Weekend News Roundup - Newsquawk Asia-Pac Market Open

- US stocks sold off again on Friday whereby the major indices suffered another drop of around 6% as tariff fears continued to dominate with the trade war escalating following the response from China which announced a 34% tariff on the US (matching the US rate on China) and traders were also fearful of equities approaching circuit breaker levels. Furthermore, T-notes initially rallied to north of 114.00 at the peaks which coincided with a 10yr yield of 3.86%, the lowest since October 2024, although the moves in the Treasury complex gradually reversed after the strong NFP report and a hawkish leaning Fed Chair Powell.

- US President Trump said China has been hit much harder than the US and that it is not even close, while he told Americans to ‘hang tough’ and it won’t be easy, but the end result will be historic.

- US Commerce Secretary Lutnick said there is no postponing tariffs and April 9th tariffs are coming, while he stated tariffs are going to stay in place for days and weeks, according to CBS News.

- US NEC Director Hassett said he would expect that job numbers are going to go up back and forth now that tariffs are in place, while he added that more than 50 countries have reached out to the White House to begin trade negotiations.

- Looking ahead, highlights include Japanese Average Cash Earnings & Leading Index, Australian Westpac Consumer Confidence.

More Newsquawk in 2 steps:

1. Subscribe to the free premarket movers reports

2. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

LOOKING AHEAD

- Note: Clocks in Australia and New Zealand Moved Back 1 hour on Sunday.

- Highlights include Japanese Average Cash Earnings & Leading Index, Australian Westpac Consumer Confidence.

- Click for the Newsquawk Week Ahead.

US TRADE

- US stocks sold off again on Friday whereby the major indices suffered another drop of around 6% as tariff fears continued to dominate with the trade war escalating following the response from China which announced a 34% tariff on the US (matching the US rate on China) and traders were also fearful of equities approaching circuit breaker levels. Furthermore, T-notes initially rallied to north of 114.00 at the peaks which coincided with a 10yr yield of 3.86%, the lowest since October 2024, although the moves in the Treasury complex gradually reversed after the strong NFP report and a hawkish leaning Fed Chair Powell.

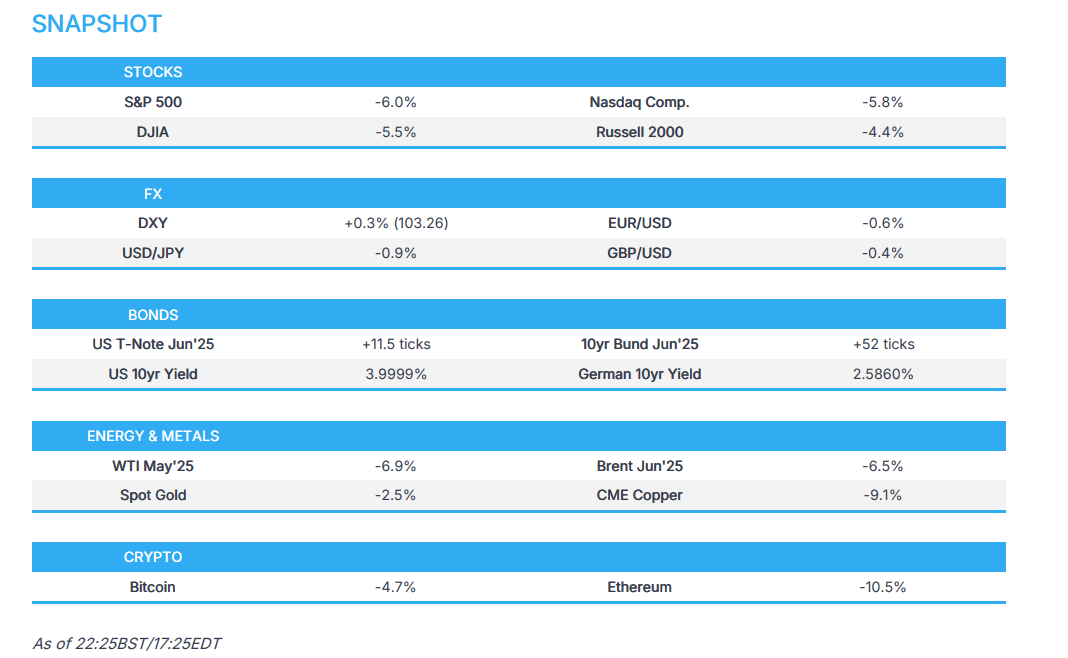

- SPX -5.97% at 5,074, NDX -6.07% at 17,398, DJI -5.50% at 38,315, RUT -4.37% at 1,827.

- Click here for a detailed summary.

TARIFFS/TRADE

- US President Trump said China has been hit much harder than the US and that it is not even close, while he told Americans to ‘hang tough’ and it won’t be easy, but the end result will be historic.

- US Commerce Secretary Lutnick said there is no postponing tariffs and April 9th tariffs are coming, while he stated tariffs are going to stay in place for days and weeks, according to CBS News.

- US NEC Director Hassett said he would expect that job numbers are going to go up back and forth now that tariffs are in place, while he added that more than 50 countries have reached out to the White House to begin trade negotiations. Hassett also stated that President Trump decided not to apply tariffs to Russia due to continuing negotiations over the war in Ukraine, according to ABC News.

- UK PM Starmer spoke with Canadian PM Carney and they agreed on the importance of free and open trade between like-minded nations, while Carney reaffirmed his commitment to Canada playing a role in the coalition of the willing and they both agreed that an all-out trade war is in no-one’s interest.

- UK PM Starmer and French President Macron agreed that a trade war was in nobody’s interests but added nothing should be off the table, while they also shared their concerns about the global economic and security impact, particularly in Southeast Asia.

- Economists believe the UK is well-placed to secure a trade deal with the US which could further reduce tariffs and boost the economy, according to Bloomberg.

- EU’s Von der Leyen said following a phone call with UK PM Starmer that US tariffs harm all countries and the EU is committed to negotiations with the US and is ready to defend itself with proportionate countermeasures.

- France suggested targeting Big Tech’s data use in response to US tariffs and is also considering taxing digital services, according to POLITICO citing French Economy and Finance Minister Eric Lombard.

- India is unlikely to immediately retaliate against US President Trump’s reciprocal tariffs and is focusing efforts on negotiating a bilateral trade deal with the US to bring down duties, according to a government official cited by Economic Times.

- China’s government said China has taken and will continue to take resolute measures to safeguard its sovereignty, security and development interests, while it added there are no winners in trade wars and added the US should stop using tariffs as a weapon, according to Xinhua.

- Taiwan pledged more investment in the US and the removal of trade barriers after Trump tariffs, while it said it will proactively resolve non-tariff trade barriers that have existed for many years and has no plans of tariff retaliation.

NOTABLE HEADLINES

- Fed Chair Powell said on Friday that it feels like the Fed does not need to be in a hurry and has time, while he added that inflation is going to be moving up and growth slowing but noted it is not clear what the path of monetary policy should be.

- US Treasury Secretary Bessent sees no reason to anticipate a recession based on Trump tariffs and downplayed the stock market drop which he said was a short-term reaction, according to NBC News.

- US Senate passed the budget blueprint for US President Trump’s tax cuts and border agenda, sending the measure to the House.

DATA RECAP

- US Non-Farm Payrolls (Mar) 228k vs. Exp. 135k (Prev. 151k, Rev. 117k)

- US Unemployment Rate (Mar) 4.2% vs. Exp. 4.1% (Prev. 4.1%)

- US Average Earnings YY (Mar) 3.8% vs. Exp. 3.9% (Prev. 4.0%)

COMMODITIES

- OPEC+ JMMC meeting made no changes to oil output policy and stressed the need to ensure full compliance.

- Saudi Arabia cut oil prices to Asia to their lowest in four months with May Arab Light Crude set at a premium of USD 1.20/bbl vs Oman/Dubai.

- Qatar set May marine crude OSP at a premium of USD 0.60/bbl vs Oman/Dubai and set land crude at a premium of USD 0.50/bbl vs Oman/Dubai.

- Chile’s government plans to cut the 2025 estimated average price of copper to USD 3.90-4.00/lb from the current USD 4.25/lb projection.

- US is reportedly closing in on a critical mineral deal with the Democratic Republic of the Congo.

GEOPOLITICAL

MIDDLE EAST

- Israel and UAE foreign ministers met in Abu Dhabi and discussed efforts to achieve a ceasefire in Gaza and secure the release of hostages.

- White House official said Israeli PM Netanyahu is visiting Washington on Monday.

RUSSIA-UKRAINE

- Russia reportedly launched its biggest attack on Kyiv in weeks. It was separately reported that Russian troops were pushing into Ukraine’s Sumy region and troops captured Basivka in Eastern Ukraine. Furthermore, Russia's Defence Ministry said Ukraine attacked Russian energy infrastructure.

- Poland scrambled an aircraft to ensure airspace security after Russia launched strikes over Ukraine.

OTHER

- G7 Foreign Ministers expressed deep concern about China’s provocative actions, particularly recent large military drills around Taiwan.

ASIA-PAC

NOTABLE HEADLINES

- Taiwan’s financial regulator announced limits on the number of short-selling of stocks and will raise the minimum short-selling margin ratio to 130% from 90%.

EU/UK

NOTABLE HEADLINES

- French PM Bayrou warned that Trump tariffs could cut France’s GDP growth by 0.5 percentage points.

- German Chancellor-in-waiting Merz’s key ally voiced optimism regarding talks with the Social Democrats on forming the next government.

- ECB’s Schnabel said some people had the view that ‘Liberation Day” could be the day of peak uncertainty although she is not entirely sure that is the case and noted that they face a dramatic surge in uncertainty.

- Fitch affirmed Italy at BBB; with Outlook Positive and affirmed Slovenia at A; Outlook Revised to Positive from Stable.