The Dollar Just Lost Its Moat: GS predicts 20% decline.

The Dollar Just Lost Its Moat: Goldman predicts a 20% decline from here.

From Dollars Per Ounce to Ounces Per Dollar Again

Contents (1200 words)

- Backdrop: Gold isn’t Reacting, It’s Predicting Again

- The Dollar Just Lost Its Moat

- Exceptionalism, Eroded

- Who Pays the Tariff?- The Currency Does

- Brexit, Not Beijing

- The End of Return-Led Flows?

- Three Risks That Could Reverse This View

- Bottom Line

Backdrop: Gold isn’t Reacting, It’s Predicting Again

Authored by GoldFix, ZH Edit

Gold is no longer reacting to the dollar as it used to (spotted in this space before most and formalized here ) and has now become a predictive indicator for the dollar. Put bluntly—as gold correlations to the dollar and interest rates have collapsed, so has gold’s predictive ability has been rediscovered. 1

The Correlation is back but with an upside beta so far...

Historical Context:

“All financial wisdom is cyclical.”

Before the 1990s, gold was a barometer of risk. For example, during the inflation spikes of the 1980s, gold would often lead other assets in pricing-in that risk. More broadly, markets didn’t always assume the U.S. bond market was unshakable. Bonds were, at one time, viewed as an experiment—gold was the hedge in case they failed. As globalization and Neo-Keynesian thinking took hold, that relationship faded from view.

But everyone back then understood: if the U.S. bond market broke, gold was the final refuge. That truth was simply forgotten over time. A new generation is now rediscovering it.

Today, as bonds lose their appeal as safe-haven assets, gold has resumed its historical role as a leading signal. Since Covid, gold has called out several major turns: inflation was not transitory; global fiat-driven deficits are structural, not cyclical; and most critically, the post-dollar, multipolar world is no longer theoretical—it’s in motion. The Gold market has been speaking this in increasing volume since the Russo-Ukraine war started in 2022.

With that framework in place, we present a breakdown of the latest from Goldman Sachs, which argues a protracted2 decline in the dollar is underway. Gold, once again, is leading rather than lagging the dollar’s moves.

While Goldman’s report is an economics piece—not gold-specific—it represents the kind of analysis that prompts shifts from dollars into real assets. Reports like this are often precursors to upward revisions in gold price targets and a renewed recognition of gold’s value as a monetary anchor.

The Dollar Just Lost Its Moat

Goldman Sachs Reverses Course as Tariff Fallout Accelerates

For more than a decade, the U.S. dollar has been the fulcrum of global finance—propped up by American exceptionalism in growth, governance, and returns. That assumption has now cracked. In its April 8 note, Global Markets Daily: Tariffs and the Dollar – Why We Flipped Our View, Goldman Sachs formally abandons its strong-dollar bias. The catalyst: a policy cocktail of trade barriers, political disorder, and waning confidence—each reinforcing the other in a feedback loop that undermines the greenback’s dominance.

This report is not about short-term FX noise. It's about a structural realignment in how the world prices risk—and where the dollar now fits.

Exceptionalism, Eroded

Goldman outlines a sharp reassessment grounded in three developments:

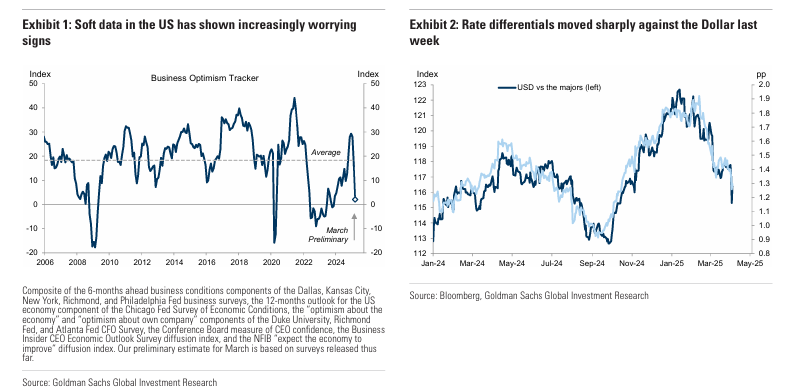

Confidence Collapse

Recent U.S. tariff hikes—particularly the blanket 10% rate—are described as “unnecessary” and actively damaging. Rather than forcing concessions abroad, the policy mix is depressing consumer and business confidence at home. Survey data shows a steeper drop in U.S. optimism than in Europe—a reversal of expectations.Institutional Decline

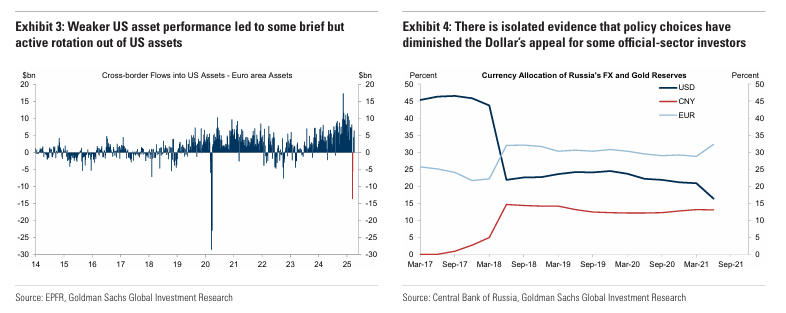

Goldman points to a deterioration in the perceived credibility of U.S. governance. Aggressive posturing toward historical allies, coupled with unstable policymaking, has begun to alienate both official and private capital. Inflows are weakening. What began with Russia de-dollarizing reserves in 2018 is now echoing through broader FX reserve behavior.Unquantifiable Uncertainty

The “market clearing” logic that underpinned earlier tariff cycles has broken down. With every new policy twist, investors are unable to price forward paths. The only predictable outcome, ironically, is more unpredictability. That suppresses positioning and boosts risk premia—further weighing on the dollar.

Imagine if China (and by proxy Russia) approached Europe promising to hold more Euro assets in return for trade deals...

Who Pays the Tariff?- The Currency Does

“The Dollar should depreciate, rather than the foreign currency.”

—Goldman Sachs

Here, Goldman turns to the mechanics. Traditional economic models assumed the U.S.—as a large country—could impose tariffs and shift some of the cost onto foreign exporters. But in cases where the imports are hard to substitute (e.g., critical components or commodities), foreign producers hold the leverage. U.S. businesses and consumers must pay up, and the dollar becomes the release valve.

Put differently: when you can't change your supplier, you pay their price—and you do it in your own currency. That means depreciation.

Continues here

Free Posts To Your Mailbox