JOLTS Data Points to Loosening Labor Market

This morning, the U.S. Bureau of Labor Statistics released its Job Openings and Labor Turnover Survey (JOLTS) for February. The number declined to 7.6 million from 7.8 million in January. That’s a drop of almost 4.5 million from the March 2022 peak.

When we compare that to the 7.1 million unemployed people, it tells us there are just under 1.1 job openings for each available employee. That compares to the March 2022 peak just over 2.

The data means the available jobs to labor pool ratio is almost back to pre-pandemic levels. It also tells the Fed that the labor market continues to loosen. That’s a signal economic growth could slow, allowing to ease monetary policy more.

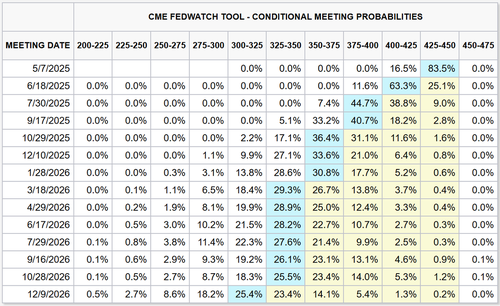

Based on the most recent number from the CME’s FedWatch tool, bond market investors are anticipating five rate cuts by the end of next year. They’ve also pulled forward expectations for this year, bumping their third rate cut expectation up to October compared to December previously.

March numbers from regional Fed bank business surveys, show the hiring picture worsened across both the manufacturing and services sectors That points to slowing economic growth.

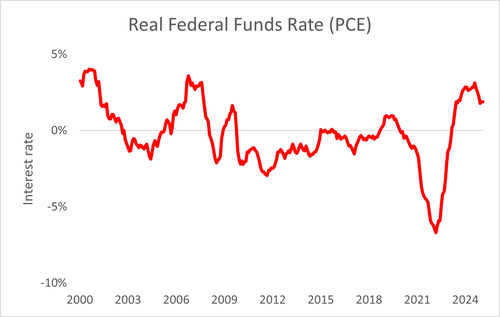

Based on the current real rate of interest (effective fed funds rate minus PCE) our central bank has roughly 190 basis points worth of rate cut room before it gets to zero. When we consider that from 2000 to 2020, it managed the number to -0.1%, it bumps the cushion up to 200 basis points.

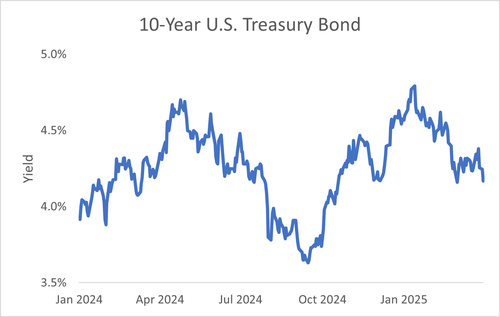

At the end of the day, the central bank will have to do more to support the economy. That should support the outlook for a move down in yields and a rally in bond prices.

If you’d like to receive more content like this to your inbox daily or see how I’d invest for any type of environment, click here.