January US Retail Sales Tumble Most In Almost 2 Years

After four months of strong gains, US retail sales were expected to decline in January data released this morning (-0.2% MoM exp) with the omniscient BofA analysts forecasting an even bigger 0.8% MoM decline.

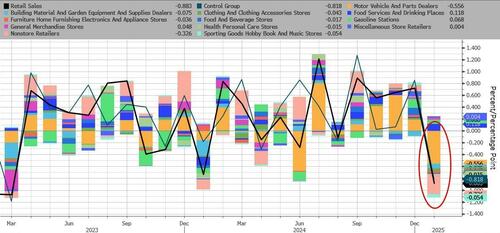

Once again, BofA nailed it - as retail sales (nominal, remember) plunged 0.9% MoM in January (after December's +0.4% MoM was revised up to +0.7% MoM). That is the biggest MoM drop since March 2023 (in a month marked by severe winter weather and deadly wildfires)...

Source: Bloomberg

Just for a sense of just how much this data is 'adjusted', the non-seasonally-adjusted retail sales for January actually crashed 16.5% MoM (post Xmas hangover, as it does every year)...

Source: Bloomberg

Nine of the report’s 13 categories posted decreases, most notably motor vehicles, sporting goods and furniture stores. The data encompassed a period marked by devastating wildfires in Los Angeles — the second-largest metropolitan area in the US — and severe winter weather in other parts with the country, which could have depressed brick-and-mortar shopping activity.

Source: Bloomberg

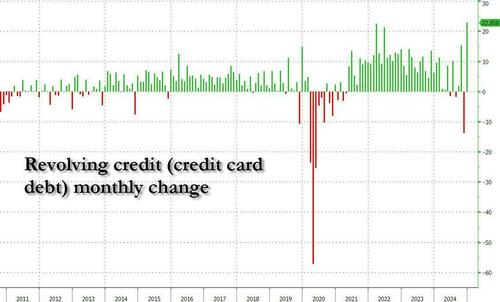

Wondering why sales slumped so hard - simple - the world and his pet rabbit max'd out their credit cards in December...

Source: Bloomberg

Core retail sales also fell (by 0.5% MoM) while the all-important Control Group - which feeds into the GDP calculation - saw a huge miss , dropping 0.8% MoM vs +0.3% MoM expected.

Source: Bloomberg

That is the biggest MoM drop for the Contrrol Group since March 2023 and bodes poorly for the start of Q1 GDP growth hopes.