The Pet Rock and the Bubble Machine

Authored by GoldFix, ZH Edit

6am Friday | Good Morning

Over the past several weeks, Michael Hartnett has revived his focus on bubbles. His recent work has coincided with my own growing interest in building a forward-looking investment plan. One centered around AI and minerals (specifically those tied to the coming cycle of industrial policy and manufacturing resurgence in the United States).1

In this process, I’ve found myself at a crossroads. The core question is simple: Is everything a buy now, if we’re investing for five years out? That includes metals, critical minerals, and American companies poised to benefit from industrial reshoring.

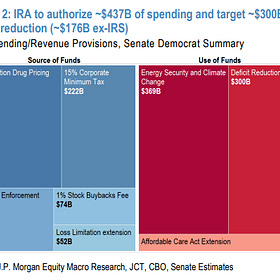

I faced a similar moment when Biden took office. At the time, I structured a portfolio built around the Inflation Reduction Act.2 That plan worked out well. I had broad semiconductor exposure, and that basket of names did what it was supposed to do.

The Next 10 Years: Who Benefits From Fixed Supply-Chains?

Regardless of its impact on inflation (marketing ploy for polling purposes), the Inflation Reduction Act (IRA) portends significant seismic shifts in how America will do business going forward. JPM lists almost 200 companies and the effect these changes will have on them. One way to weather whatever is coming financially is to have the right portfolio mix Read full story

Now, under President Trump, we face the repeal of the IRA and its replacement by what’s being described as one “big, beautiful bill.” That pivot echoes Hartnett’s renewed interest in asset bubbles. Once again, we are looking at where capital will flow.

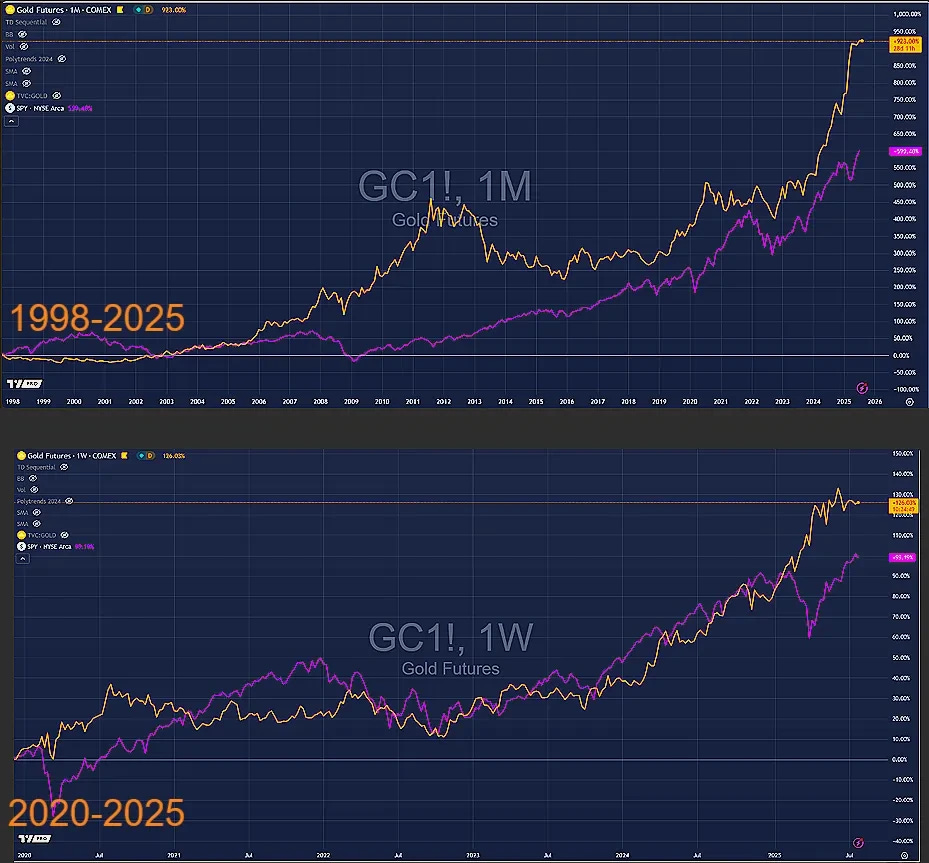

To make sense of that, I’ve returned to a familiar benchmark: gold. Gold as a comparative reference point against the equity market over various time horizons (one year, two years, five years). Then going further: back to 2008, and again to 1999.

What emerges is a deeply uncomfortable truth. Gold has not only kept pace with equities; over longer timeframes, it has outperformed them. Since the post-crisis era, and again across a full 25-year window starting in 1999, gold (a so-called “pet rock”) has done as well, or better, than all the financialized ingenuity the equity markets have produced.

That comparison forces a deeper question: What have markets actually accomplished over that time? I don’t mean in material terms. There’s no denying the technological and infrastructure progress of the past two decades. But in investment terms, measured against a barometer that does nothing (produces no yield, throws off no dividends, and cannot be improved upon), what exactly have we achieved?

We still pretend gold is inert and therefore irrelevant. It does not compound. It doesn’t innovate. And we can’t “add value” to it, which offends the very premise of the modern financial system. We worship growth, optimization, and dominion over nature. And yet, for 25 years, our best minds and engineered capital cycles have not consistently outperformed a metal we buried in the ground and forgot.3

Gold, for me, has long been the true benchmark of risk-free opportunity cost. Not the 10-year Treasury. Not LIBOR or SOFR. When I make an investment decision, I ask one question: Will this asset outperform gold over time? If not, it’s not worth the risk.

That context leads to an unsettling but familiar conclusion. The market, in its current form, no longer produces sustainable value. Instead, it produces bubbles. Bubbles built through speculation encouraged by government policy designed to perpteually distract from monetary power grabs.

The model is now well established. The Federal Reserve creates liquidity; that money is funneled through banks and directed toward politically or strategically favored sectors. The regulatory environment is modified to favor those channels. Prices rise. A narrative is built. Capital floods in. The bubble expands.4

"Gold is Useless, And Therefore Perfect" plus other essays for potential posts

The following are some unfinished sections and notes on Gold and global markets used in putting together a piece for zerohedge readers entitled: What Do Michael Every and Zoltan Pozsar Even Disagree About? It reads like a collection of essays cobbled together. Read full story

Then one of two things happens: The bubble bursts, or the Fed orchestrates a controlled deflation. We saw this play out with Silicon Valley Bank. Whether viewed as an accident, a controlled takedown, or a stress test for the digital financial system, it was part of the pattern. Create. Inflate. Contain.

The Redistribution Machine

Richard Werner’s recent interview with Tucker Carlson5 provided sharp clarity on this mechanism. The cycle of boom and bust is not accidental. It is managed at both ends. It is designed. Its purpose is clear: redirect capital away from the real economy. Inflate assets. Maintain control. Provide cover for the powerful while telling everyone else to keep chasing returns they likely will never realize.

And so, we return again to gold.

For all our innovation (AI, chips, quantum computing) we still cannot improve upon money. Fiat is a social contract, enforced by power. Gold is nature’s contract, enforced by scarcity. The inability to improve on gold is not a flaw; it is the flaw in our system that we refuse to confront.

That is why the money keeps printing. The search for new parking spots for that money never ends. Each cycle ends with a correction, a bailout, or a restructuring of rules. Then the next cycle begins. Always engineered. Never reformed.

That for me is a call to reframe how we understand value.

Continues here unlocked and in audio form