Sponsored Content

Earn 12% on Silver: Limited Spots Left in the First Silver Bond in 200 Years!

Financial markets are increasingly volatile. Sophisticated investors seek out opportunities that offer both stability and substantial returns. If you're looking to diversify your portfolio with physical metals while earning an impressive yield, you need to read this.

Invest in silver bonds and earn 12% on silver, paid in silver.

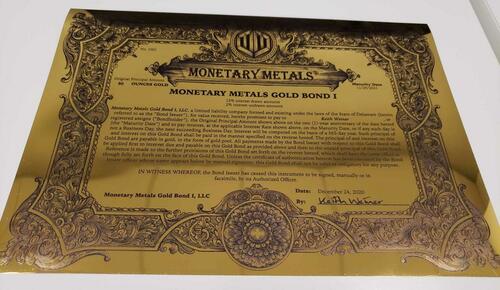

Monetary Metals has made a name in the industry for bringing back gold bonds, and now they’re offering the first silver bond in nearly 200 years, where you can earn 12% annually, paid in physical silver.

Monetary Metals has already filled over half of the bond!

As of August 8, over half the bond has already been filled. We are actively raising capital for the next tranche. Please contact us to secure your place in this historic opportunity.

CLICK HERE TO INDICATE YOUR INTEREST

No commitment needed

This isn’t just any investment; it’s an innovative way to secure and grow your wealth with a hard asset that can’t simply be printed.

Key Details:

- Investment Structure: Silver bond (just like a dollar bond but with principal and interest denominated in silver and paid in silver).

- Use of Funds: Proceeds will restart and develop a publicly traded US-based mining company, with production scheduled to begin this year.

- Term: 3 years.

- Estimated Return: 12% annual, paid in silver.

- Payments: Quarterly payments in physical silver made directly into your Monetary Metals account.

- Minimum Investment: 1,000 ounces of silver, plus accrued interest

Participation is limited and you must be an accredited investor. Secure your place in this historic opportunity by completing the no obligation form on this page before it’s too late.

Invest in silver. Earn in silver. Protect and GROW your wealth with Monetary Metals.

Visit Monetary Metals to learn more.

About Monetary Metals

Monetary Metals has delivered a yield on gold and silver to their clients since 2016. The company has a track record of over 57 funded transactions, including the first gold bond offered in the United States since 1933. Since then, they’ve financed two other gold bonds and are actively raising capital for the first silver bond in almost 200 years.