Sponsored Content

🔮MAR-A-LAGO PARLAY

🔮NEW: Oracle on YouTube.

We’re now distributing the Polymarket podcast and show clips on YouTube.

When you subscribe to our channel, like, and comment, it will really help us get rolling.

👉Subscribe to The Oracle on YouTube

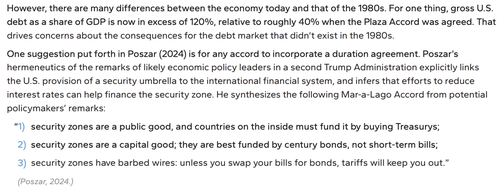

The first mention of the term “Mar-a-Lago Accord” arrived in a November 2024 paper by Stephen Miran, “A User’s Guide to Restructuring the Global Trading System” (PDF).

Miran would soon enter the administration as Trump’s Chair of the Council of Economic Advisers.

The central idea in Miran’s paper is to leverage America’s military power to shore up its over-leveraged debt system:

Since then, the term has been all over the press, and for good reason: it would be a ground-up restructuring of the global security and financial orders.

Is it working?

Let’s look at some relevant Polymarkets:

Security Leverage

Miran argues that trade partners must help finance the US security machine, and suggests the US remove military support from nations that don't pull their weight.

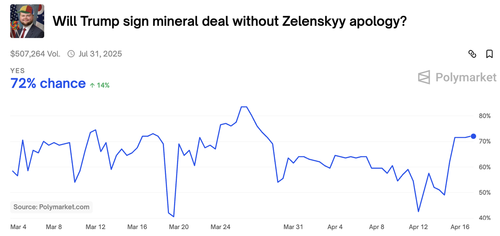

- Ukraine. Trump has pulled intel sharing and pressured Zelensky to sign a number of economic deals. Ukraine has held out so far, but there’s a 🔮76% chance that the US and Ukraine sign a minerals-for-security deal by the end of July.

- European Alliances. Trump has threatened to pull the US out of NATO if member states don’t spend more on defense. But the market is skeptical that the US would pull out of NATO (🔮 3% odds) or remove troops from Warsaw Pact countries (🔮 10%) by July.

- F-35. Instead of rolling over, a number of European states including Portugal are cancelling or rethinking plans to buy F-35s and other military hardware from the US.

Bottom Line. Trump is trying to run the MaLA playbook in both Ukraine and Europe. He is likely to extract concessions from Ukraine where there is a hot war going on, but is facing more pushback in Europe.

These moves have called into question the security guarantees underlying NATO, but the market thinks the alliance is likely to keep existing on paper for now.

Tariffs

Miran calls for tariffs to be used as a revenue source and as leverage for negotiations with trade partners.

The tariffs, Miran argues, should start small and be ramped up on a predictable schedule (eg. 2% monthly increases) with the levels set by willingness to play ball on security and economic demands.

- Big Bang. But the tariffs have definitely not started small. Trump’s ‘liberation day’ announcement spiked odds for the overall tariff level to double. And some countries are facing 200%+ tariffs.

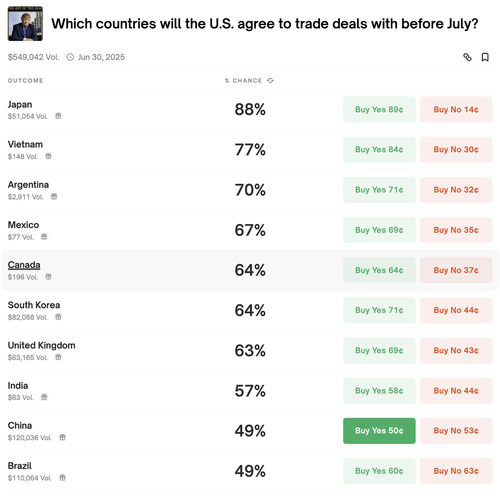

- Deals Deals Deals. Since the announcement, odds for a deal with China have fallen as Beijing retaliated, but risen highest for Japan and Vietnam, both countries that have had accommodative responses to the tariffs.

Debt Deals & Sovereign Wealth Fund

- Century Bonds. Another part of the plan is for the US to term out its debt, swapping shorter term debt for 100-year, zero-coupon “century bonds” (30-year is the longest maturity issued today). This would give the US greater breathing room on its debt service. As of today, there is no Polymarket on whether the US issues longer dated paper.

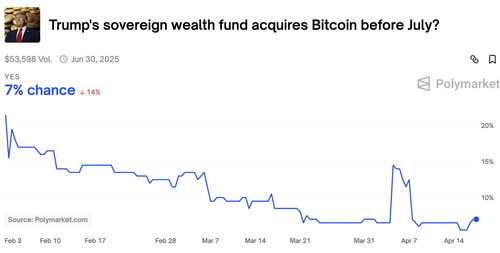

- Sovereign Wealth Fund. In February, Trump rolled out plans for establishing a SWF and there have been various proposals floating around as to what could go into it: a stake in TikTok, Fort Knox gold, Federal mineral rights, Bitcoin?

Polymarket has several shorter-term markets for the SWF, but all have been trending steadily downward since launch.

Weaker Dollar & Lower Borrowing Costs?

As we have seen, Trump is moving towards implementing Miran’s plan, with mixed results so far.

In the long run, the program aims to produce two key results:

- A weaker (but still globally dominant) US dollar, and

- Lower long term US borrowing costs.

Is it starting to deliver?

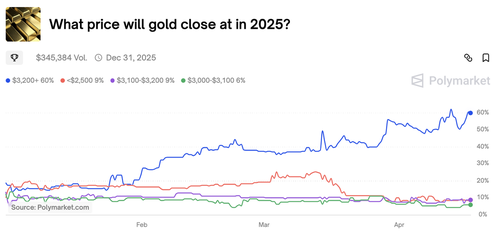

On Polymarket, the end-2025 gold price market has already moved into the highest possible band ($3,200) reflecting the massive runup in precious metals since inauguration. The DXY (dollar index) is also down about 9% this year.

Weaker dollar? ✅

What about borrowing costs? Here the results are less rosy.

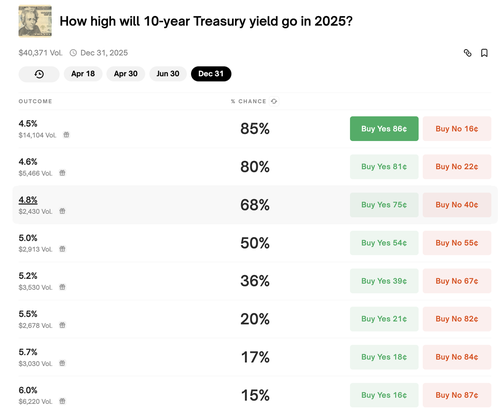

The 10-year treasury rate has spiked since Trump unveiled his tariff blitz - possibly reflecting a market judgement that the tariffs are likely to backfire and send the US into recession which tends to boost deficits. There is no sign yet of a sustained fall in US longer term rates.

On Polymarket, the odds are greater for the 10-year yield to rise this year than fall.

Market participants believe the 10-year Treasury yield is almost certain to reach at least 4.5% in 2025 (🔮 85% probability), with a good chance of further increases beyond that point.

While there's a 76% chance the yield could drop to 4.0% at some point during the year, the probabilities of deeper declines below 3.5% are much lower (🔮 35% or less).

So far, the Mar-a-Lago Accord has weakened the dollar as planned, but the promised land of lower borrowing costs remains stubbornly over the horizon—suggesting that even in dealmaking, America can't always have its cake and eat it too.

Disclaimer

Nothing in The Oracle is financial, investment, legal or any other type of professional advice. Anything provided in any newsletter is for informational purposes only and is not meant to be an endorsement of any type of activity or any particular market or product. Terms of Service on polymarket.com prohibit US persons and persons from certain other jurisdictions from using Polymarket to trade, although data and information is viewable globally.