Gold vs Stocks, Debunking a Myth

Gold and Equity Market Behavior: Debunking the Correlation Myth

Authored by GoldFix, ZH Edit

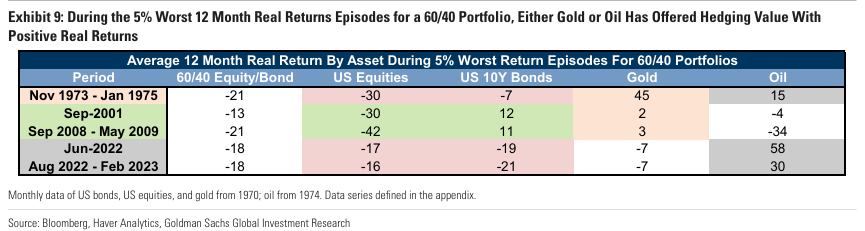

Two days ago we read a historical data piece by Michael Oliver on a recurring fallacy about gold in stock selloffs: “Gold does not hedge against stock loss.” Hard to believe this disproven canard still persists, but it does. We’ve broken it down with original charts below. For good measure, we’ve also included excerpted graphics from a recent Goldman report, Buy Gold Not Bonds, which calls for ending the 60/40 portfolio and replacing bonds with gold as a stock hedge. Enjoy your weekends.

“The legacy 60/40 Stock-Bond portfolio is dead.”

- Goldman Sachs, May 2025

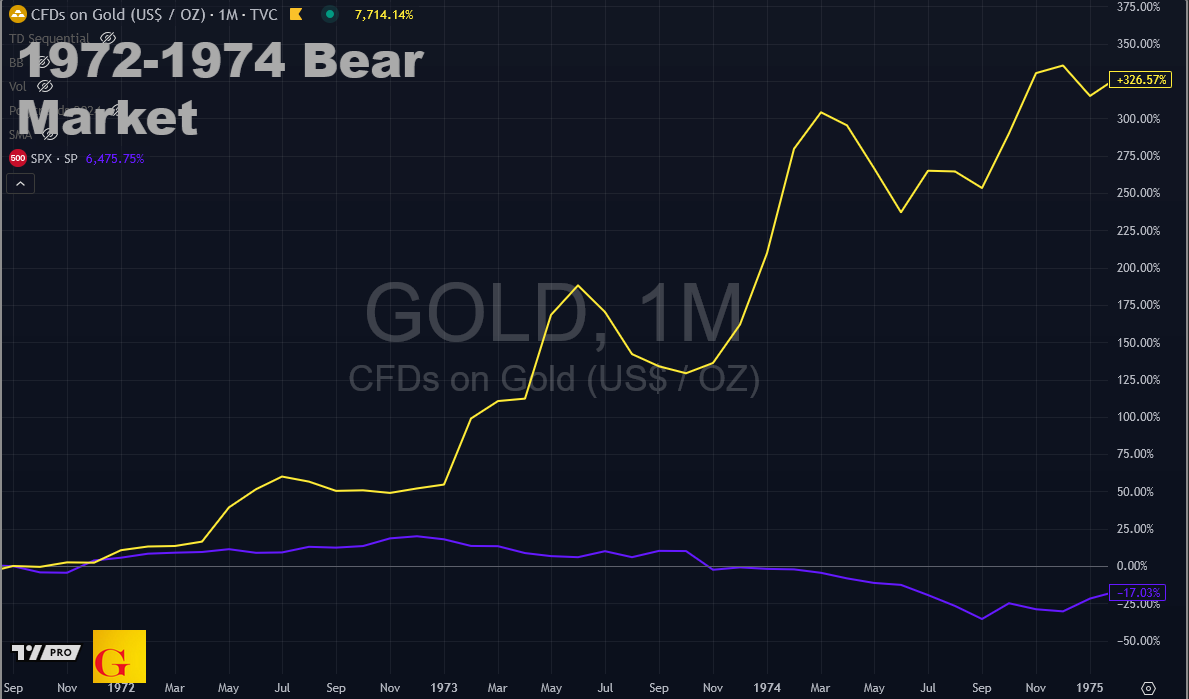

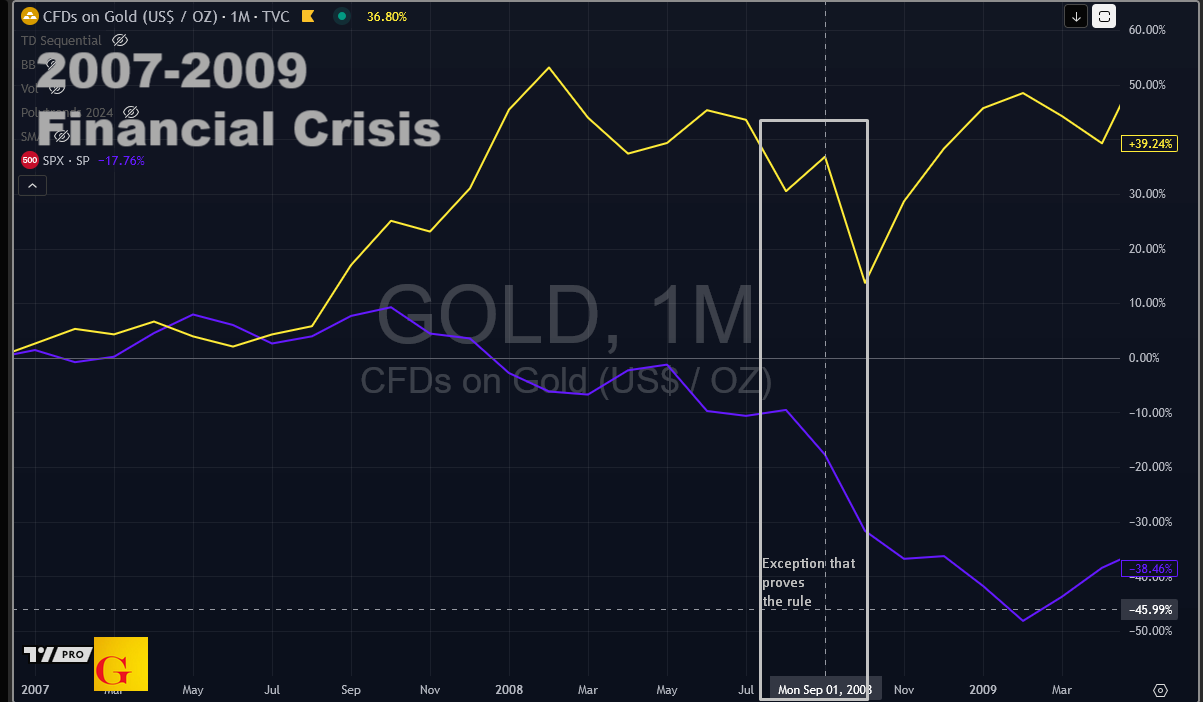

The prevailing belief that gold prices inevitably decline alongside major stock market sell-offs is not consistently supported by historical evidence. Multiple significant market episodes show gold performing in opposition to equity declines, often serving as a countertrend asset during periods of financial stress.

Archival market data across several decades demonstrates that gold frequently appreciates during sharp equity drawdowns, challenging the assumption of an automatic positive correlation between the two markets.

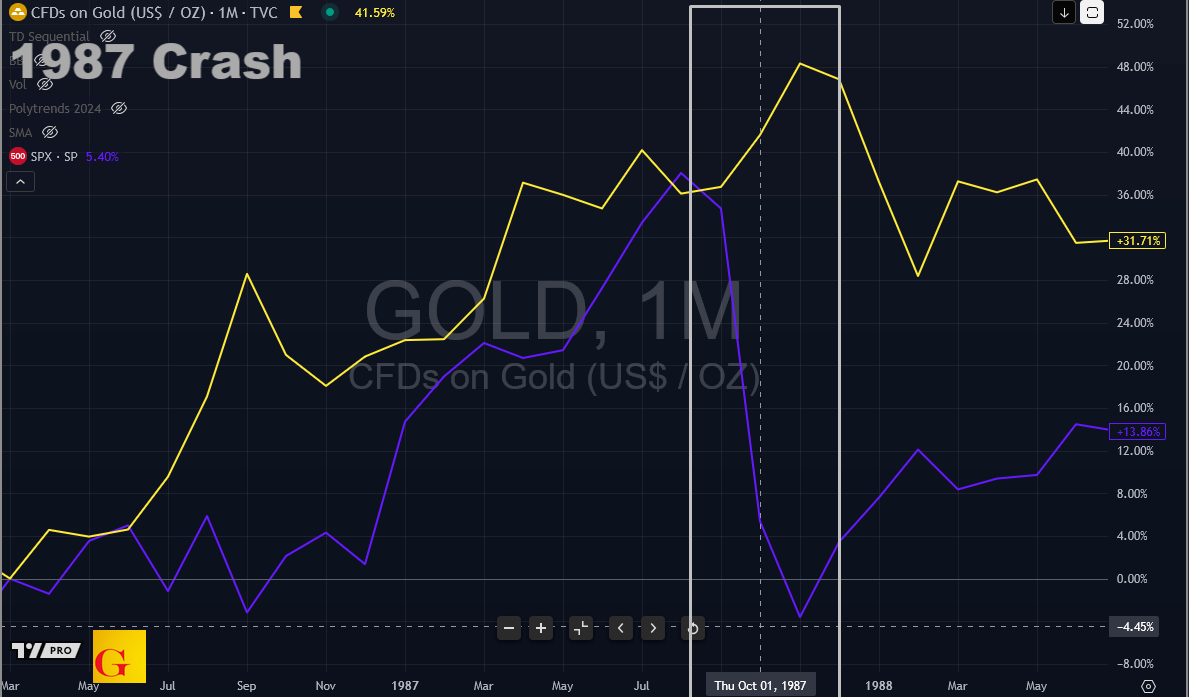

1987 Crash

During the October 1987 crash, the S&P 500 lost over 34% from peak to trough, whereas gold rose by roughly 8.5% from its October low to its subsequent peak.

2000-2002 Bear Market

Similarly, during the 2000–2002 equity bear market, gold trended upward while the S&P 500 entered an extended decline.