State of the Markets – Did we bottom?

Subscribe to our research. www.gmgresearch.com

We are monitoring key conditions that typically define a tactical market low:

1) Sentiment Extremes

VIX > 50

Spike in put/call ratios

2) Capitulative Price Action

Over 70% of S&P 500 experiencing -2 standard deviation declines

Fewer than 20% of S&P 500 stocks trading above their 200-day ma

Additional Observations:

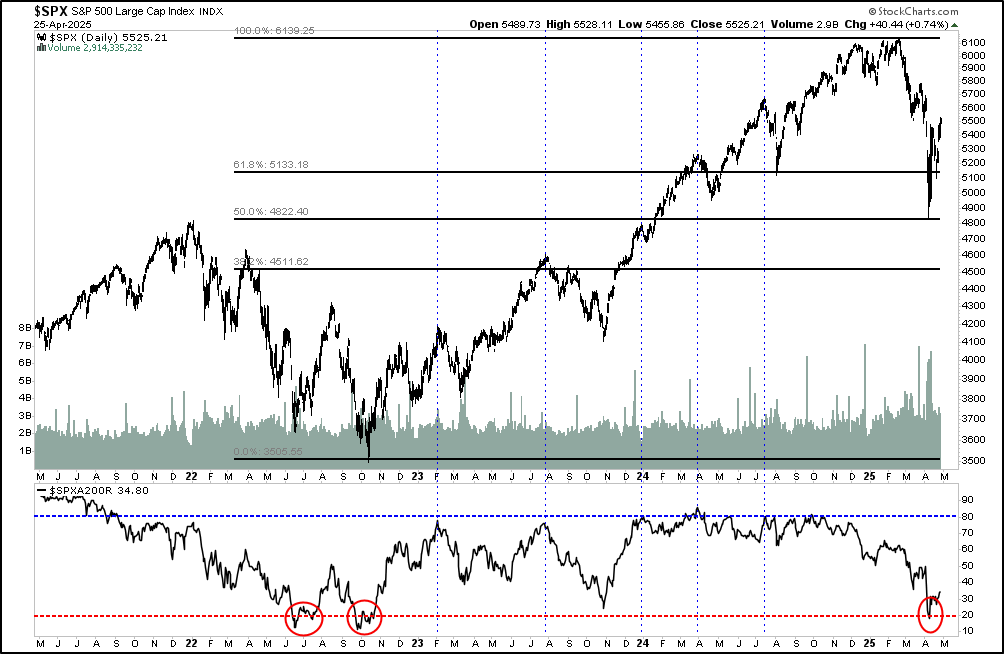

The S&P 500 has retraced roughly 50% of its prior move.

Less than 20% of the S&P 500 remains above the 200-day moving average — historically an incredible bottoming indidcator.

Gold volumes are reaching climactic levels, suggesting potential inflection.

Again, Bitcoin will prevail as one of the top performing assets in 2025

“The best indicators in a drawdown” from our last publication on April 7th.

Volume profile

% of stocks above 50ma✓

% of stocks above 200ma✓

Gold Volatility (Gold -2 Sigma Decline Friday on Huge Volume) ✓

Spot VIX vs 3m VIX (needs to be greater than 18pts, currently is) ✓

On April 7th we published, “Indicators to Watch for a Bottom”.

Again, “% of stocks above 50day moving average is an incredible bottoming indicator.”

Same with % of stocks above 200 day moving average.

QQQ hit our bottom level almost to the point. Volume profile is one of the best indicators during drawdowns.

Bitcoin going higher. “Best Asset of 2025”. Federal Reserve canceled more crypto regulations. Here

This is starting to look like a blow off the top for Gold.

GTA 6 is around the corner and TTWO is outperforming.

Tencent will make new highs very soon.

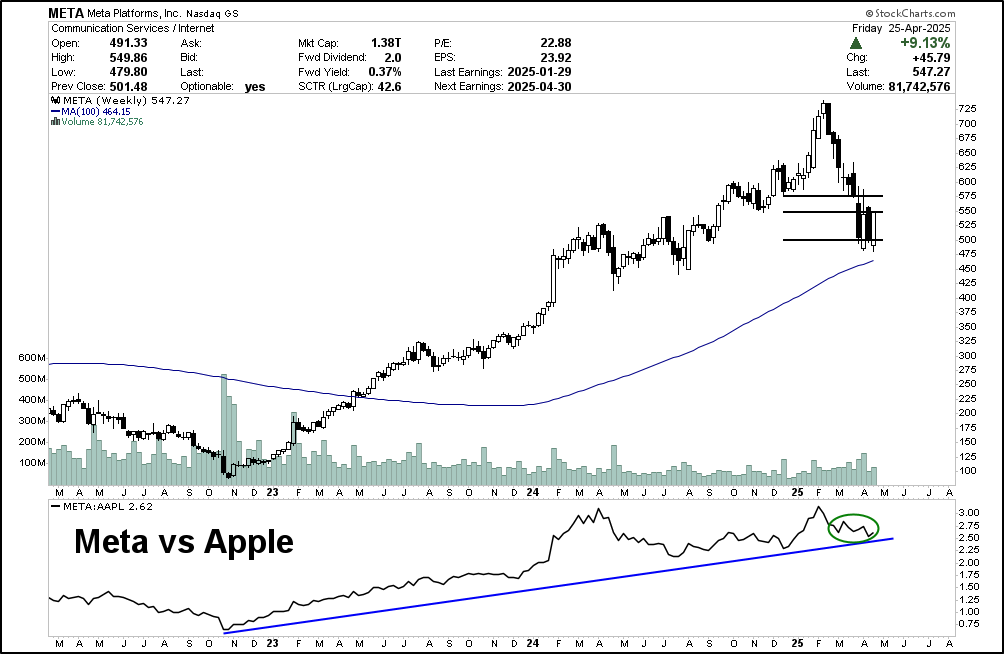

Long Meta / Short Apple Continues.

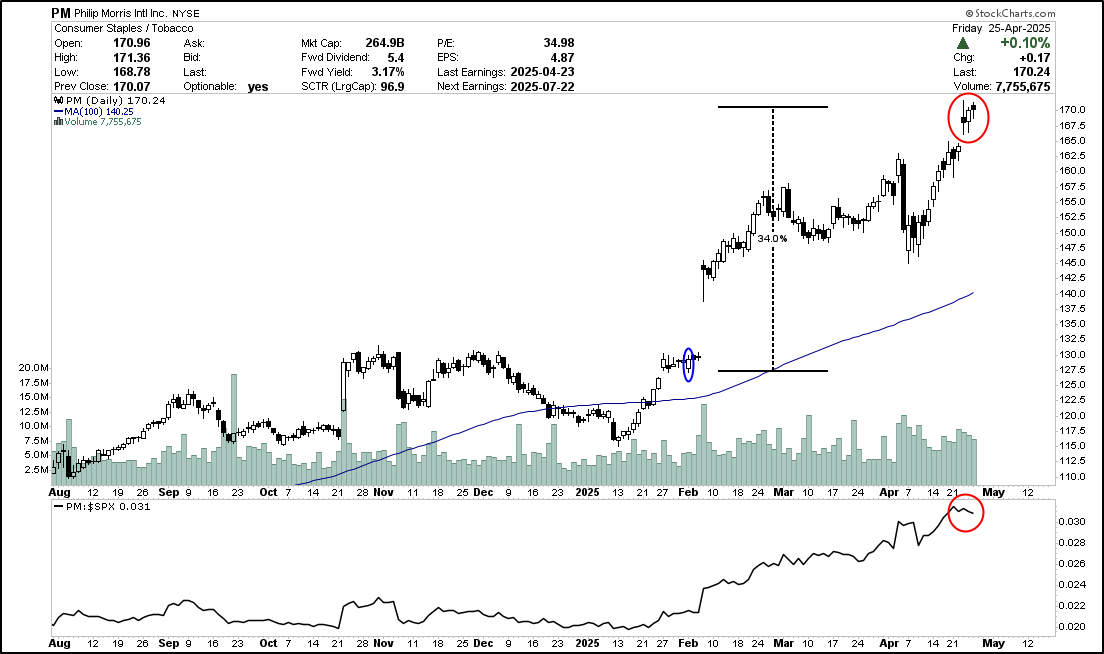

PM: Cigs and Zyn are starting to weaken here. If the dividend gets to 5% its an opportunity.

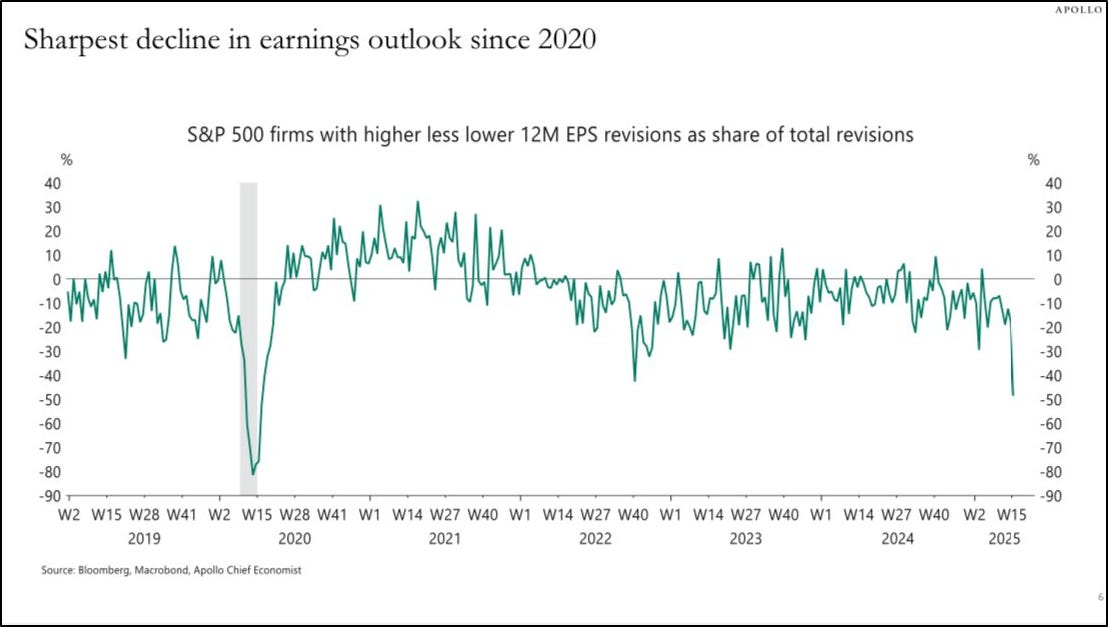

Earnings outlook revisions are cascading.

Counter strike skins are up an average 70% in the last 60 days. We’ve been pounding the table on this for years.

Learn Something.

Hedge funds use the repo market to finance their Treasury positions. They can borrow more with little to no collateral. If the basis trade — arbitraging the small difference between Treasury futures and cash prices — becomes unprofitable or unsustainable, funds may be forced to unwind quickly, creating stress and illiquidity in the Treasury market. In short: systemic risk. A minor unwind occurred on April 8th.