Stellar 2Y Auction Stops Through Amid Solid Foreign Demand

The week's first coupon auction just took place, and in response to the Treasury offering $69BN in 2 year paper, the demand was nothing short of superb.

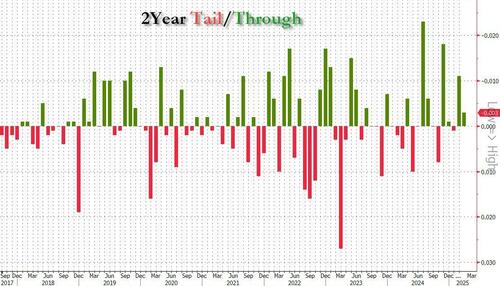

The high yield in today's auction was 3.984% (resulting in a coupon of 3.875%), which was the first sub-4% auction since Sept 2024 (when it was 3.520% and followed the Fed's 50bps jumbo rate cut). The auction stopped through the When Issued 3.987% by 0.3bps, the 4th through auction in the past 5.

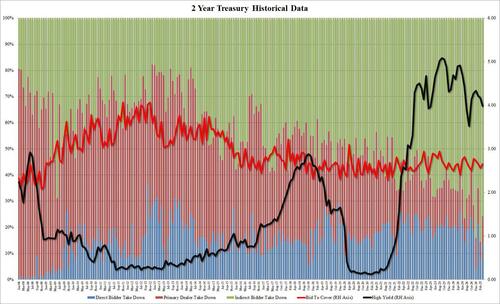

The bid to cover was 2.656, up from 2.559 in February and the highest since December.

The internals were solid, as Indirects took down 75.8%, down from 85.5%, but above the recent average of 71.7%. And with Directs awarded 13.6%, Dealers were left holding 10.7%, above last month's near record low 6.9% below the recent average of 12.0%.

Overall, this was a very strong auction and one which obviously did not need a concession (10Y yields slid 6bps from session highs of 4.36% earlier to 4.30% at the time of the sale) to price on highly beneficial terms.