Gold is a Gun: Why is All This Gold Being Repatriated?

Gold: The Gun Bankers Pretend They Don’t Need, But Can't Live Without

Authored by GoldFix, ZH Edit

Gold to a banker is like a gun to a liberal. They publicly dismiss it, advocate for financial "gun control," and pretend it’s unnecessary—until it isn’t. Behind closed doors, though, they keep it close. Not because they want to use it, but because they might have to. Gold is to a family’s finances what a gun is to home safety: a last line of defense when the system fails.

1. Repatriation: Quiet Additions to the U.S. Balance Sheet

The gold being repatriated now isn’t just sitting idle. A significant portion is being added—or more accurately, restored—to the U.S. balance sheet.

2. The Gold Wasn’t Sold—But It Was Loaned, Then Shorted

The U.S. Treasury never sold this gold outright. That would have been a constitutional violation, as gold can only be sold to retire U.S. debt directly. Instead, in the 1990s, the gold was loaned out to bullion banks under a perpetual rolling structure. These banks then hedged it through carry trades, profiting off borrowed gold.

Who was behind this? Look no further than Robert Rubin and Alan Greenspan. The Fed facilitated it, the Treasury allowed it, and the bullion banks executed it. In some cases, what now sits in place of actual gold are IOUs issued by those same banks

.

3. Why It Happened: Monetizing Gold While Keeping Prices Down

At the time, the rationale was simple:

- The Fed got to monetize gold by loaning reserves, earning a small return.

- Gold prices remained suppressed, preventing inflation fears from spiking (a lesson Greenspan learned from Volcker’s battles).

- Bullion banks used the gold for leveraged carry trades, compounding their profits.

No laws were broken. But in the process, a critical asset tied to American sovereignty was placed in the hands of private banks—banks that could, and eventually would, default.

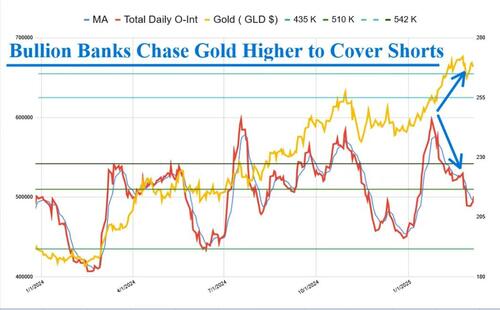

This gold leasing and carry trade structure went on for decades. This chart gives an idea of how big it was. In 2022 JPMorgan, Citibank, and others were forced to disclose their derivative books in compliance with Basel III. But the cracks had been forming for years.

4. Fast Forward to Today: A Balance Sheet Reckoning

For reasons still unclear, the U.S. has decided to clean up its balance sheet. That means some of those IOUs have been called in.

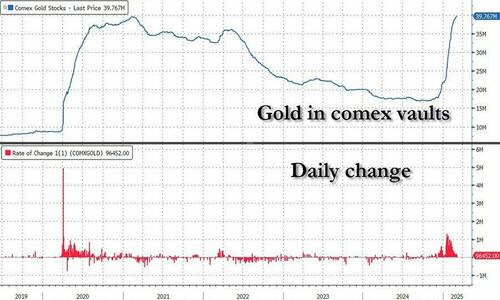

Comex Coffers Fill With Recalled Gold…

Source: ZeroHedge

The problem? Many bullion banks, complacent for years, now face a scramble. They have far more claims against gold than they have actual gold. And with IOUs being recalled, they’re being forced to cover their positions—at any cost.

Why is the U.S. doing this now?

- Fear of BRICS gold purchases?

- A need to consolidate assets for monetization, as Treasury Secretary Bessent has hinted?

- A preparation to create a gold-backed bond-type instrument for international dealings?

Regardless of the reason, the underlying reality is the same: If everyone else is securing gold, the U.S. needs gold too. The bullion banks, caught in the middle, are paying the price.

Banks cover gold shorts on all time highs…

Original R.Blava. Edits GoldFix

5. From Greed to Fear: The Shift in Bullion Bank Behavior

Over the last two years, bullion banks have gone from aggressively shorting gold to desperately covering their positions. See for yourself

More here

Free Posts To Your Mailbox

Stay tuned.