Bitcoin Still Has Room To Run

Welcome to MktContext! I am a professional money manager, trader, and investor who has been timing and beating the market for over a decade. We specialize in predicting market direction by studying the economy and market signals. Join 9,000 subscribers at MktContext.com in improving your portfolio returns — it’s free!

Bitcoin to New Highs

Bitcoin was the talk of the town this week as it broke out to new all-time highs of $118K, after consolidating for two months. There were record inflows into spot Bitcoin and Ethereum ETFs while many alt coins made similar moves. With key resistance broken, there’s a real chance BTC reaches $150K, $200K, and beyond.

We correctly predicted this breakout as we have been tracking the interplay between money supply, BTC, and stocks. Specifically, the rising global money supply (which we previously described as excess money sloshing around in the economy) is being pushed into the riskiest of assets, i.e. BTC.

Historically, BTC responds quickly to changes in global money. More importantly, it leads other markets like equities. As central banks have signaled easier monetary policy and the Dollar has weakened, the gush of money supply is fueling all risk assets including stocks. It’s no coincidence stocks are concurrently making new highs. Bitcoin will continue to lead the way for stocks.

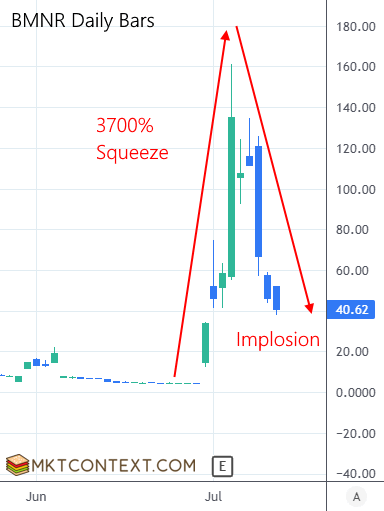

Meanwhile, the stablecoin and crypto-treasury mania reached a peak and is pulling back. It’s a strange dichotomy where BTC is at the highs but crypto-adjacent names like CRCL (reached +800% since IPO) and BMNR (an Ethereum treasury, reached +3700% since the announcement) have both cratered.

Dozens of micro-cap companies have made similar crypto-treasury announcements, but their stock prices don’t see much more than a small pop. Remember: It’s not novel to issue shares to buy crypto. That is easily replicable — which has always been the fatal flaw in crypto business models. One could argue that the only one with any staying power is the original, MSTR (though this will implode too, eventually). But make no mistake, more and more companies will want to invest their cash reserves in crypto going forward.

It is important to distinguish between the crypto-treasury bubble and the rally in O.G. Bitcoin. The former is nearing its end, but the latter is just getting started. One does not necessarily drag down the other. These kind of bubbles occur at the early stages of every disruptive transformation, but does not derail the broader thesis of crypto’s mainstream adoption (which we outlined here). Expect to see a new era for crypto under this regulation-friendly administration.

To read the rest of this article, and to see our portfolios and get more market timing content, head over to MktContext.com and subscribe today!