Another Bite At The Nuclear Apple

Taking the Other Side of a Good Company’s Bad Print

Context. In late May, we highlighted Powell Industries (POWL 5.07%↑) as a classic picks & shovels way to play the nuclear build-out and the broader scramble for power capacity driven by AI data centers.

Powell doesn’t build reactors—it builds the switchgear, e-houses/packaged power rooms, bus duct, and related equipment that sit at the center of high-reliability power distribution. That’s where the sustained demand is.

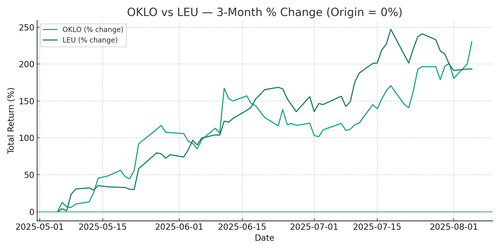

Since then. Nuclear-adjacent names have reminded everyone why this theme matters: OKLO (OKLO -0.18%↓) and Centrus Energy (LEU 5.25%↑) have both ripped recently, reflecting investor appetite for the “more electrons, more reliability” trade.

We have an open trade in OKLO, and just exited our LEU trade on Wednesday for a 225% gain:

Call spread on Centrus Energy (LEU 7.03%↑). Entered at a net debit of $6 on 6/9/2025; exited at a net credit of $19.50 on 8/6/2025. Profit: 225%.

Powell’s report after Tuesday’s close cut against that grain near-term (EPS strong, revenue light), and the stock sold off. Nevertheless, we exited our bullish trade on Powell today for a 124% gain:

Call spread on Powell Industries (POWL 4.84%↑). Entered at a net debit of $6 on 5/27/2025; Exited at a net credit of $13.45 on 8/6/2025. Profit: 124%.

What changed (and what didn’t)

Changed: Near-term sentiment. A revenue miss shakes out fast money and compresses multiples in the short run.

Didn’t change: The structural drivers—data-center power needs, grid modernization, and growing nuclear momentum—are intact. Powell’s role supplying the gear that ties generation to load hasn’t changed because one quarter was lumpy.

Our Plan

We’re using the post-earnings drop to add a bullish options position in POWL. Put options have become more expensive into and after the slide, which lets us structure a trade that benefits from elevated put pricing while maintaining meaningful upside if the shares stabilize and grind higher.

A second “picks & shovels” play

We’re also entering a bullish trade on one of Portfolio Armor’s Top 10 names from Tuesday’s close—another company levered to the power industry’s capex cycle (think test/diagnostics and grid-reliability tools rather than generation itself).

How this fits our macro map

Both trades line up with our interlocked themes of Reindustrialization, Embodied AI, and Energy: factories and robots need power, AI data centers need a lot of power, and the grid needs to be tougher and smarter to deliver it.

We want to own the suppliers that make that possible.

Details on both trades are in your inbox if you're a Portfolio Armor Substack subscriber. If you're not, you can subscribe below.

And if you want to add downside protection, you can do so using the Portfolio Armor website or iPhone app.