Is Dr. Paul’s Dark Prophecy About to Finally Unfold?

By Graham Summers, MBA | Chief Market Strategist

I’m a big fan of Dr Ron Paul.

For years, Dr Paul has proclaimed that the U.S. government should NOT be engaged in reckless spending, that U.S. debt levels were reaching the levels at which we could expect a crisis, and that the U.S. currency, the $USD was in danger of collapse.

I’ve been thinking a lot about Dr. Paul lately as the financial system lurches towards another crisis. Specifically, I vividly remember Dr. Paul telling me about a private lunch he once had with former Fed Chair Paul Volcker in which Volcker told him that the Fed is OK with orderly selling, but that it’s only when things get DISORDERLY that the Fed panics.

Well, buckle up, because things are about to get disorderly.

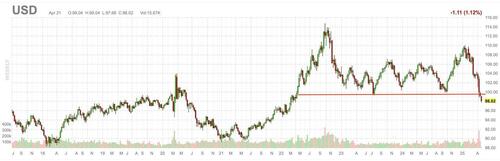

The $USD is collapsing. It just took out critical support in the overnight session. This is a huge deal as the last time the $USD was at the these levels, it had $13 TRILLION less in debt and the economy was about to erupt higher as the Fed and federal government pumped $11 trillion in stimulus/ interventions into it.

Today, the $USD is collapsing while the economy is rolling over and the Fed has explicitly stated it is NOT coming to the rescue. When asked if the Fed would intervene if the stock market collapsed, Fed Chair Jerome Powell explicitly stated, “No, with an exclamation.”

Meanwhile, the bond market is on edge. The U.S. now has over $36 trillion in debt outstanding. Uncle Sam needs to roll over a quarter of this ($9 TRILLION) in the next 12 months.

This is enough for concern even during ideal circumstances. But today, it’s happening at a time when Treasury yields are on the verge of breaking out to the upside! The debt crisis Dr. Paul has been warning about for years could very well be finally happening. What happens to the debt markets if the U.S. tries to roll over its debt while bonds are collapsing/ yields are soaring?!

And finally, stocks are rolling over again, after being rejected at resistance. This is a BAD sign as it indicates that the market can’t even get enough momentum to put in a significant bounce after one of the worst corrections in the last 75 years.

Stocks have already erased $11 trillion in wealth in the two months. By the look of things, we’re nowhere near the wealth destruction being over.

This is the kind of environment in which things become “disorderly” AKA crashes happen. It is clear the financial system is on edge. And this is all happening in the context of both a trade war and a war between the White House and the Fed.

This is an extremely dangerous situation. The odds of a stock market crash are now higher than at any point since the pandemic.

Indeed, our proprietary Crash Trigger is now on red alert. This trigger went off before the 1987 Crash, the Tech Crash, and the 2008 Great Financial Crisis.

We detail this trigger, how it works, and what it’s saying about the market today in a Special Investment Report titled How to Predict a Crash.

Normally this report is only available to our paying clients, but in light of what’s happening in the markets today, we are making just 99 copies available to the general public.

To pick up one of the remaining copies…

Graham Summers, MBA

Chief Market Strategist

Phoenix Capital Research