines catch up.