Fed Openly Discusses Gold Revaluation

Global Cases of Gold-Based Fiscal Relief

Contents

- TL DR:

- Global Cases of Gold-Based Fiscal Relief

- Revaluation: Accounting Mechanics and Policy Rationale

- Use Case 1: Central Bank Operations – Italy and Curacao & Saint Martin

- Use Case 2: Central Government Fiscal Relief – South Africa, Lebanon, Germany

- Observations and Outcomes

- Relevance to the US

- Conclusion

- Report Excerpts making our case

TL/DR

They believe it’s a quick fiscal fix; But it should not be ignored based on past; If the US were to consider doing it, it must be done transparently; Without stating as much, in our opinion, they are against it; The Fed is getting defensive as an institution.

Introduction: Context and U.S. Proposal

Late last week, The Fed published a lengthy piece assessing the potential benefits of Gold Revaluation in a piece titled: Official Reserve Revaluations: The International Experience1. Here is our summary and assessment.

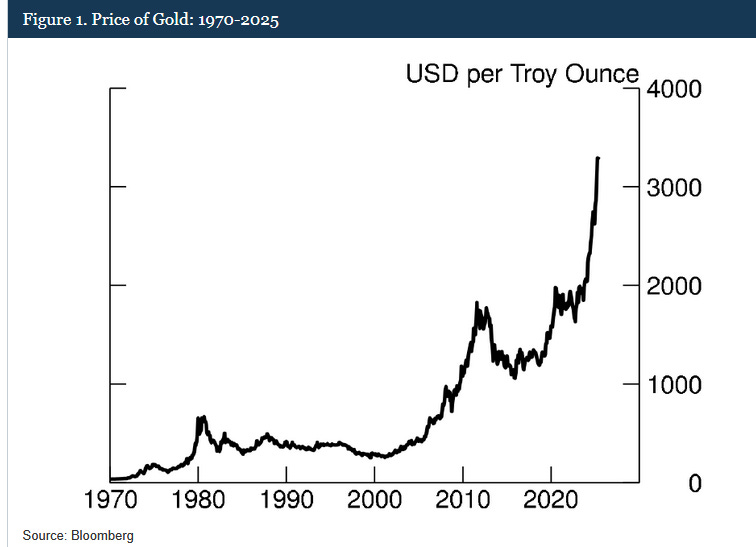

With debt levels high and tax hikes politically constrained, some governments are exploring unconventional strategies to fund expenditures. Among these, gold reserve revaluation has resurfaced as a policy tool. In the United States, revaluing the government's 261.5 million troy ounces of gold—currently priced at a statutory $42.22 per ounce—at market rates near $3,300 could unlock significant fiscal capacity. This note by Colin Weiss for the Federal Reserve reviews five international cases where valuation gains on gold or foreign exchange reserves were used as funding mechanisms, analyzing motivations, accounting methods, and policy outcomes.

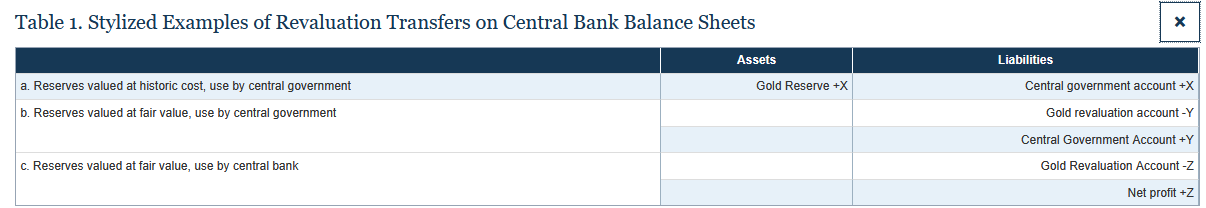

Revaluation: Accounting Mechanics and Policy Rationale

Use Case 1: Central Bank Operations – Italy and Curacao & Saint Martin

In both cases, the central banks utilized gold revaluation to address specific financial shortfalls.

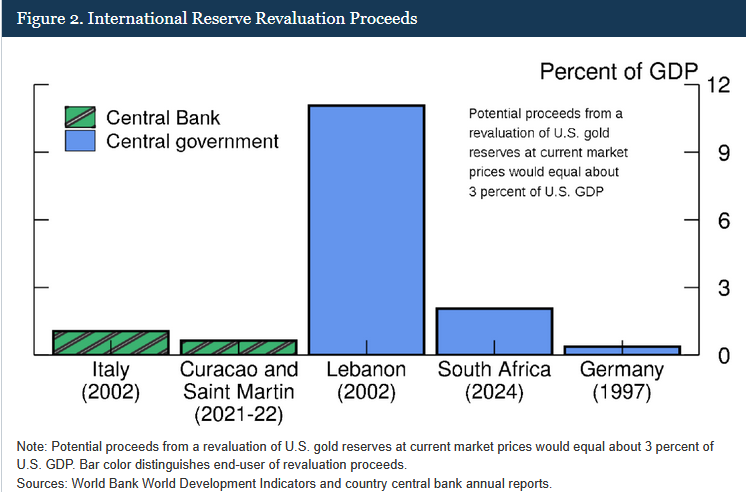

- In 2002, Banca d’Italia used €13 billion—approximately 1 percent of Italy’s GDP—from its gold revaluation account to absorb losses from converting nonmarketable sovereign bonds into marketable securities. The move aligned with European regulations and helped the central bank report a small net profit.

- More recently, in 2021 and 2022, the Central Bank of Curacao and Saint Martin executed “sale and repurchase” transactions of gold to convert valuation gains into realized profits. This maneuver offset operational losses stemming from lower interest income and portfolio rebalancing. However, in 2023, the bank shifted strategy, reducing its gold reserves by 1 percent to boost yield directly through higher-interest assets, moving toward sustainable income generation.

Use Case 2: Central Government Fiscal Relief – South Africa, Lebanon, Germany

Governments used revaluation proceeds to retire debt or mitigate budget deficits, though the efficacy varied.

- South Africa (2024–2027): The National Treasury coordinated with the South African Reserve Bank to transfer R150 billion (around 2 percent of 2023 GDP) to slow debt accumulation and reduce interest payments. The fiscal context included high debt servicing costs and subpar GDP growth. Bond yields declined immediately following the announcement, though long-term consolidated public sector savings remain uncertain due to offsetting costs at the central bank.

- Lebanon (2002, 2007): Facing post-civil war reconstruction burdens and exceptionally high debt servicing ratios, Lebanon transferred revaluation gains to retire $1.8 billion in treasury bills (11 percent of GDP). A second round of gold-based financing in 2007 followed further IMF-supported restructuring. Despite these efforts, debt-to-GDP ratios continued rising, underscoring the limited structural relief revaluations can offer.

- Germany (1997): To comply with Maastricht deficit criteria and enable eurozone entry, Chancellor Kohl and Finance Minister Waigel proposed revaluing gold reserves. The Bundesbank, which had historically valued gold at cost, resisted strongly, citing central bank independence and concerns over precedent. Public opinion echoed institutional resistance. A compromise allowed DM13 billion in revaluation gains to be distributed in 1998 rather than 1997, and the 1997 deficit ultimately met EU thresholds without the revaluation’s fiscal contribution.

Observations and Outcomes

Across the five cases, the scale and intent behind gold revaluation varied. Where central banks were end-users, the amounts were modest, and the focus was on operational stability. When governments received the proceeds, the revaluations were larger and linked to exceptional fiscal pressures. Figure 2 in the report illustrates this difference, with the German, South African, and Lebanese revaluations exceeding 1.5 percent of GDP in most cases, while central bank-led uses remained below 1 percent.

Importantly, the revaluations did not involve physical gold sales or reductions in total reserves. Instead, they functioned through balance sheet restructuring. However, these maneuvers, while offering temporary fiscal or operational relief, did not resolve underlying structural weaknesses. Lebanon’s case highlights this most clearly, as multiple revaluation-based interventions failed to contain rising debt burdens.

Continues here