A Week Where Decades Happened

Submitted by QTR's Fringe Finance

This week, I took a hard look at the role Bitcoin might play as an exit ramp from dollar hegemony. For centuries, that exit was paved with gold and silver. Now, it seems Bitcoin could be joining them. My reasoning here:

Can I Say One Thing About Bitcoin?

I also dug into the latest Trump-Fed speculation. At this point, it doesn’t seem like Trump merely wants to audit or tame the Fed—it feels like he wants to be the Fed. Central bank independence may be a myth, but replacing the myth with a monarch is no solution. Just ask Turkey.

Will Trump End the Fed or Put Himself in Charge of It?

🔥 70% OFF FOR LIFE: Using the below coupon gives you 70% off an annual subscription to Fringe Finance for as long as you wish to remain a subscriber. Your discount under this plan will never expire, but this offer is good only for today! Get 70% off forever

Reflecting on the week’s crazy tariff news cycle, I couldn’t help but notice how fast things flared up and died down. One minute, the entire media class was in a frenzy; the next, it was radio silence. These flash storms pass quickly, and we rarely learn much—except that most outrage has a short half-life.

What Did We Learn, Palmer?

I also revisited the history of protective tariffs in the U.S. They’ve never lasted long, and the politicians who push them usually get booted out shortly after. There’s a reason: tariffs might sound like economic nationalism, but they can sometimes turn into political suicide.

High Protective Tariffs Have Been Short-Lived in American History

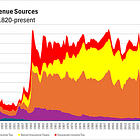

Finally, on the bond front, I warned readers to pay attention to treasuries early last week. Something fundamental seems off, and when bonds stop behaving, it’s usually a sign of deeper structural issues—ones that can’t be papered over by headlines or Fed speak.

Stop What You're Doing And Watch Bonds Now

This week, watch for U.S. retail sales on Wednesday for clues about consumer strength, and keep an eye on Thursday’s expected ECB rate cut. Earnings from Goldman Sachs, Bank of America, and Netflix will also shed light on how corporate America is weathering economic uncertainty.

Here’s what else is new on the blog:

QTR’s Disclaimer: Please read my full legal disclaimer on my About page here. This post represents my opinions only. In addition, please understand I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. Contributor posts and aggregated posts have been hand selected by me, have not been fact checked and are the opinions of their authors. They are either submitted to QTR by their author, reprinted under a Creative Commons license with my best effort to uphold what the license asks, or with the permission of the author.

This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. I may or may not own names I write about and are watching. Sometimes I’m bullish without owning things, sometimes I’m bearish and do own things. Just assume my positions could be exactly the opposite of what you think they are just in case. If I’m long I could quickly be short and vice versa. I won’t update my positions. All positions can change immediately as soon as I publish this, with or without notice and at any point I can be long, short or neutral on any position. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. I edit after my posts are published because I’m impatient and lazy, so if you see a typo, check back in a half hour. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.