Buying The Crash And Selling The Rally

You Can Still Trade Rallies In A Market Downturn

On Tuesday afternoon, ZeroHedge noted a problem with buying the dip: namely, that professional money managers have low cash levels, so they have little dry powder to buy along with you. That doesn't mean you can't enter short term trades when the market drops, provided you sell the rallies:

Finally, as we noted earlier, given the magnitude of moves yesterday, a bounce is increasingly likely and is likely a tradeable bounce, but we remain of the view that all rallies should be sold.

Given how oversold and fear-riddled the market is, we could see an aggressive rebound, but we would fade any such potential move.

How We Did Just That

In our post Monday (Sea Of Red), we mentioned we entered two trades on one of our top ten names from Friday.

We elaborated on that in our post here:

Today’s Stock

Today’s stock was one of Portfolio Armor’s top ten names on Friday. Readers may recall we’ve had some success placing bullish short term bets on PA top tens during market drops...

Calls on Delta Air Lines (DAL 1.13%↑). Bought for $1.70 on 2/21/2025; sold for $2.02 on 2/26/2025. Profit: 19%.

Calls on Up Fintech Holding (TIGR 9.51%↑). Bought for $0.39 on 2/24/2025; sold for $0.82 on 2/26/2025. Profit: 110%.

Calls on Robinhood Markets (HOOD 4.26%↑). $48.50 strike. Bought for $1.43 on 2/25/2025; sold (half) for $3 on 2/26/2025. Profit: 110%.

Calls on Oklo (OKLO 8.48%↑). Bought for $1.40 on 2/25/2025; sold (half) for $3 on 2/26/2025. Profit: 114%.

Calls on Robinhood Markets (HOOD 1.14%↑), $45 strike. Bought for $1.46 on 3/4/2025; sold for $3 on 3/5/2025. Profit: 105%.

But also some losses:

Calls on Robinhoood Markets (HOOD -1.11%↓), $48.50 strike. Bought for $1.43 on 2/25/2025; (second half) expired worthless on 3/7/2025. Loss 100%.

Calls on Oklo, Inc. (OKLO -0.49%↓). Bought for $1.40 on 2/25/2025; (second half) expired worthless on 3/7/2025. Loss: 100%.

In addition, this stock looks oversold, with an RSI of about 28, but as you may recall from our last Exits post, oversold stocks can still go lower. Chartmill gives it an overall technical rating of 8 and an overall fundamental rating of 6—better scores than any of our other top names from Friday.

As we noted there, we had two trades on this stock:

a short term, speculative trade betting on a bounce this week, and an earnings trade going out to late April. The maximum upside on the short term trade is uncapped, and the maximum upside on the earnings trade is about 300%. The maximum loss in both cases is 100%.

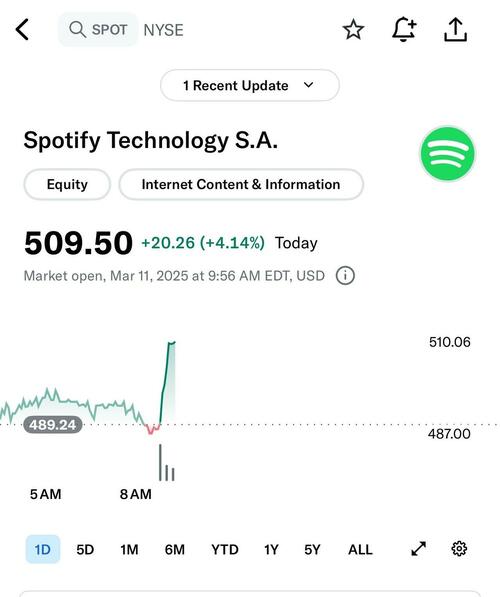

The Stock Was Spotify

We didn't get a fill on our earnings trade yet (it's still open), but we did get a fill on our short term trade on Monday, which was buying $530 strike calls on Spotify (SPOT 5.52%↑) expiring on March 14th (this Friday) for $2.40. We got those calls when SPOT was trading at about $487 on Monday.

On early Tuesday, we got a bounce.

We immediately sold half of our calls at $6, for a gain of 150%. In a normal market, we would have held the rest until later in the week, to try to get a larger gain. But we took ZeroHedge's advice and decided to sell this rally, selling the second half of our calls for $6 later in the day Tuesday.

Calls on Spotify (SPOT 0.00%↑). Bought for $2.40 on 3/10/2025; sold (half) for $6 on 3/11/2025. Profit: 150%.

Calls on Spotify (SPOT 0.00%↑). Bought for $2.40 on 3/10/2025; sold (second half) for $6 on 3/11/2025. Profit: 150%

Can We Do This Again?

We'll certainly try. If you'd like to try alongside with us, feel free to subscribe to our trading Substack/occasional email list, and we'll give you a heads up when we place our next trade.

And if you want to add some downside protection during the next market rally, you can download the Portfolio Armor optimal hedging app by aiming your iPhone camera at the QR code below (or by tapping here, if you're reading this on your phone). Our app can help you find the least expensive hedges given your risk tolerance and time frame.

If you'd like to stay in touch

You can scan for optimal hedges for individual securities, find our current top ten names, and create hedged portfolios on our website. You can also follow Portfolio Armor on X here, or become a free subscriber to our trading Substack using the link below (we're using that for our occasional emails now).