A Double Squeeze is Coming

Welcome to MktContext! I am a professional money manager, trader, and investor who has been timing and beating the market for over a decade. We specialize in predicting market direction by studying the economy and market signals. Join 9,000 subscribers at MktContext.com in improving your portfolio returns — it’s free!

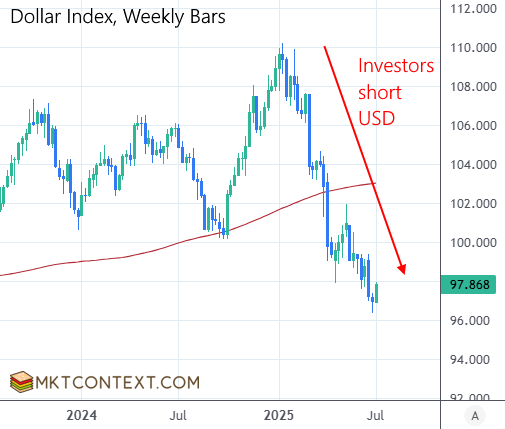

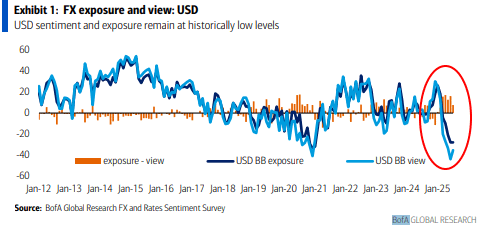

Currently, investors are massively short the US Dollar. This is evident from the fact that the Dollar Index (USD vs. a basket of foreign currencies) is down -11% since the beginning of the year, and futures positioning is at a multi-year low. Anecdotally, of all the institutional investors we have spoken to, there’s not a single person that is long USD.

The predominant thesis rests on mounting US fiscal debt concerns, erratic trade policy, and expectations of Fed rate cuts. The world simply hates the USD right now. Central banks are actively reducing USD reserves to avoid the political risk associated with it. But with positioning this extreme, the risk of a snap-back rally is high. Investors might be right about the long-term downtrend but that doesn’t mean interim short squeezes can’t happen.

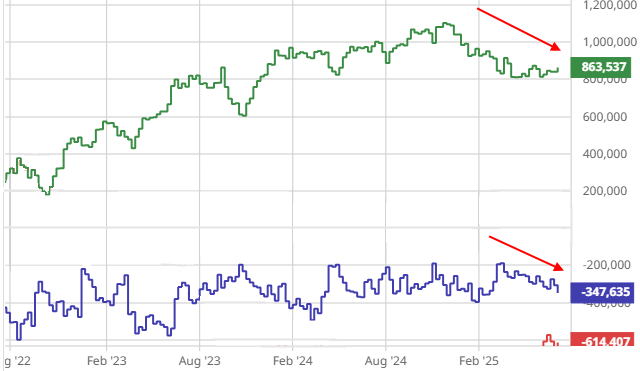

Concurrently, S&P500 and Nasdaq positioning is also short, as we’ve been writing about lately and as evidenced in futures data below. Global investors have incorrectly called for non-US equities to outperform US ones, and now find themselves offside. The only saving grace, and the reason they haven't rotated back to US already, is their currency hedges are working (recall the large decline in USD this far).

If we are correct about the USD shorts unwind, then this will also trigger the rotation back into US equities from the rest of the world. The odds of this happening are increasingly likely as the US exceptionalism scenario is fast materializing (we’ve been writing about this too). We're dubbing this a potential double short squeeze (a squeeze of two separate assets with large short positioning) that could drive stocks painfully higher. It’s an interesting setup that not many people are talking about yet.

When will the unwind get triggered? No one knows. But we already know that foreign equity markets have lagged SPX since around April, and most currency pairs (e.g. EUR/USD, USD/CAD, USD/JPY, etc) are at heavy resistance levels. After 6 months of persistent selling, there isn’t much USD left out there to sell. So when the positioning unwinds in both of these assets, we could be in for some fireworks.

To read the rest of this article, and to see our portfolios and get more market timing content, head over to MktContext.com and subscribe today!