Don’t Fear the Fall: What September’s Slump Sets Up for Bulls

Don’t Fear the Fall: What September’s Slump Sets Up for Bulls

- Analysts are increasingly calling for a stock market pullback.

- September tends to be the worst performing month for the S&P 500.

- October through January is typically the best four-month stretch.

Don’t be surprised by a September swoon—embrace it.

After three decades of surveying financial markets and helping people invest, you start to notice patterns. One of my favorites? The perennial mistake pundits make every spring on CNBC: “Sell in May and go away.”

What they’re really saying is, “Take a break from equities so you can enjoy your summer.” But what they’re actually doing is giving bad advice.

First, it’s short-term thinking. Most households are investing for retirement, not for seasonal trades. Constantly jumping in and out of stocks erodes the power of compounding and adds unnecessary friction.

Second, it ignores long-term market behavior. Since 1928, the best three-month stretch for the S&P 500 has consistently been June through August. May is a terrible time to exit.

Now, here’s the twist: when I look at seasonal charts like the one above, I’m not asking when to get out—I’m asking when to get in. And historically, September has often been that moment.

Right now, Wall Street strategists are calling for a pullback, citing tech’s recent strength. But they’re likely looking at the same chart and playing it safe. Often, the best entry point is when consensus is bracing for impact. So, if we do get a selloff, it may be the perfect opportunity to add exposure to risk assets like stocks.

But don’t take my word for it, let’s look at what the data’s telling us…

Whenever I think about investing in stocks, I start with one simple truth… the S&P 500 has averaged a 9.5% annual return on a total return basis (dividends reinvested) since 1928. That means, through the power of compounding, you double your money roughly every 9.5 years—and quadruple it in two decades. It’s not guaranteed, but that track record has weathered wars, recessions, inflation shocks, and technological revolutions.

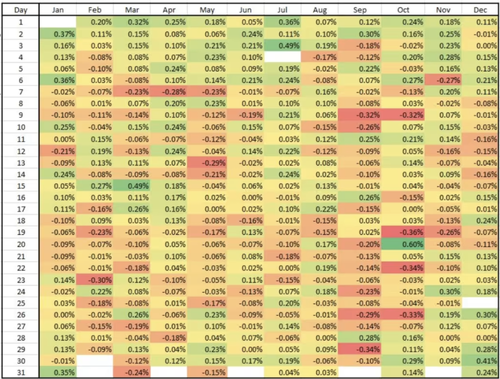

Because the index has been around for so long, we have a treasure trove of data. One of my favorite charts—courtesy of Goldman Sachs—breaks down the S&P 500’s average return for every day of the month going back to 1928. Green squares mark strong days, red squares mark weak ones. And September? It’s littered with red.

The seasonal downtrend typically begins in late August, around the 25th, when fund managers likely start buying protection ahead of a potential September swoon. That pressure tends to persist through the month—until around September 28th, when the tide begins to turn. From there, sentiment improves, and history shows that October through January is the strongest four-month stretch for the S&P 500.

Let me be clear: I haven't changed my opinion on the investing outlook. Quite the opposite. I remain optimistic about the operating efficiencies that technological advancements will bring to corporate balance sheets. These innovations should drive margin expansion and revenue growth—fueling the next leg higher in the index.

But in the near term, seasonal trends could weigh on stocks. Instead of bailing at the first sign of weakness, consider what history tells us: better days lie ahead.

By year-end, the S&P 500 will likely be priced off 2026 earnings estimates. Based on current expectations of $302.53, and applying today’s multiple, I arrive at a target of ~7,000. That should underpin a steady rally in risk assets like stocks.

If you'd like to receive more commentary like this to your inbox daily or see how I'd invest for any type of market, click here.