US stocks marginally declined amid quiet catalyst and cautiousness heading into US CPI data - Newsquawk Asia-Pac Market Open

- US stocks ultimately settled lower to start the week in a day of quiet newsflow, with attention turning to US CPI on Tuesday. Highlights came from over the weekend, whereby US President Trump approved export licenses for NVIDIA (NVDA) and AMD (AMD) to sell chips to China, albeit not tier 1 chips, but in return for 15% of revenue to be paid back to the US government, while the announcement that Trump signed an Executive Order for a 90-day extension to the US-China trade truce was widely expected and garnered little reaction. Meanwhile, sectors were mixed as Consumer Discretionary, Staples, and Health Care outperformed, although Energy, Tech and Real Estate lagged.

- USD was firmer to start the week in light trade as participants awaited US CPI on Tuesday, while there were several recent developments but had little sway on price action for the dollar including Trump signing an EO to extend US/China trade truce for 90 days to November 9th, while Trump announced that gold would not be tariffed, and it was also reported that Fed Governor Bowman, Fed Vice Chair Jefferson, and Dallas Fed President Logan are all under consideration for the Fed Chair with the White House on track for a Fed Chair announcement in the fall.

- Looking ahead, highlights include Japanese Money Supply, Singapore GDP, Australian NAB Business Confidence, RBA Rate Decision & Governor Bullock's Press Conference.

More Newsquawk in 2 steps:

1. Subscribe to the free premarket movers reports

2. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

LOOKING AHEAD

- Highlights include Japanese Money Supply, Singapore GDP, Australian NAB Business Confidence, RBA Rate Decision & Governor Bullock's Press Conference.

- Click for the Newsquawk Week Ahead.

US TRADE

- US stocks ultimately settled lower to start the week in a day of quiet newsflow, with attention turning to US CPI on Tuesday. Highlights came from over the weekend, whereby US President Trump approved export licenses for NVIDIA (NVDA) and AMD (AMD) to sell chips to China, albeit not tier 1 chips, but in return for 15% of revenue to be paid back to the US government, while the announcement that Trump signed an Executive Order for a 90-day extension to the US-China trade truce was widely expected and garnered little reaction. Meanwhile, sectors were mixed as Consumer Discretionary, Staples, and Health Care outperformed, although Energy, Tech and Real Estate lagged.

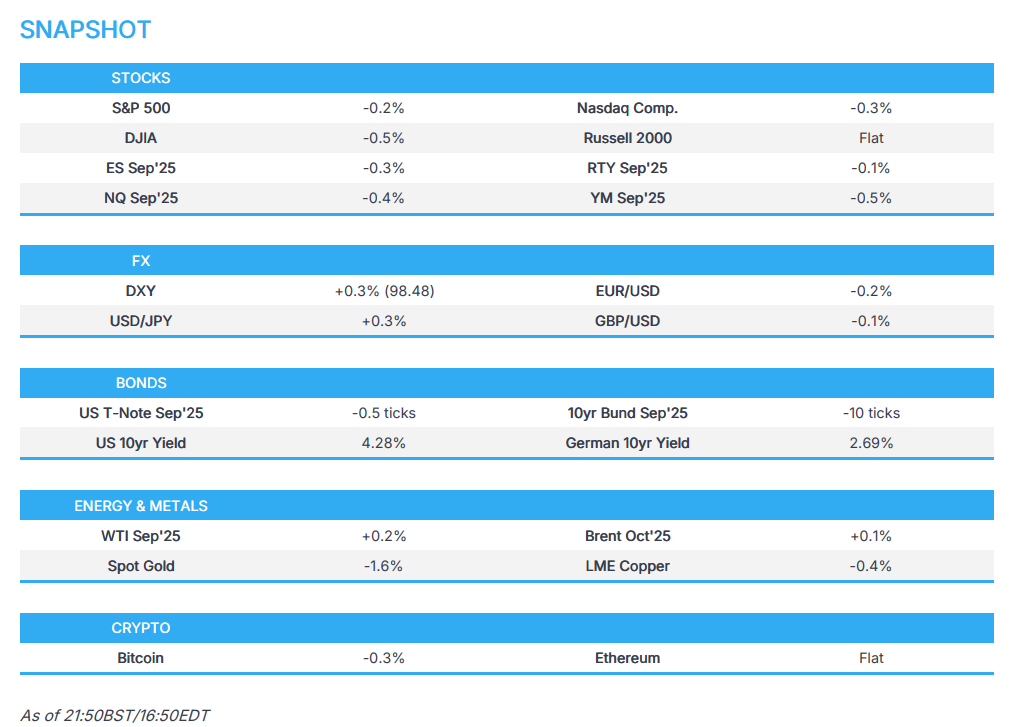

- SPX -0.20% at 6,377, NDX -0.36% at 23,527, DJI -0.45% at 43,976, RUT -0.04% at 2,217.

- Click here for a detailed summary.

TARIFFS/TRADE

- US President Trump said on China trade that we'll see what happens with the deadline, and they've been dealing nicely, as well as noted that he has a very good relationship with Chinese President Xi. It was later reported that an Executive Order was signed to extend the US/China trade truce for 90 days with Sunday 9th November the new deadline, according to CNBC citing a White House official.

- US President Trump said regarding NVIDIA (NVDA) and AMD (AMD) chips that it involves an old chip that China already has and he would not make a deal with NVIDIA’s new advanced chips, while he confirmed Nvidia's 15% payment on H20 chips to China. In relevant news, AMD (AMD) confirmed it received China AI chip licenses.

- Brazilian Finance Minister Haddad said a virtual meeting with US Treasury Secretary Bessent has been called off and no fresh date has been scheduled. It was separately reported that former Brazilian President Bolsonaro's son suggested US President Trump has a range of possibilities on his table, from sanctioning more Brazilian authorities, to a new wave of visa withdrawals, to tariff issues, according to the FT.

NOTABLE HEADLINES

- Fed Governor Bowman, Fed Vice Chair Jefferson, and Dallas Fed President Logan are reportedly under consideration for Fed Chair, while the White House is on track for a Fed Chair announcement this fall, according to Bloomberg.

- US President Trump invoked the Home Rule Act and deployed National Guard troops in Washington D.C.

FX

- USD was firmer to start the week in light trade as participants awaited US CPI on Tuesday, while there were several recent developments but had little sway on price action for the dollar including Trump signing an EO to extend US/China trade truce for 90 days to November 9th, while Trump announced that gold would not be tariffed, and it was also reported that Fed Governor Bowman, Fed Vice Chair Jefferson, and Dallas Fed President Logan are all under consideration for the Fed Chair with the White House on track for a Fed Chair announcement in the fall.

- EUR gave up ground to the firmer buck and with little fresh catalysts as geopolitics remains in the spotlight ahead of the Trump/Puting meeting on Friday, while ING suggested "Should a ceasefire materialise in the coming weeks, the euro is likely to perform well, primarily against the dollar, yen, and Swiss franc".

- GBP weakened but with GBP/USD off intraday lows after support held at the 1.3400 level and with UK employment and average earnings data scheduled on Tuesday.

- JPY gradually softened which saw USD/JPY edge higher and reclaim the 148.00 level, while a Reuters analysis piece noted political uncertainty in Japan adds to the bearish outlook and that speculation around a possible LDP leadership election in September is raising questions about fiscal policy and trade relations with the US, while it added that coupled with growth concerns from US tariffs, the instability could keep the BoJ cautious despite domestic inflation remaining elevated and a rate hike, if accelerated, may have limited impact on yen strength.

FIXED INCOME

- T-notes meandered throughout the day ahead of US CPI while the Trump administration widened Fed Chair nominees.

COMMODITIES

- Oil prices were more or less flat to start the week in light newsflow as traders await US CPI and the Trump/Putin meeting on Friday.

- US President Trump said gold will not be tariffed.

- Chile's Codelco copper production rose 17.3% Y/Y in June to 120.2k tons, while Escondida copper production fell 33% Y/Y in June to 76.4k tons and Collahuasi copper production fell 29.1% Y/Y in June to 34.3k tons.

GEOPOLITICAL

MIDDLE EAST

- Israeli PM Netanyahu said "We are close to completing the battle and working to defeat the remnants of the Iranian axis and free all our hostages", according to Sky News Arabia.

- Mediators are proposing a new formula that includes a comprehensive deal, the release of all hostages and withdrawals of the Israeli army before negotiating a permanent solution, according to Sky News Arabia citing sources.

- Iranian Foreign Ministry said Tehran may agree to specific restrictions on nuclear activities in exchange for lifting sanctions, while it noted that channels with the US are still open via an intermediary, according to Al Arabiya.

- Israeli Defence Minister threatened Iranian Supreme Leader Khamenei after media outlets close to Iran published a list of Israeli officials and threats to eliminate them", according to Sky News Arabia.

RUSSIA-UKRAINE

- US President Trump said regarding the upcoming meeting with Russian President Putin that it is a feel-out meeting and he is going to tell Putin to end the war, while he thinks they will have a constructive conversation and he will speak with Ukrainian President Zelensky. Furthermore, Trump said the next meeting will be with Zelensky, or with Putin and Zelensky, and there will be some swapping and changes in land.

- Ukraine could agree to stop fighting and cede territory already held by Russia as part of a European-backed plan for peace, according to The Telegraph. Ukrainian President Zelensky told European leaders they must reject any settlement proposed by Trump which sees them giving up Ukrainian land they still hold, but Ukrainian territory in Russian control could be on the table.

- EU Foreign Policy Chief Kallas said EU foreign ministers expressed support for US steps that will lead to peace in Russia and Ukraine, while they will work on more Russian sanctions and more military support for Ukraine.

- Polish PM Tusk said Russia must recognise that the West rejects demands for Ukraine to cede territory.