US stocks tumble again but close off lows as markets await NVIDIA earnings - Newsquawk Asia-Pac Market Open

- US stocks were lower, albeit settling well off troughs, as mega-cap sectors Consumer Discretionary and Technology underperformed amid continued concerns regarding AI overvaluation.

- Worries were heightened on Tuesday, as Rothschild downgraded both Amazon and Microsoft, saying itʼs time to take a more cautious stance on AI hyperscalers.

- US data painted a sluggish picture of the labour market, as jobless claims printed 232k (w/e 18th Oct), while weekly ADP saw 2.5k jobs shed a week for the four weeks ending 1st Nov, an improvement W/W but still languishing.

- The crude complex saw gains, albeit on no specific headline, but upside coincided with Trumpʼs/Saudi Crown Prince conference.

- Looking ahead, highlights include New Zealand PPI, Japanese Trade Balance, Australian Composite Leading Index, Australian Wage Price Index, Speech from Fed's Logan, and supply from Australia and Japan.

More Newsquawk in 2 steps:

1. Subscribe to the free premarket movers reports

2. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

SNAPSHOT

US TRADE

- US stocks were lower, albeit settling well off troughs, as mega-cap sectors Consumer Discretionary and Technology underperformed amid continued concerns regarding AI overvaluation. These worries were heightened on Tuesday, as Rothschild downgraded both Amazon and Microsoft, saying it’s time to take a more cautious stance on AI hyperscalers. For the record, Health and Energy sit atop of the sectorial breakdown, with the latter buoyed by strength in the crude complex, albeit not on any specific headline driver.

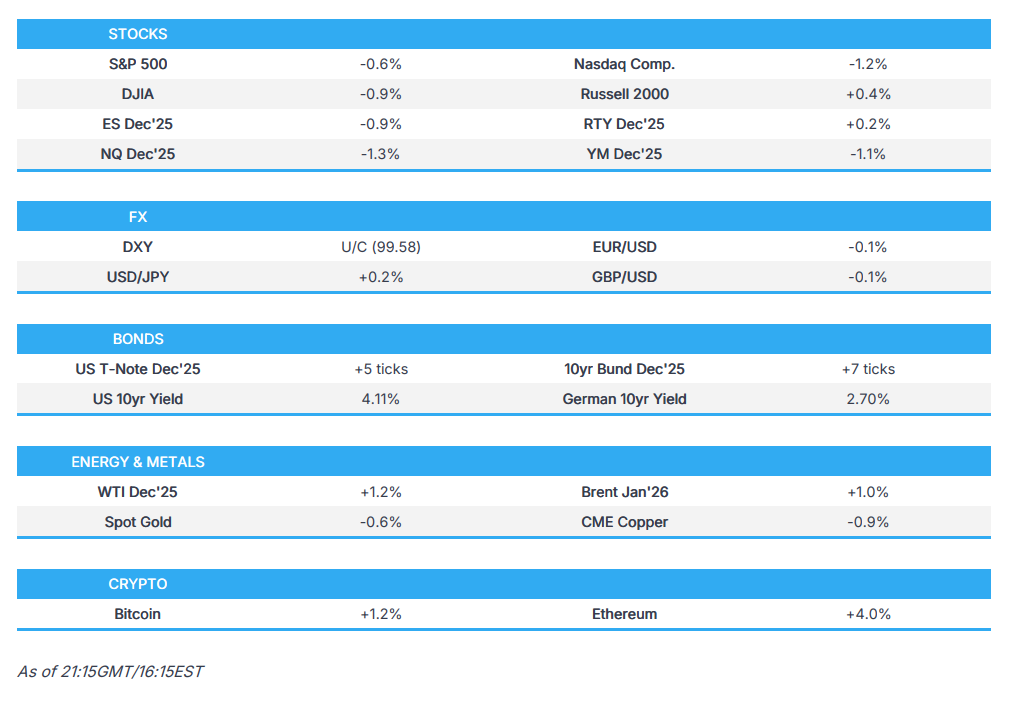

- SPX -0.83% at 6,617, NDX -1.20% at 24,503, DJI -1.05% at 46,103, RUT +0.21% at 2,346.

- Click here for a detailed summary.

TARIFFS/TRADE

- EU Trade Commissioner Šefčovič said the EU plans to introduce restrictions on EU exports of aluminium scrap, according to Reuters.

- Germany’s Finance Minister said Germany must do its homework and diversify supply chains with regard to rare earths, according to Reuters.

- US President Trump said China is on schedule in buying US farm products but wants China to speed up soybean purchases, adding that he wants Treasury Secretary Bessent to tell China to accelerate those purchases, according to Reuters.

NOTABLE US HEADLINES

- US President Trump said he has begun interviews for Fed Chair and would love to remove Powell immediately, adding he thinks he already knows his choice; he said there are some surprising names under consideration but he may go the standard route, and noted that people are holding him back from firing Powell, according to Reuters.

- The US Department of Labor said weekly jobless-claims data will be released on Thursday and that a technical issue caused an early posting of some of the claims data, according to Reuters.

- Fed’s Barkin (2027 voter) said high housing prices may still reflect a supply shortage rooted in the 2007–2009 financial crisis, with housing supply constrained even as demand has grown; he said he worries about banks’ exposure to private credit and agreed with Chair Powell that a December rate cut is not a foregone conclusion. He said there are still pressures on both sides of the mandate, with job growth down and labour supply slowing. On inflation, he said it is above target but unlikely to accelerate, and while it does not appear headed higher it is also not clear it is returning to 2%. He said he hopes upcoming data and community surveys will clarify the economic direction, noted that credit-card spending and Q3 earnings remain healthy though some sectors and consumers are struggling, and said that without compelling data it is hard to reach a broad consensus. He said policy is still modestly restrictive. On the labour market, he said he is not hearing of firms planning further layoffs, that the market is softening but likely not by much, and that it is hard to declare victory on either mandate though neither clearly requires a policy response; he expects unemployment to edge higher but not by much, according to Reuters.

- Fed’s Barr (voter) said effective supervision requires a credible rating system and warned that moves to weaken bank supervision present real dangers, via the Federal Reserve.

- A CoreWeave (CRWV) executive said the company has almost doubled its revenue backlog in the last quarter and that the supply environment has impacted it, with one provider delayed on data-centre deliveries by a few weeks, according to Reuters.

- Meta (META) won its FTC antitrust trial over the Instagram and WhatsApp acquisitions, with the judge ruling the deals did not create an illegal monopoly, according to Bloomberg.

- Microsoft (MSFT), NVIDIA (NVDA) and Anthropic announced a strategic partnership in which MSFT and NVDA will invest up to USD 10bln and USD 5bln respectively in Anthropic, while Anthropic has committed to buy USD 30bln of Azure compute capacity and contract up to 1GW of additional compute capacity, according to Reuters. NVIDIA (NVDA) and Microsoft (MSFT) are committing to invest in Anthropic’s next fundraising round, according to Reuters citing sources.

- Cloudflare said it was aware of and investigating an issue potentially impacting multiple customers, and later reported that a fix had been implemented, according to the company’s system status page.

- US President Trump posted that “the only healthcare I will support or approve is sending the money directly back to the people, with nothing going to the big, fat, rich insurance companies, who have made $trillions and ripped off America long enough”, via Truth Social.

- JPMorgan COO Pinto said the US economy is not likely to enter a recession; on AI he said there is likely to be a “correction” in AI valuations at some point, and added that upside for the S&P from here is relatively limited, according to Reuters.

DATA RECAP

- US jobless claims at 232k in the October 18th week, via DOL; continuing claims 1.957mln. Note, the last release was for the week of the 20th of September at 219k for initial claims. The last release for continuing claims was for the week of October 11th at 1.947mln.

- Weekly ADP Employment Change (Four weeks, ending 1st Nov 2025): -2,500/week (prev. -11,250/week).

- US Nondef Cap Ex-Air R MM (Aug) 0.4% (Prev. 0.6%)

- US Factory Ex-Transp MM (Aug) 0.1% (Prev. 0.6%, Rev. 0.5%)

- US Factory Orders MM (Aug) 1.4% vs. Exp. 1.4% (Prev. -1.3%)

- US Durable Goods, R MM (Aug) 2.9% (Prev. 2.9%)

- US Durables Ex-Def, R MM (Aug) 1.9% (Prev. 1.9%)

- US NAHB Housing Market Indx (Nov) 38.0 vs. Exp. 37.0 (Prev. 37.0)

- US Durables Ex-Transpt R MM (Aug) 0.3% (Prev. 0.4%)

FX

- The Dollar was more-or-less flat, with DXY trading between 99.396-662. US jobs data on Tuesday painted a sluggish picture of the labour market.

- G10 FX was mixed. CAD, AUD, and NZD were the clear gainers, GBP and EUR were flat, while JPY and CHF saw weakness. CAD and AUD were buoyed by firmer commodity prices, and that came despite little move seen in the Aussie overnight on RBA Minutes.

- For the Yen, while the recent sell-off in US equities would usually be a prime opportunity for a recovery in the oversold Yen, its own domestic factors continue to keep USD/JPY bid.

FIXED INCOME

- Treasury curve ultimately steepens in two-way trade

- UK sold GBP 1.25bln 4.75% 2030 Gilt by tender: b/c 3.75x, average yield 3.896%

COMMODITIES

- The crude complex saw gains, albeit on no specific headline, but upside coincided with Trump’s/Saudi Crown Prince conference.

- Goldman Sachs said that as global LNG supply continues to rise faster than Asian demand, it estimates Northwest European storage will face congestion in 2028/29, which would pressure TTF and JKM prices low enough to reduce global LNG supply, according to Reuters.

- Commerzbank expects copper and aluminium to reach USD 12,000/t and USD 3,200/t respectively in 2026, with zinc prices seen settling around USD 3,000/t and nickel prices around USD 16,000/t, according to Reuters.

GEOPOLITICAL

MIDDLE EAST

- US President Trump said he is working on approving advanced chips for Saudi Arabia, calling Saudi a great ally; he said F-35 jets sold to Saudi will be similar to those sold to Israel and that both Israel and Saudi should receive top-of-the-line F-35s. He said he had a good discussion on the Abraham Accords, that the US has reached a defence agreement with Saudi Arabia, and that he can see a civil-nuclear deal happening with the kingdom.

- Saudi Crown Prince Mohammed bin Salman said Saudi Arabia wants to be part of the Abraham Accords while ensuring a path to a two-state solution, and added that the kingdom will raise its investment in the US to USD 1tln, according to Reuters.

- US President Trump said Iran wants to make a deal very badly, while Saudi Crown Prince Mohammed bin Salman said Saudi Arabia will do its best on an Iran deal, according to Reuters.

RUSSIA-UKRAINE

- Russia and the US have reportedly discussed the possibility of conducting another prisoner exchange, via Axios’ Ravid citing comments from a Russian special envoy.

CHINA-JAPAN

- A senior Japanese official met his counterpart in Beijing on Tuesday to try to ease tensions, but no breakthrough appeared imminent, according to Reuters.

EU/UK

NOTABLE HEADLINES

- BoE’s Pill said policymakers are in a series of finely balanced decisions and that underlying inflation dynamics in the UK are lower than the headline suggests; he cautioned against over-interpreting recent changes in key data and said moderation in key nominal data has not occurred to the extent previously expected. He said the QE portfolio held for monetary-policy purposes should be wound down to a very low level and warned that capping yields to halt QT would create a target for speculation. He added he does not expect his view on rates to shift much, according to Reuters.

- BoE’s Dhingra said interest rates should be brought to the neutral level soon and added that UK disposable income is just as weak as consumption.

- Barclays forecast a 2026 year-end target of 620 for the Stoxx 600 and adjusted sector weightings, upgrading Mining and Diversified Financials to Overweight, downgrading Transportation and Business Services to Underweight, and lowering Electricals and Chemicals to Market Weight, according to Reuters.

- The EU Commission said the definitive measures consist of country-specific tariff-rate quotas for each type of ferroalloy, limiting the volume of imports that can enter the EU duty-free, according to Reuters.

- German Chancellor Merz said French and German companies took part in today’s digital sovereignty summit and agreed on additional investments of EUR 12bln, according to Reuters.