Indicators to Watch for a Bottom

Subscribe on our website www.gmgresearch.com

Corrections typically end on bad news, not good news.

Markets are close to a technical bottom

Odds of a rate cut before the May meeting are skyrocketing

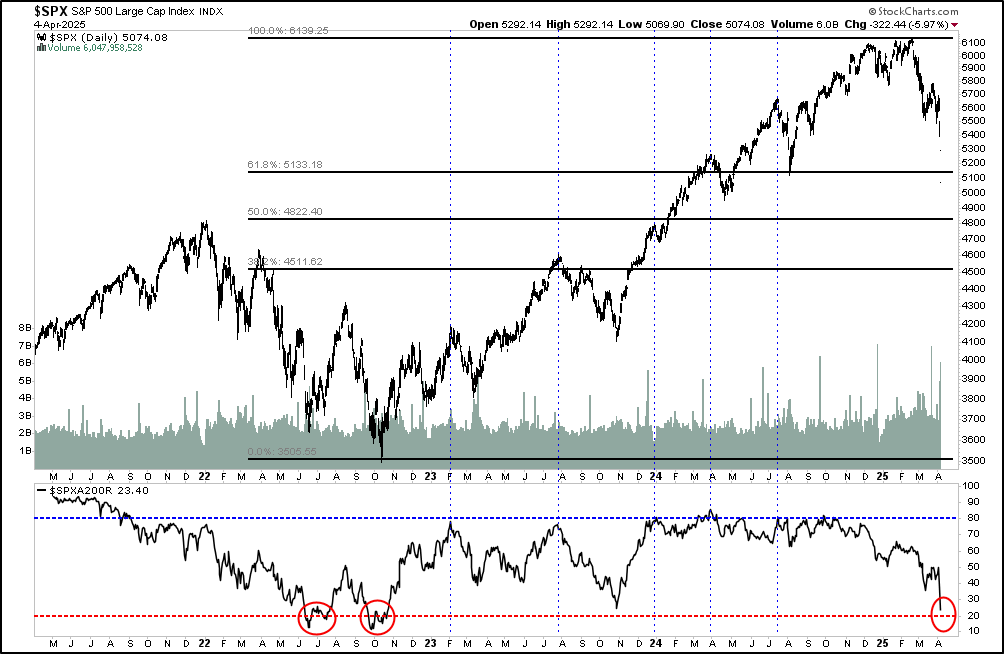

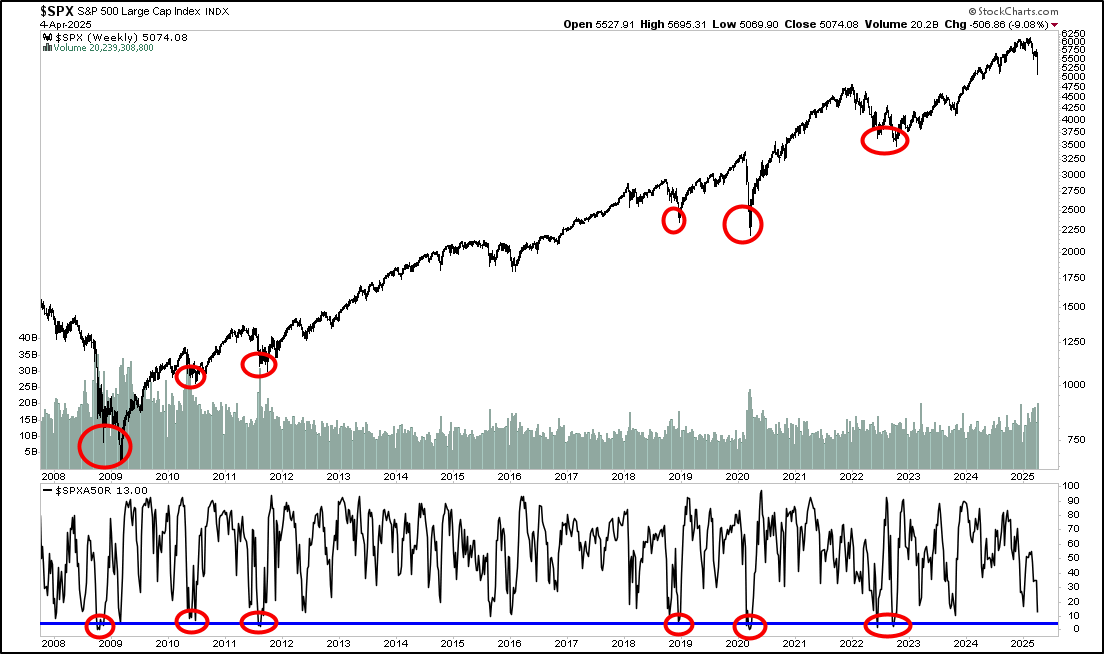

The best indicators in a drawdown

Volume profile

% of stocks below 20ma✓

% of stocks below 200ma✓

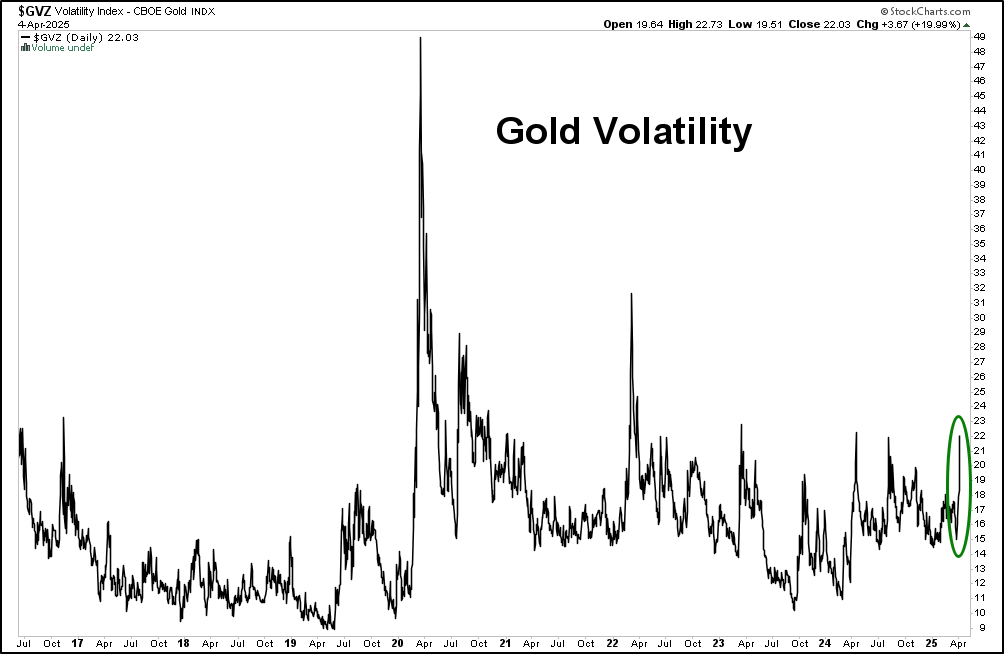

Gold Volatility (Gold -2 Sigma Decline Friday on Huge Volume) ✓

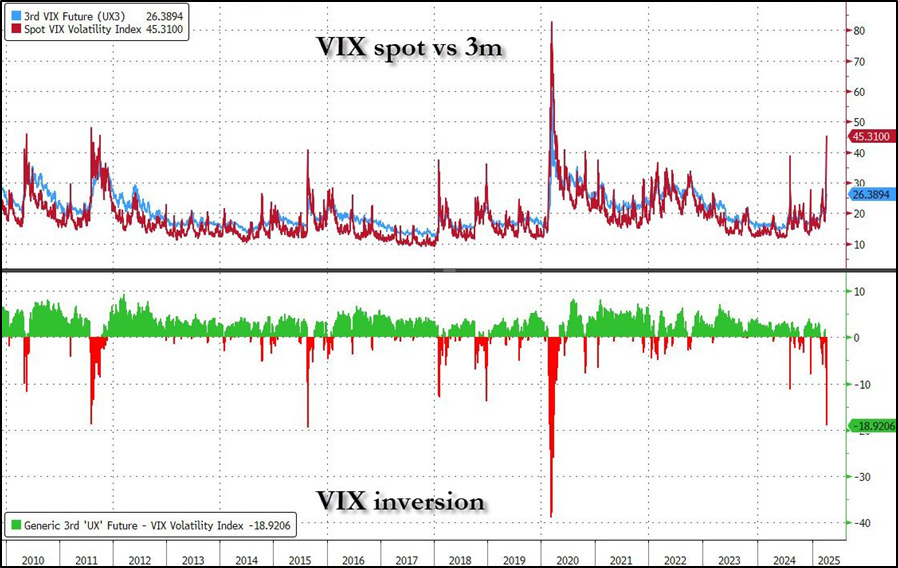

Spot VIX vs 3m VIX (needs to be greater than 18pts, currently is) ✓

VIX going from backwardation to contango (not yet)

Indescriminate selling (> 75% of S&P with -2 Sigma Decline on Friday) ✓

Bitcoin will prevail as one of the top performing assets in 2025

President Trump’s policies aim to disrupt the stock market, pushing the Federal Reserve to cut interest rates sharply, easing debt refinancing and triggering deflation to lower costs. He plans to use tariffs to boost domestic production, urging American farmers to sell locally and reduce grocery prices, while global trade retaliation may further decrease import costs.

% of stocks below 200 day moving average will be below the bottom threshold today.

% of stocks below 50day moving average is an incredible bottoming indicator.

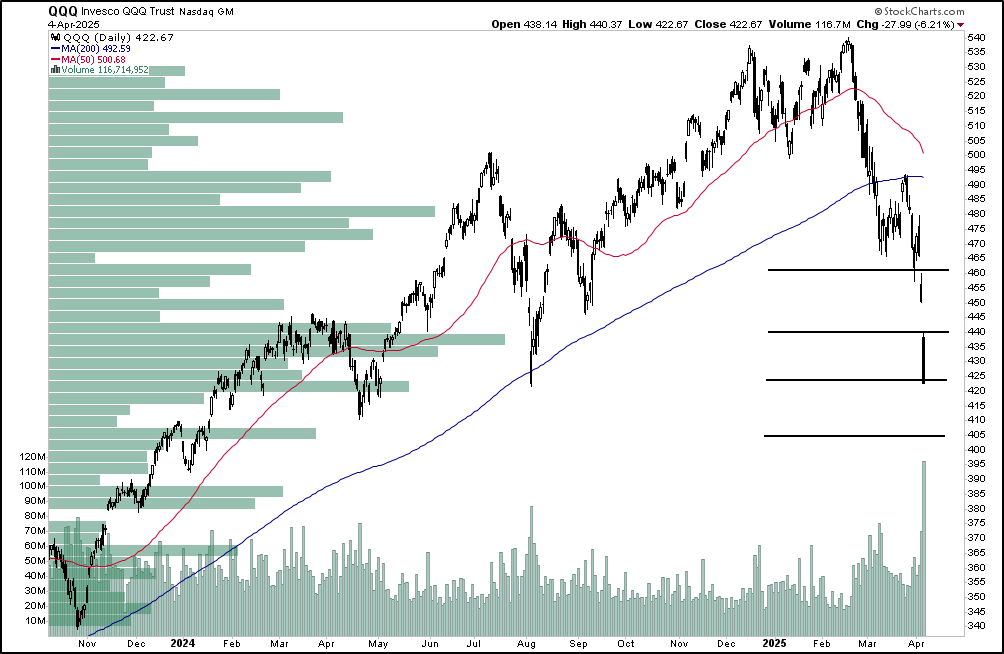

Important levels on the QQQs

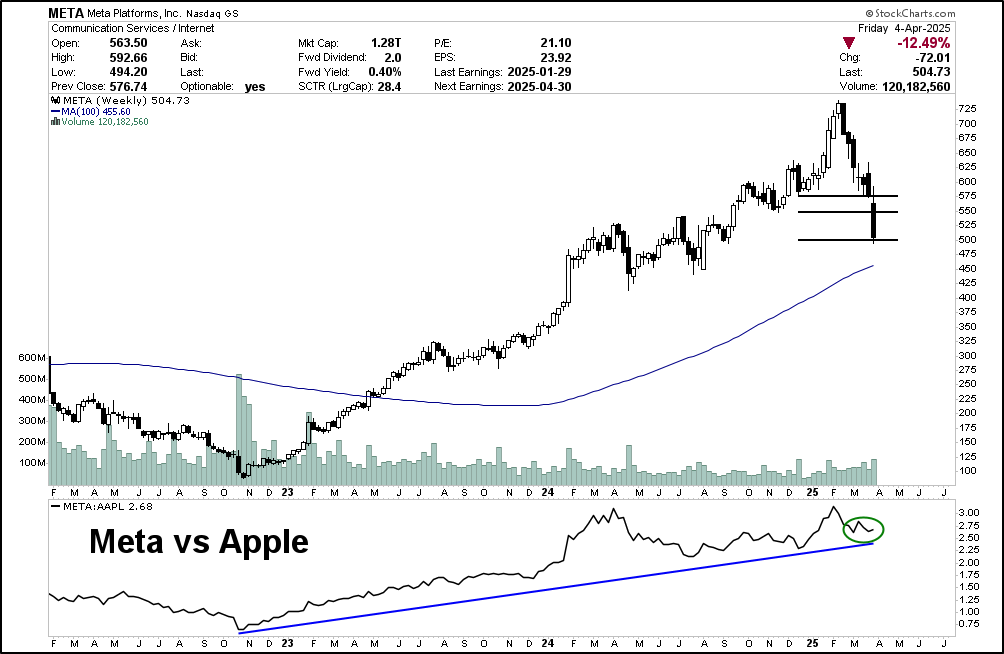

Levels on Meta

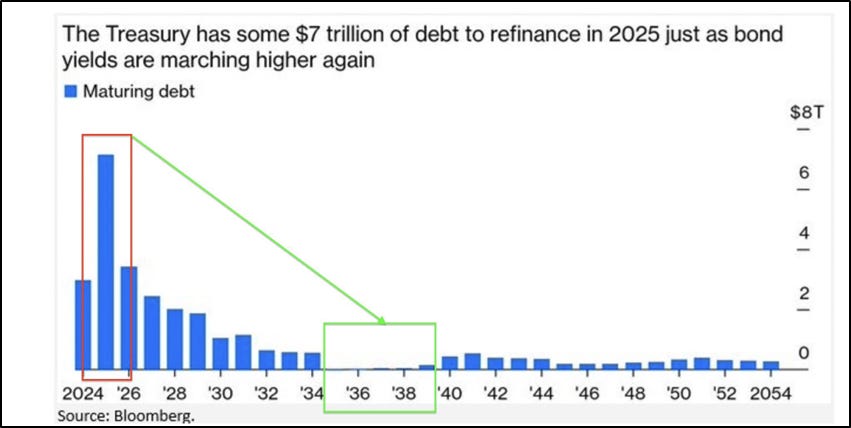

Trump wants lower rates because over $7T in treasuries are maturing this year (scroll down for chart). This explains why bonds have been rallying for the last two weeks.

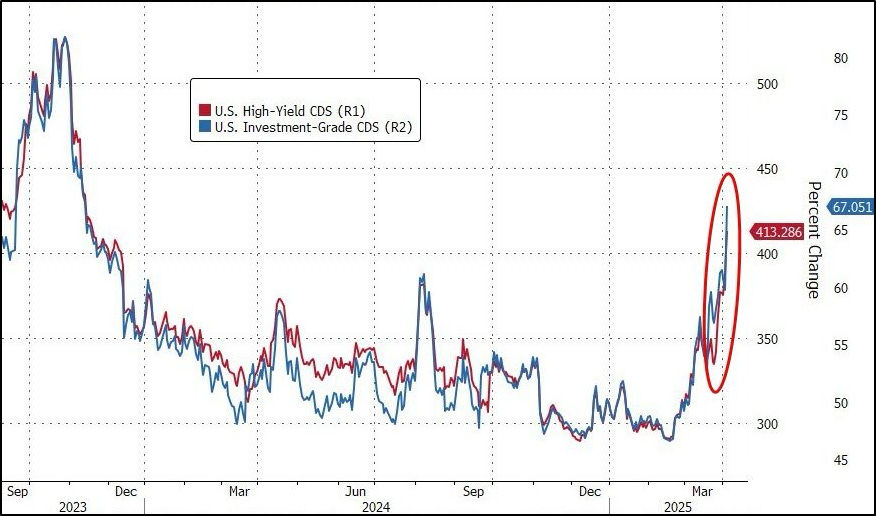

Credit is blowing up.

Spot VIX and 3M hit over 20. Key indicator

Learn Something

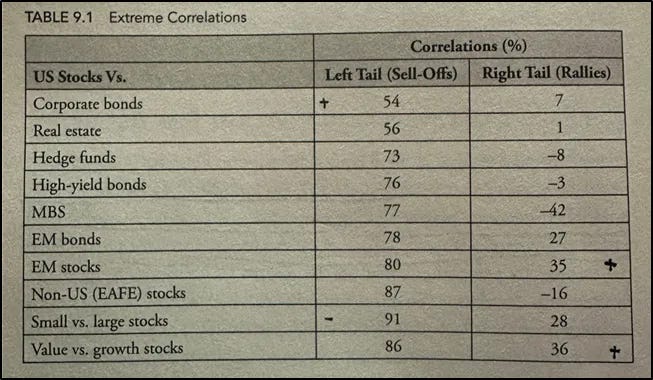

IMPORTANT: Correlations between asset classes are asymmetrical; they behave differently in good times versus bad. Essentially, diversification tends to work well when you don’t want it to (during rallies), but it fails to protect us during downturns. This challenges the traditional investment strategy of diversification, highlighting the need for a more nuanced approach to managing portfolio risk, especially in volatile markets. Being overly diversified is a bad thing. Just remember, most “Financial Advisors” (90%) have NO CLUE what they are doing and just babysitting your money for a fee.

Costco relative new highs. This is strong.

Gold Vol is here.

What doesn’t care about tariffs? Sealed Pokemon, Magic The Gathering and CS Skins. The best asset classes of the decade.

Macro: Most “investors” on Wall Street are brainless with a bottom-up mindset (CFA) which can lead to a lot of confusion when macro forces take over the narrative.