UMich Inflation Expectations Surge Even Higher As Democrats Freak Out

Having been widely mocked - and quantitatvely denigrated by Goldman Sachs - this morning's final print for UMich consumer sentiment for March is now a must watch.

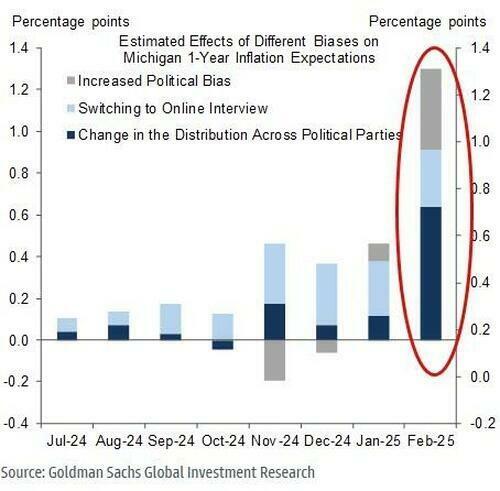

As a reminder, Goldman explained that the Michigan measure has been especially susceptible to the tariff news recently for three reasons.

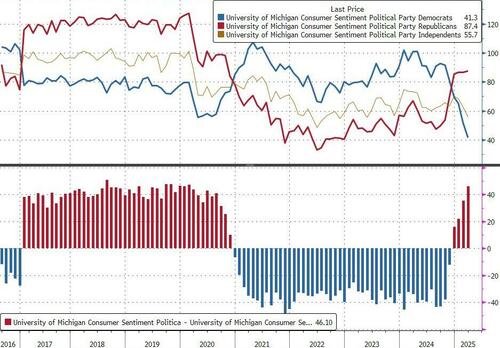

First, inflation expectations in the survey have become extremely partisan.

Second, the share of respondents in the Michigan survey who are Democrats has always been consistently higher than the share of respondents who are Republicans

Third, switching from a phone-based to an online-based data collection process has led to more extreme answers on inflation expectations.

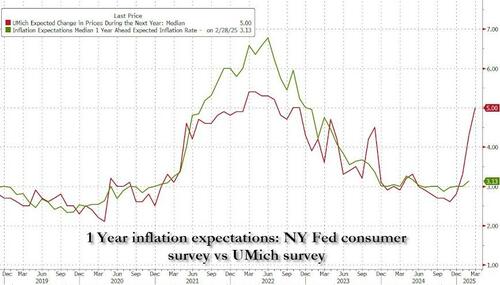

These three issues together have boosted short-term inflation expectations in the Michigan survey by about 1.3pp and long-term inflation expectations by 0.5pp since 2024Q4. In particular, the change in distribution across political parties and increased partisanship together generated an outsized 1.0pp boost to the 1-year inflation expectation in February.

So, with all that in mind, let's see what the final data looks like - did it get even crazier?

The short answer is - YES!

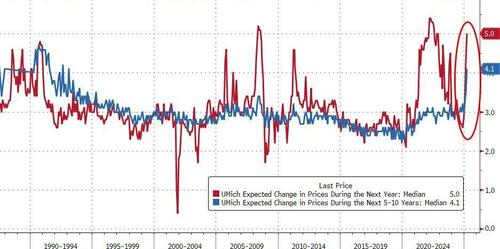

UMich 1Yr inflation expectations rose to 5.0% (from 4.9% preliminary) while the 5-10Y expectations jumped to 4.1% (from 3.9% flash) - the highest since August 1992...

Source: Bloomberg

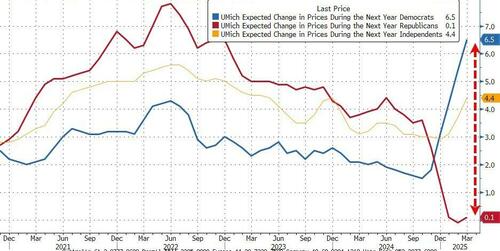

The gaping chasm of propaganda-driven fear is evident below the surface with Republicans expected 0.1% inflation while Democrats expect - wait for it - 6.5% price rises in the next year...

Source: Bloomberg

Source: Bloomberg

Bear in mind that Democrat's 1Yr inflation expectations are now more than 2 times higher than they were in June 2021 when inflation would actually rise to 9%. Back then the Democrats were only off by a factor of 3x.

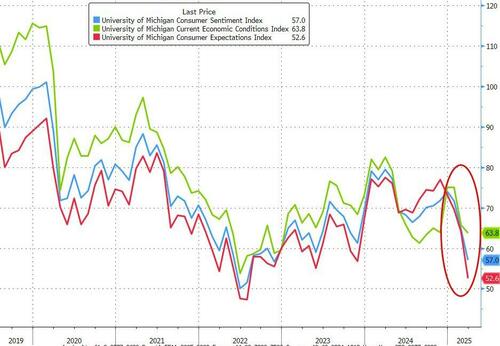

The final March sentiment index declined to 57 from 64.7 a month earlier. The latest reading was below both the 57.9 preliminary number and the median estimate in a Bloomberg survey of economists.

“Consumers continue to worry about the potential for pain amid ongoing economic policy developments,’’ Joanne Hsu, director of the survey, said in a statement.

“Notably, two-thirds of consumers expect unemployment to rise in the year ahead, the highest reading since 2009.’’

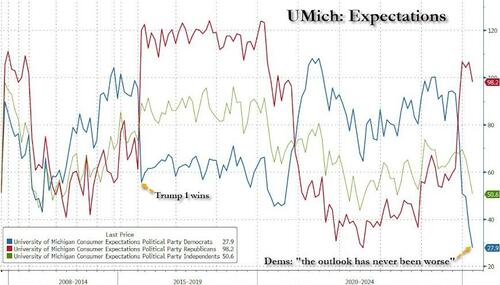

The survey showed the expectations index plunged 11.4 points, the sharpest drop since 2021, to 52.6 this month. The current conditions gauge decreased to a six-month low of 63.8.

Source: Bloomberg

And the political divergence is exploding there too...

Source: Bloomberg

Labor market expectations worsened considerably across demographic and political groups in a sign of subdued spending over the coming months, the report showed. Moreover, expectations among high-income consumers sank.

“This trend reveals a key vulnerability for consumers, given that strong labor markets and incomes have been the primary source of strength supporting consumer spending in recent years,’’ Hsu said.

According to Democrats, the US outlook has literally NEVER been worse: worse than the global financial crisis, worse than covid, worse than ever.

One thing we note is that if Democrats are so terrified about the loss of purchasing power in the next year, why (based on the slowing spending data this morning) are they not rushing out to buy any and everything they can before Trump's terrible tariff tax trashes their wealth? Unless - of course - they are just making up their UMich responses as part of the #Resistance?

Starting this month, Democrats will unleash an historic spending spree as they scramble to preserve the purchasing power of their dollars ahead of what they view as runaway inflation. Unless, of course, they are just making up their UMich responses. https://t.co/k3cwmCrq3v

— zerohedge (@zerohedge) March 28, 2025

Finally, even Fed Chair Jerome Powell largely dismissed the Michigan survey as an outlier for longer-run expectations, and other policymakers have since echoed his remarks.

Which data series do you trust?