US Existing Home Sales Jump Most In A Year In February

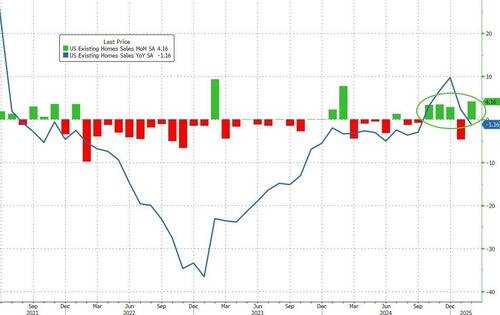

Following January's big tumble in existing home sales (blamed in large part on winter storms... which apparently surprised analysts as happening in the winter and impacting sales), expectations - despite suddenly declining mortgage rates - were for February to see further weakness in sales (-3.2% MoM).

As we suspected (in our sarcastic intro), sales surprised bigly to the upside in February, rising 4.2% MoM (from a revised 4.7% MoM decline in January). That is the biggest MoM jump since Feb 2024...

Source: Bloomberg

However, despite the rebound, sales remain down 1.2% YoY.

Source: Bloomberg

Sales climbed the most in the West and South, which were afflicted at the start of the year by destructive wildfires in Los Angeles and severe winter storms, respectively.

To the extent January sales were affected by weather, NAR Chief Economist Lawrence Yun said last month that those transactions would be carried into February.

“Home buyers are slowly entering the market,” Yun said in a statement.

“Mortgage rates have not changed much, but more inventory and choices are releasing pent-up housing demand.”

Source: Bloomberg

The supply of previously owned homes jumped 17% from a year ago to 1.24 million, the most for any February since 2020.

Even so, the median sales price increased 3.8% from a year ago to $398,400 - a record for the month - extending a run of year-over-year price gains dating back to mid-2023.

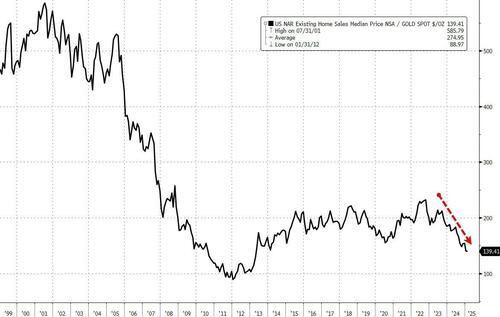

Which got us thinking...

While home prices (in nominal dollars) are testing new record highs, the number of ounces of gold required to buy a home is at its lowest level in 12 years.