US stocks were in risk-on mode following the announced ceasefire from US President Trump - Newsquawk Asia-Pac Market Open

- US stocks were in risk-on mode following the announced ceasefire from US President Trump between Israel and Iran.

- Fed Chair Powell said the Fed is well-positioned for the time being to wait to learn more about the likely course of the economy before adjusting policy, once again reaffirming his wait-and-see position on rate cuts.

- Iranian Foreign Minister Araqchi said the nuclear programme continues, according to Al Arabiya; US military strikes on three Iranian nuclear facilities last weekend likely set the programme back by only a few months.

- EU warned that a baseline Trump tariff would still spur retaliation, and noted that retaliatory tariffs on US imports could include Boeing (BA) aircraft, according to Bloomberg.

- Looking ahead, highlights include New Zealand Trade Balance, Japanese PPI, Australian CPI, BoJ SOO, Fed's Schmid, BoJ's Tamura, Supply from Australia and Japan

More Newsquawk in 2 steps:

1. Subscribe to the free premarket movers reports

2. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

SNAPSHOT

US TRADE

- US stocks were in risk-on mode following the announced ceasefire from US President Trump between Israel and Iran. Despite reports of both Iran and Israel breaking the agreement and Trump showing discontent, risk-taking remained intact with US major indices up over 1%, and the SPX c. 1% of ATH’s.

- Sectors ex-Energy were in the green with gains led in Financials, Tech, and Communications, while Energy suffered amid a continued slump in crude prices

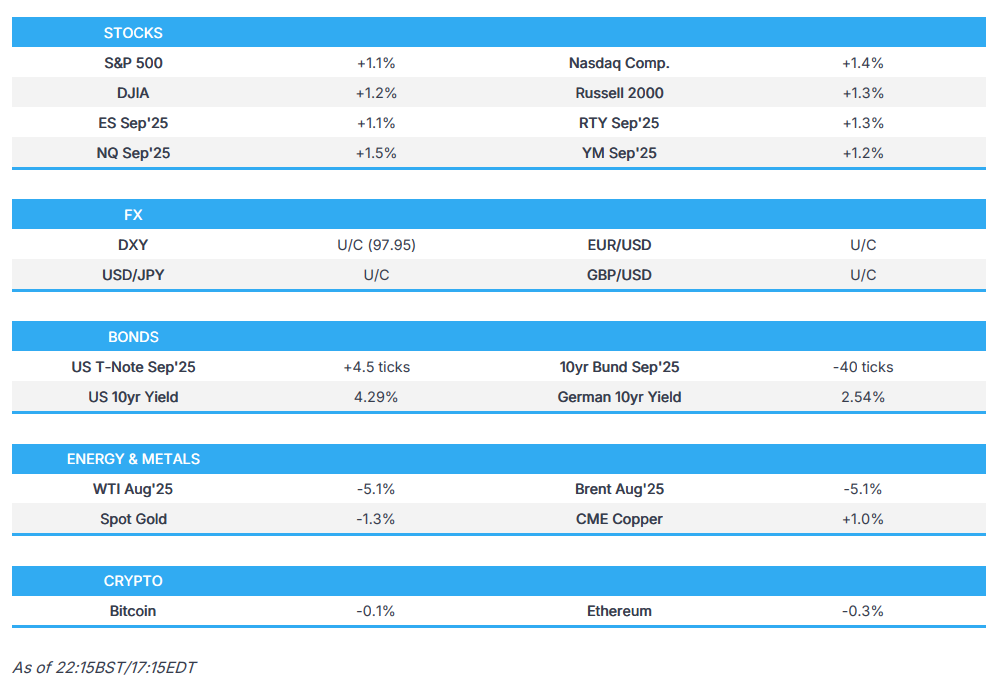

- SPX +1.11% at 6,092, NDX +1.53% at 22,191, DJI +1.19% at 43,089, RUT +1.34% at 2,161

- Click here for a detailed summary.

NOTABLE HEADLINES

- Senate Majority Leader Thune planned a Friday Senate vote on the Trump tax bill, according to Axios.

- US Treasury Secretary Bessent said they were on track for a vote, hopefully on Friday, and noted that the X-date for the debt ceiling could change if courts interfered with Trump. He expressed confidence that the US House would pass the Senate bill and said they were in a good spot.

DATA RECAP

- US Rich Fed Comp. Index (Jun) -7.0 (Prev. -9.0)

- US Rich Fed Mfg Shipments (Jun) -3.0 (Prev. -10.0)

- US Consumer Confidence (Jun) 93.0 vs. Exp. 100.0 (Prev. 98.0, Rev. 98.4)

- US Rich Fed, Services Index (Jun) -4.0 (Prev. -11.0)

- US CaseShiller 20 MM SA (Apr) -0.3% vs. Exp. -0.1% (Prev. -0.1%, Rev. -0.2%)

- US CaseShiller 20 YY NSA (Apr) 3.4% vs. Exp. 4.0% (Prev. 4.1%)

- US CaseShiller 20 MM NSA (Apr) 0.8% (Prev. 1.1%)

- US Monthly Home Price YY (Apr) 3.0% (Prev. 3.7%, Rev. 3.9%)

- US Monthly Home Price MM (Apr) -0.4% (Prev. -0.1%)

- US Monthly Home Price Index (Apr) 434.9 (Prev. 436.6, Rev. 436.7)

- Canadian CPI Inflation YY (May) 1.7% vs. Exp. 1.7% (Prev. 1.7%)

- Canadian CPI Inflation MM (May) 0.6% vs. Exp. 0.5% (Prev. -0.1%)

- BoC Core CPI Measures Average (May): 2.86% (prev. 2.93%, rev. 2.90%)

- Bank of America's (BAC) CEO says US consumer spending is up about 4.5% Y/Y.

GEOPOLITICS

- Iranian Foreign Minister Araqchi said the nuclear programme continues, according to Al Arabiya.

- US President Trump posted: China can now continue to purchase Oil from Iran. Hopefully, they will be purchasing plenty from the US, also. It was my Great Honor to make this happen!.

- "There have been no [US] sanctions lifted on Iran", says Fox Business' Lawrence in reference to President Trump's post that China can continue buy oil from Iran. "The President continues to call on China and all countries to import our state-of-the-art oil rather than import Iranian oil in violation of US sanctions." according to a White House official cited by FBN.

- Iran's Revolutionary Guards denied there was any drone attack in the northwestern city of Tabriz following reports air defenses were activated in the area, according to Iranian news sites.

- Early US intelligence assessment suggested that the strikes on Iran did not destroy core nuclear sites, CNN reported. According to three sources briefed on the DIA’s findings, US military strikes on three Iranian nuclear facilities last weekend likely set the programme back by only a few months. The initial assessment—based on battle damage evaluations from US Central Command—contradicted President Trump’s public statements that the sites were “completely and totally obliterated.” Two sources confirmed Iran’s enriched uranium stockpile remained intact, and one said the centrifuges were largely unaffected. The White House acknowledged the report but said it disagreed with the conclusions.

- Israeli security source, cited by Al Hadath, said they knew exactly where Iran transported its enriched uranium. However, they would not target the enriched uranium sites to avoid causing a nuclear disaster.

- Israeli PM Netanyahu confirmed that the ceasefire was now in effect and stated that the war had achieved its goals. He warned that Israel would respond forcefully to any violations. The PM’s office added that Netanyahu would deliver a statement later today.

- A Times of Israel journalist posted on X that the IDF had detected a new launch of ballistic missiles from Iran, and that sirens were expected to sound in northern Israel in the coming minutes (08:28 BST).

- Israeli Minister Ben-Gvir, following Trump’s ceasefire announcement, said the operation should have been extended for “a few more days” to “designate the collapse of the [Iranian] regime,” according to i24news’ Stein.

- Israel’s Finance Minister Smotrich said the ceasefire was violated and that one launch from Iran had been identified — adding “Tehran will tremble,” via N12 News.

- Two Iranian missiles were reportedly launched at northern Israel and intercepted, according to an initial assessment, via Horowitz on X.

- Israel’s Defence Minister stated he had instructed the military to respond “forcefully” to Iran’s violation of the ceasefire with high-intensity strikes against targets in the heart of Tehran.

- Israel’s Chief of Staff said Israel would attack Iran with force in response to the ceasefire breach.

- Iranian state media denied that any missiles had been fired at Israel after the ceasefire, according to Soylu on X.

- Iran’s Top Security Body said its armed forces had no trust in the words of enemies and would “keep finger on trigger to respond to any further act of aggression,” via Fars News.

- An Israeli official told the Jerusalem Post that “The Americans are with us—they know Iran has violated the ceasefire.”

- The Qatari Prime Minister said indirect talks between Hamas and Israel to reach a ceasefire would take place in the next two days.

- US President Trump said: “I did not like that Israel 'unloaded' right after they agreed to a ceasefire”; When asked if the truce had broken, he responded: “I do not think so.” “Israel has to calm down. I have to get Israel to calm down; going to see if I can stop it.” “Israel and Iran have been fighting so long and so hard they don’t know what the fk they are doing.”

- IRGC claimed it fired 14 missiles at Israeli military centres in a final wave launched minutes before the ceasefire took effect, via Tasnim.

- Israeli official told the Jerusalem Post that only one target would be struck, according to Amichai Stein.

- US President Trump, via Truth Social, said Israel would not attack Iran. All planes would turn around and head home. “Nobody will be hurt. The ceasefire is in effect.”

- PM Netanyahu reportedly told Trump that he could not cancel the attack and that some response was necessary after Iran’s violation of the ceasefire, via Axios.

- President Trump also claimed “Iran will never rebuild their nuclear facilities!”

- Israeli Army Radio reported that the military attacked Iranian radar near Tehran.

- Israel confirmed that planes hit one target and pilots were on their way back, via N12.

- During a phone call with Netanyahu, President Trump was “angry and spoke in a very aggressive and direct manner”, making it clear what needed to be done to prevent the ceasefire from collapsing, via Ravid on X.

- Iran’s President said: “We will respect the ceasefire if Israel respects it,” via Al Arabiya.

- China’s Foreign Minister said it was in contact with both Iran and Israel and hoped to see a “real ceasefire,” per official statement.

TRADE/TARIFFS

- EU warned that a baseline Trump tariff would still spur retaliation, and noted that retaliatory tariffs on US imports could include Boeing (BA) aircraft, according to Bloomberg.

- German Chancellor Scholz backed a more muscular EU approach ahead of the July trade talks deadline, according to the FT, as the bloc prepared retaliatory tariffs in a bid to secure a better deal with Trump.

- "White House Economic Adviser Kevin Hassett said we will see a sequence of trade deals around the 4th of July", via Fox's Lawrence. On the Bill; "He says the administration has been focused on getting the One Big Beautiful Bill passed through Congress".

CENTRAL BANKS

- Fed Chair Powell testified in front of the House on Tuesday. In his text release, he said the Fed is well-positioned for the time being to wait to learn more about the likely course of the economy before adjusting policy, once again reaffirming his wait-and-see position on rate cuts. In the initial text release, Powell made no nod to rate cuts or, more specifically, July, so Bowman and Waller remain the outliers on the dovish side. However, as Powell spoke in the Q&A section to the House, he had a marginally dovish skew at points - when questioned about the possibility of a July cut, he said many paths are possible and could see inflation come in not as strong as expected if that was the case, that would suggest cutting sooner as would a weakening labour market. However, he swiftly offered the other side as he noted that strong inflation or a labour market could see cuts come later. The Chair added that the reason the Fed is not cutting rates is that it forecasts in and out of the Fed look for a meaningful increase in inflation this year. Powell further echoed his known stance of wait and see and as long as the economy is strong and can take a little bit of a pause here. Further still, the Chair repeated that if it turns out inflation pressures are contained, they will get to a place where they cut rates, but they do not need to be in any rush and won't point to a particular month. Powell said rates are modestly, not moderately, restrictive.

- Fed's Bostic (2027 voter) sees economic growth slowing to 1.1% this year, and inflation rising to 2.9%. Bostic said there is no need to cut rates now and still sees a single 25bps reduction late this year, which puts him beneath the median year-end 2025 SEP dot plot for this year (50bps of cuts), and likely means he is one of the two Committee members who pencilled in 25bps of rate cuts this year in the latest Fed SEP’s. The Atlanta Fed President added business officials have become less pessimistic, and feel they can manage through tariffs, and price increases are just a matter of time.

- Fed's Hammack (2026 voter) said rate policy could be "on hold for quiet some time" as Fed seeks clarity, does not see any imminent case to cut rates, and the Fed has time to make decision on monetary policy. On the path, Hammack added would rather be slow and right than fast and wrong on monetary policy. Re. tariffs, notes possible tariffs may have a one-time hit on inflation, but that is hard to say right now. On the dot plots, said she is towards the top end of the Fed dot plots. Overall, it shows Bowman and Waller remain the dovish outliers as opposed to a general consensus shift from FOMC members, albeit from the members we have heard from so far post-meeting.

- Fed's Williams (2025 voter) said monetary policy is well positioned right now and is modestly restrictive which gives space to examine new data (echoes Powell) Note, Chair Powell in his testimony to the House said, “rates modestly, not moderately, restrictive”. The NY Fed President expects the unemployment rate to climb to around 4.5% by year end - in line with the year-end 2025 Fed median unemployment rate forecast. Williams added US economy is in a good place and the job market is still solid. Expects tariffs will boost inflation to 3% this year and expects inflation to gradually decline to 2% over the next two years. Williams reiterated familiar lines and flagged weak soft data vs. more resilient hard data. Speaking on tariffs, said they may be adding a quarter of a percentage point to inflation right now. On rates, 'eventually' interest rates need to move lower, and the Fed will get data over time to help make the next interest rate decision.

- Fed's Kashkari (2026 voter) said the Fed is in wait-and-see mode to get more clarity on tariff effect on inflation and wants to get a better sense of what's really going on before making a policy change. As such, Kashkari joined the chorus of Powell, Collins, Bostic, Barr, and Hammack, as opposed to the dovish outliers of Bowman and Waller. Kashkari added it is possible the Fed could cut rates when inflation is still high if the labour market deteriorates sharply, but do not forecast that situation.

- Fed’s Barr (voter) said monetary policy was well positioned for the Fed to wait and observe how economic conditions unfolded. He noted the US economy remained on solid footing, with low and steady unemployment and ongoing disinflation. However, he warned inflation was set to rise due to tariffs and flagged potential persistence from higher short-term expectations, supply chain adjustments, and second-round effects. Tariffs could also slow the economy and push unemployment higher. While real-world rates were shaped by various forces, Barr acknowledged Fed policy still played a role.

- Fed’s Collins (2025 voter) said the current state of monetary policy was necessary, according to Reuters.

- BoE Governor Bailey said the persistence of inflation in the UK was probably linked to the tighter labour market.

- BoE's Greene said underlying activity is weak, the labour market has loosened further and the disinflationary process is continuing. Worries about both demand and supply sides of the economy. Continue to think risks remain two sided but skewed to the downside on growth and to the upside on inflation. A careful and gradual approach to removing monetary policy restrictiveness continues to be warranted. On the domestic front, noisy data means that it will take longer for me to take comfort from recent disinflationary trends. It’s unlikely that the uncertainty from these events – and subsequent developments – will be resolved any time soon (in reference to global points of uncertainty, i.e. tariffs, geopols). Still expect trade policy to have a net disinflationary impact on the UK, but it may be muted relative to my expectations in May, when it was a factor in my decision to cut Bank Rate. The risk that our near-term plateau in inflation feeds through into second round effects is skewed to the upside.

- BoE's Ramsden said "cumulative evidence of material loosening in the labour market has influenced me"; "I’m now attaching more weight to the downside risks in the medium term". "I see no inconsistency with my latest vote and the MPC’s gradual and careful approach to the withdrawal of restrictiveness. This has served the MPC well over the last year as we have cut Bank Rate four times by a total of 100bps in total". "I still think the risks to inflation continue to be two-sided I’m now attaching more weight to the downside risks in the medium term".

- ECB’s de Guindos said the Iran situation added an extra layer of uncertainty, but emphasised that the underlying disinflation process had not been derailed, regardless of oil prices.

- ECB’s Kazimir said caution would take priority in policymaking.

- ECB’s Lane noted there was still some distance to go on services inflation but expressed confidence that the ECB had largely completed the process of bringing inflation to target.

- Reuters Poll: 46 of 86 economists expect the ECB to cut the deposit rate once more this year to 1.75%, most likely in September. Nearly 80% said the risks to their eurozone inflation forecasts for this year and next were balanced.

- Hungary Base Rate (Jun): 6.5% vs. Exp. 6.5% (Prev. 6.5%).

FX

- Dollar was weaker as the safe-haven allure continued to unwind on Tuesday after US President Trump declared a ceasefire between Israel and Iran; albeit, it did see violations from either side throughout the day, but after a Trump intervention against Israel, it seems to be holding, thus far.

- G10 FX was exclusively firmer, and benefited from the Greenback’s weakness as JPY, CHF saw the strongest gains, while CAD ‘underperformed’ and was likely weighed on by lower oil prices.

- EUR/USD traded between 1.1575-1641, although little move was seen after German IFO data, which saw a larger-than-expected increase for the Business climate metric.

- CHF and JPY outperformed with USD/CHF and USD/JPY reaching levels of 0.8036 and 144.52, respectively, despite a lack of currency-specific newsflow.

- Cable hit a peak of 1.3648, and currently hovers around 1.3630. BoE Deputy Governor Ramsden remarked that his dovish dissent at the prior meeting was based on the view that there has been a material loosening in the labour market, and he did not see such a vote as being inconsistent with the MPC's "gradual and careful" approach.

FIXED INCOME

- T-notes were bid as Fed Chair Powell kept July options open.

- US sells USD 69bln of 2yr notes; 0.1bps stop-through: High Yield: 3.786% (prev. 3.955%, six-auction average 4.075%); WI: 3.787%. Tail: -0.1bps (prev. -1.0bps, six-auction avg. -0.3bps). Bid-to-Cover: 2.58x (prev. 2.57x, six-auction avg. 2.62x). Dealers: 13.2% (prev. 10.5%, six-auction avg. 11.1%). Directs: 26.3% (prev. 26.2%, six-auction avg. 17.6%). Indirects: 60.5% (prev. 63.3%, six-auction avg. 71.3%)

COMMODITIES

- Oil prices tumbled again on Tuesday due to the Israel/Iran ceasefire announcement.

- Private Inventories: Crude -4.28mln (exp. -0.8mln), Distillate -1.03mln (exp. +0.4mln), Gasoline +0.75mln (exp. +0.4mln), Cushing -0.08mln.

GEOPOLITICAL

RUSSIA-UKRAINE

- Turkish President Erdogan is also set to meet President Trump at the NATO summit in a bid to reset US–Turkey relations, via Bloomberg.

- President Trump is scheduled to meet President Zelensky during the NATO summit, according to Bloomberg.

- President Trump stated: “Heading to NATO where, at worst, it will be a much calmer period than what I just went through with Israel and Iran. I look forward to seeing all of my very good European friends, and others. Hopefully, much will be accomplished!”

- President Trump also posted a screenshot of a conversation with NATO Secretary General Rutte, in which Rutte said: “It was not easy but we’ve got them all signed onto 5 percent!”

ASIA-PAC

- Chinese President Xi Jinping is reportedly not attending next week’s BRICS summit, marking his first-ever absence, due to a scheduling conflict, according to SCMP sources.

EU/UK

DATA RECAP

- German Ifo Curr Conditions New (Jun) 86.2 vs. Exp. 86.5 (Prev. 86.1); Ifo Business Climate New (Jun) 88.4 vs. Exp. 88.3 (Prev. 87.5); Ifo Expectations New (Jun) 90.7 vs. Exp. 90 (Prev. 88.9)

- UK CBI Trends - Orders (Jun) -33.0 vs. Exp. -27.0 (Prev. -30.0)