Sponsored Content

EV Battery-Related Nickel Demand is Expected to Continue to Grow Rapidly; Little Known and Dramatically Undervalued Renforth Resources is a Great Speculative Play on the Battery Metal

Nickel plays a critical role in the rapidly growing electric vehicle (EV) industry. By mass, it is the most important metal in the cathode of lithium-ion batteries, which are by far the most widely used types of EV batteries. (Lithium-ion battery cells have four main components: a cathode, an anode, an electrolyte, and a separator.) The cathode contains lithium mixed with nickel and other minerals. Nickel comprises about one-third of nickel manganese cobalt (NMC) cathodes and 80% of nickel cobalt aluminum (NCA) cathodes, respectively. Nickel is employed so extensively in EV batteries because it has nearly twice the energy density of other potential battery metals and helps deliver greater storage capacity -- and it does this at a lower cost than other metals like cobalt.

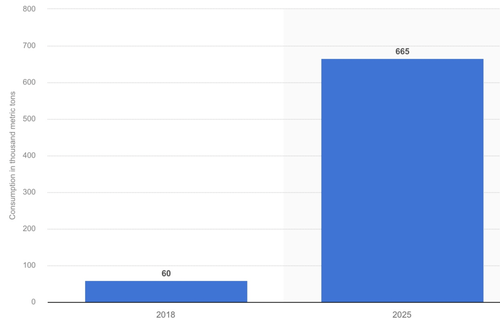

For all these reasons, the demand for nickel in EV batteries is growing at near exponential rates. Indeed, Statista projects that EV battery-related global nickel demand will be 665 million tonnes in 2025, up more than tenfold from 60 million tonnes in 2018. See Figure 1.

Figure 1: Global Demand for Nickel in Electric Vehicle Batteries from 2018 – 2025

(in 1,000s of tonnes)

According to the U.S. Geological Survey, global mine nickel production totaled 3.3 billion tonnes in 2022, of which 2.15 million tonnes were mined in Indonesia, the Philippines, and Russia. About 68% of all nickel production is used to make stainless steel, and 26% is used in nonferrous alloys, electroplating, and alloy steel, per the Nickel Institute. A higher grade of nickel is required for use in EV batteries and in clean energy storage systems.

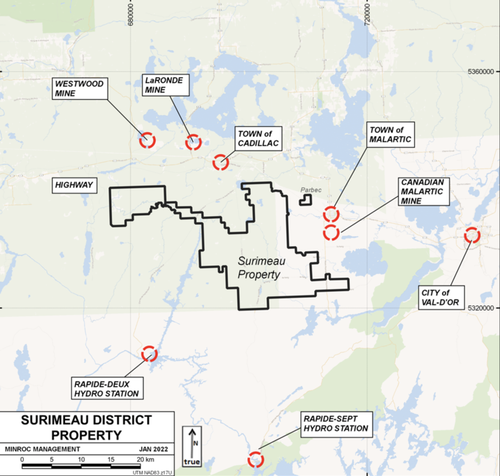

With all this in mind, Renforth Resources Inc. (CSE: RFR; OTCQB: RFHRF) represents an intriguing play on the growing market for battery-grade nickel. The company, which has an enterprise value of only C$4.2 million, owns 100% of the 330 square-kilometer (km) Surimeau District Property in Quebec. See Figure 2. Surimeau appears to be rich in EV battery metals, primarily nickel. (The property also hosts significant gold mineralization; see below.). If Renforth continues to find evidence of significant mineralization at Surimeau, the stock market will be forced to revalue Renforth shares to much higher levels.

Figure 2: Location of Surimeau Relative to Other Mines and Cities in Quebec

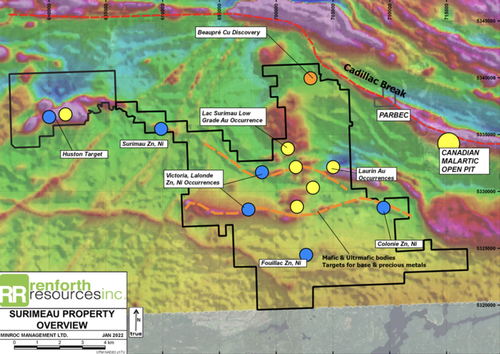

In 2021, Renforth discovered a 20-km magnetic anomaly crossing the center of the Surimeau, which is now called the Victoria structure, with the western end of Victoria being the most significant irregularity. See Figure 3. The peculiarity is clearly identifiable in government geophysics data.

Figure 3: Surimeau Geophysics (Note the Orange Lines for Victoria and Lalonde Anomalies; Lalonde is another potential highly mineralized sytem 4 km north of Victoria)

Victoria displays consistent nickel and cobalt mineralization, including some areas with extremely high grades. For example, one hole encountered 3.46% nickel (and 491 parts per million of cobalt) over a 1.5-meter span less than 200 meters from the surface. Furthermore, another mineralized system containing zinc, copper, gold, and silver occurs across the 20-km span. Both systems can found be identified at or near the surface and at depth.

Equally important, several areas of Victoria are either unexplored or very lightly explored (including one region where Renforth uncovered the highest-grade surface nickel sample). It is possible that these nearly untouched areas of Victoria have more exploration potential than the regions in which significant exploration effort has been devoted.

More specifically, the Victoria structure contains graphitic mudstone and interlayered mafic and ultramafic rock. Such a composition is similar to the Outokumpu District in eastern Finland. Mines in that region produced around 50 million tonnes of ore (primarily copper, zinc, and cobalt with minor amounts of nickel and gold) over the period 1913 through 1988.

Surimeau’s location in southern Quebec is advantageous from the perspectives of both labor and infrastructure. Not only can it be accessed by paved roads in a region where inexpensive hydroelectric power is available, but Surimeau is near established mining towns such as Malartic, Val d'Or and Rouyn-Noranda, as well as operating mines like Canadian Malartic, LaRonde, Westwood, and others. See Figure 2.

Five Reasons Renforth Resources Should Be on Your Watchlist

- Surimeau could potentially be a large and very valuable polymetallic resource, and investors have paid little attention to its potential. Importantly, Renforth has the financial capability to drill the property to determine its size and metal composition. The company is currently designing a drill program in the central area of the 20-km Victoria mineralized structure. The drilling program should commence this winter.

- Renforth trades at a marked discount to the sum of its parts. Indeed, even if one were to ignore the value and upside of Surimeau, Renforth’s enterprise value of just over C$4 million equates to 50% or less of the likely C$8-C$10 million price its currently warehoused Parbec gold property would fetch in a transaction. Located along the famous Cadillac Break in Quebec, Parbec is a shallow, high-grade gold resource that is adjacent to Agnico Eagle’s Canadian Malartic Mine, the largest open pit gold mine in the country.

- Renforth has a pristine balance sheet. Factoring in its recent sale of ten million shares of Radisson Mining Resources, Inc. (TSXV: RDS), Renforth has cash of about C$2.3 million and no debt.

- Renforth’s CEO Nicole Brewster owns a 3.2% stake in the company and controls discretionary spending extremely well. General and corporate expenses have averaged less than C$200,000 per quarter over the last three reported quarters.

- Both Renforth’s Surimeau and Parbec projects sit along the Cadillac Break, a prolific gold structure which runs between Quebec and Ontario. Furthermore, both properties are located near operating mines owned by much larger mining companies. Consequently, an eventual M&A transaction that would be highly accretive to Renforth shareholders has to be considered a likely possibility for Renforth.

Renforth Resources Inc. last traded at C$0.02 on the Canadian Securities Exchange.

Please read the our disclaimer regarding sponsored posts and advertisements.