US stocks were choppy in thin conditions ahead of the Christmas period - Newsquawk Asia-Pac Market Open

- US stocks were choppy in thin conditions ahead of the Christmas period with indices ultimately closing mixed but with a bias to the upside with only the Russell in the red.

- USD was firmer on Monday albeit in thin ranges and in very light newsflow with many participants away on account of the upcoming holidays.

- T-notes bear steepen in holiday conditions with focus this week on supply.

- Oil prices was choppy and settled with marginal losses in thin holiday trade.

- Looking ahead, highlights include BoJ Minutes, RBA Minutes, Japanese Chain Store Sales

More Newsquawk in 2 steps:

1. Subscribe to the free premarket movers reports

2. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

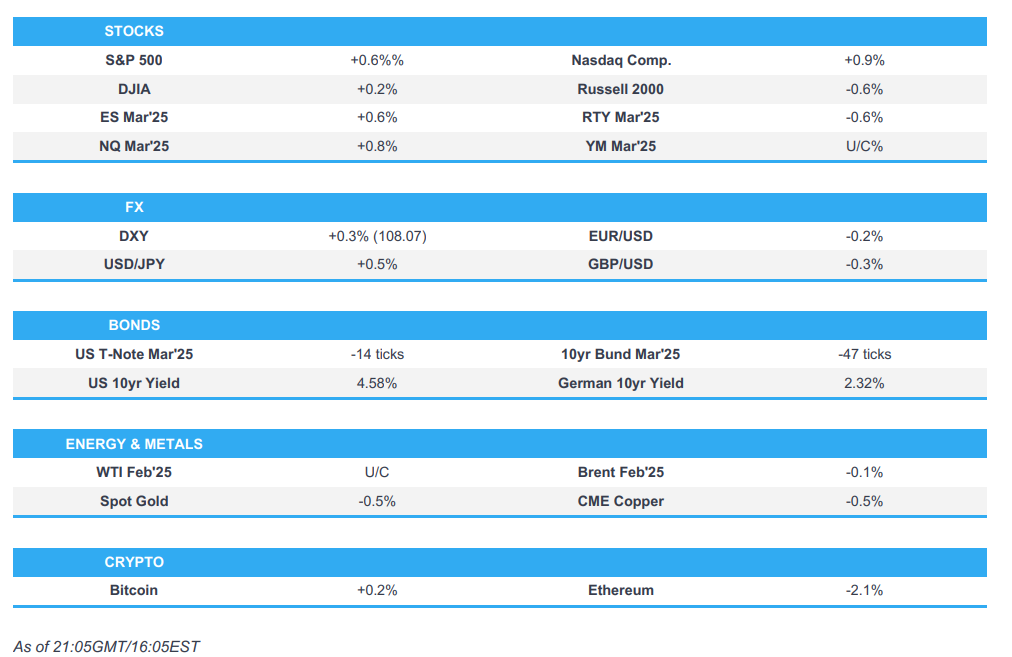

SNAPSHOT

US TRADE

- US stocks were choppy in thin conditions ahead of the Christmas period with indices ultimately closing mixed but with a bias to the upside with only the Russell in the red. There was notable outperformance in the Nasdaq with upside in Nvidia (NVDA) supporting the move with reports suggesting the company has resolved production issues with its Blackwell chip. The Russell and equal weighted S&P lagged while sectors were mixed.

- Outperformance was seen in Communication Services, Technology and Health Care, while underperformance was seen in Consumer Staples, Materials and Industrials. There were little fresh macro drivers on Monday with liquidity/vol thinning out ahead of the Christmas period.

- SPX +0.73% at 5,974, NDX +1.01% at 21,503, DJI +0.16% at 42,907, RUT -0.22% at 2,237.

- Click here for a detailed summary.

NOTABLE HEADLINES

- BoC Minute: Decision to cut by 50bps on 11th Dec was a close call, members discussed arguments for both a 25 and 50bps reductionThose in favour of a 50bps cut acknowledged that not all data called for such a reduction. This group said it seemed unlikely that a cut of 50bps would take rates lower than they needed to go over the next couple of meetings. Those in favour of a 25bps cut suggested policy could be patient while the full effects of past cuts became clearer. There was a range of views on how much further the policy rate would need to be reduced, and over what period that should happen. Decision to cut by 50bps reflected weaker than expected growth outlook and fact that monetary policy no longer needed to be clearly restrictive. There was a range of views on how much further the policy rate would need to be reduced, and over what period that should happen. Members agreed they would likely be considering further reductions in the policy rate at future meetings, and they would take each decision one meeting at a time.

DATA RECAP

- US Durable Goods (Nov) -1.1% vs. Exp. -0.3% (Prev. 0.3%); Ex-Transport -0.1% vs. Exp. 0.2% (Prev. 0.2%); Ex-Defense -0.3% (Prev. 0.5%)

- US National Activity Index (Nov) -0.12 (Prev. -0.4, Rev. -0.50)

- US New Home Sales-Units * (Nov) 0.664M vs. Exp. 0.66M (Prev. 0.61M, Rev. 0.627M)

- US New Home Sales Chg MM * (Nov) 5.9% (Prev. -17.3%, Rev. -14.8%)

- US Consumer Confidence * (Dec) 104.7 vs. Exp. 113.3 (Prev. 111.7, Rev. 112.8)

- Canadian GDP MM (Oct) 0.3% vs. Exp. 0.1% (Prev. 0.1%, Rev. 0.2%)

FX

- USD was firmer on Monday albeit in thin ranges and in very light newsflow with many participants away on account of the upcoming holidays. There was no Fed speak, but there was a little bit of US data, although it failed to really move the needle.

- Antipodeans and CAD were flat against the Dollar, and as such the relative outperformers as EUR, GBP, JPY, and CHF saw losses with the latter two underperforming and all weighed on by the aforementioned Buck bid and move higher in UST yields. Cognizant of sounding like a broken record, currency specific headline newsflow was unsurprisingly sparse with little to no drivers.

- EMFX was weaker across the board and hit by the Dollar continuing its hot streak into year-end as opposed to anything currency related. As we head into 2025 they will be continued focus on EMs, particularly the Yuan and MXN, as it becomes clearer and more evident what tariffs President-elect Trump will slap on these countries. I

FIXED INCOME

- T-notes bear steepen in holiday conditions with focus this week on supply.

- US sells USD 69bln in 2yr notes; stop-through 0.1bps. High Yield: 4.335% (prev. 4.274%, six-auction average 4.156%). WI: 4.336%. Tail: -0.1bps (prev. -1.8bps, six-auction avg. -0.6bps) id-to-Cover: 2.73x (prev. 2.77x, six-auction avg. 2.68x). Dealers: 11.3% (prev. 9.2%, six-auction avg. 12.4%). Directs: 6.7% (prev. 19.2%, six-auction avg. 19.5%). Indirects: 82.1% (prev. 71.6%, six-auction avg. 68.1%)

COMMODITIES

- Oil prices was choppy and settled with marginal losses in thin holiday trade. Benchmarks began the European session on the front foot, echoing the APAC tone seen overnight, but as US participants joined for the day oil was weighed on by the broader Buck bid, as opposed to a specific energy headline.

- Russia's Kremlin says Putin discussed gas, Ukraine and bilateral ties with Slovakia's Fico; situation with European countries that get Russian gas is complicated and needs further attention.

GEOPOLITICAL

MIDDLE EAST

- Israeli officials have began debating the question: Should Israel fully withdraw from S. Lebanon by day 60 even if the Lebanese army is not fully deployed in the South, according to Amichai Stein.

ASIA-PAC

NOTABLE HEADLINES

- China's Commerce Ministry says the US chip investigation will disrupt global chip industry and supply chains, harming the interests of US firms and consumers. Will take all necessary measures to firmly safeguard its rights and interests.

DATA RECAP

- South Korean Consumer Sentiment Ind (Dec) 88.4 (Prev. 100.7).

NEVER MISS THE NEWS THAT MATTERS MOST

ZEROHEDGE DIRECTLY TO YOUR INBOX

Receive a daily recap featuring a curated list of must-read stories.