Bonfire of the Teslas

Bonfire of The Teslas

You may have noticed that boomers and transsexuals have been overrepresented among the arsonists and vandals of Tesla vehicles and charging stations recently. In the thread below, our friend Kevin Dolan offers a theory for why that is. Following that, we'll close with a surprisingly positive market note.

First, for those unfamiliar with Kevin, he is the founder of Exit, a fraternity of like-minded men who take a short position in the present system and build for what comes next. He is also the founder of the Natal Conference, which is happening next week. You can learn more about it by clicking on the image below.

Now on to Kevin's insightful thread.

You may have noticed that the violent reaction is dominated by boomers & trans

— Bennett's Phylactery (@extradeadjcb) March 20, 2025

Common factor is a need to retroactively maintain a personal narrative - "Temporal Bioleninism"

Liberal boomers burned down millennia of culture, wealth, & wisdom, sold their inheritance to… https://t.co/tdhdjM7rf3 pic.twitter.com/Bgoj3NayZG

Here is the full text of that post:

You may have noticed that the violent reaction is dominated by boomers & trans

Common factor is a need to retroactively maintain a personal narrative - "Temporal Bioleninism"

Liberal boomers burned down millennia of culture, wealth, & wisdom, sold their inheritance to foreigners, abandoned their families - & all of that was justified by the postwar progressive political project

If that project is repudiated by their grandchildren - if they find themselves, ironically, "on the wrong side of history" - then it all came to nothing

It would mean that, actually, they were just assholes - their ideology was always a self-serving joke, the story of their lives is pure waste & loss & tragedy, they are already in hell

& since the book of their lives is written, & there's nothing they can do about it, they'll do pretty much anything that lets them believe a different story about themselves

Moving on:

Temporal bioleninism is radicalization by one's position in time

— Bennett's Phylactery (@extradeadjcb) March 20, 2025

These aren't mutant dregs glomming on to Marxism as their only plausible path to status

they might have been other things - but now radical Marxism is the only tolerable mode of understanding their past & present

I can't imagine what goes on in Cynthia Nixon's head when she contemplates the possibility that she might have mutilated & sterilized her child for a celebrity fad - but I guarantee she doesn't stay there long

— Bennett's Phylactery (@extradeadjcb) March 20, 2025

She'll believe & do & say literally anything that kills that thought

Thought-provoking stuff as usual, from Kevin. Now on to our market note.

A Positive Note Amid The Market Madness

Via The Portfolio Armor Substack

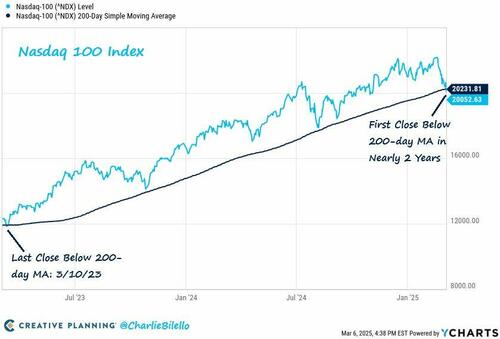

A couple of weeks ago, I first shared this chart by Charlie Bilello, showing that the Nasdaq 100 Index had broken its 200-day moving average for the first time in early two years…

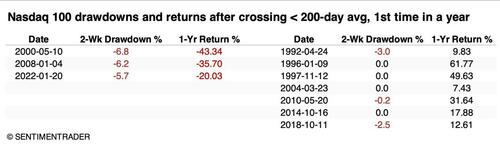

… And this table by Jason Goepfert, of previous times when the Nasdaq broke its 200-day moving average after long bull run. Over the next two weeks, if the index was down less than 3%, the bull market continued. But if it was down more than that, look out below.

Now, it’s been two weeks, and as surprising as it seems, given the drops in its largest components, the Nasdaq 100 was only down about 1.58% since, as of Thursday's close.

Nevertheless, you might want to take advantage of the next market rally to hedge. You can download the Portfolio Armor optimal hedging app by aiming your iPhone camera at the QR code below (or by tapping here, if you're reading this on your phone). Our app can help you find the least expensive hedges given your risk tolerance and time frame.

And if you want to swing for the fences with us when we place our next trade, like we did with Robinhood Markets this week...

Calls on Robinhood Markets (HOOD 6.70%↑). Bought for $1.32 on 3/13/2025; sold (half) for $4 on 3/17/2025. Profit: 203%.

Robinhood Markets (HOOD 6.70%↑). Bought for $1.32 on 3/13/2025; sold (second half) for $5.25 on 3/21/2025. Profit: 305%

...feel free to sign up to our trading Substack/occasional email list below.

If you'd like to stay in touch

You can scan for optimal hedges for individual securities, find our current top ten names, and create hedged portfolios on our website. You can also follow Portfolio Armor on X here, or become a free subscriber to our trading Substack using the link below (we're using that for our occasional emails now).