Risk off mood, but off worst levels amid reports China is open to talks with the US, NVIDIA -5.8% after warning of a USD 5.5bln hit - Newsquawk US Market Open

- China is said to be open to talks if US President Trump shows respect, via Bloomberg sources; China wants Trump to rein in cabinet members and show consistency; wants US talks to address concerns on Taiwan and sanctions.

- White House said over 15 trade deal proposals are being considered and some could be announced soon.

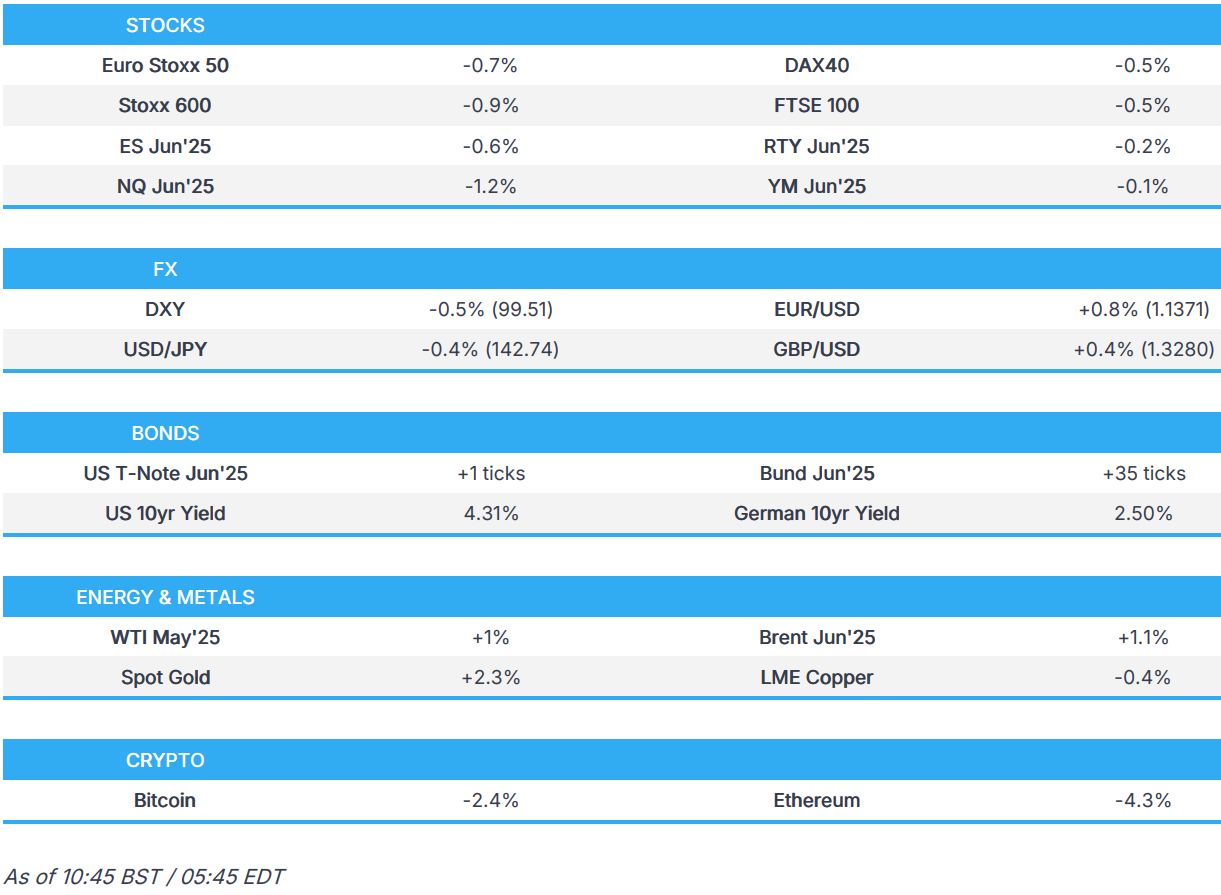

- European indices downbeat, but some upside seen on source reports that China is open to talks, albeit with conditions; ASML -5% after poor Q1 results amid trade uncertainty.

- US equity futures lower and NQ underperforms with NVDA down 5.9% after it expects a USD 5.5bln hit due to export controls.

- USD is softer vs. G10 peers. Support from a conciliatory trade report proved to be fleeting.

- Fixed is underpinned by the risk-off tone, though off best given the latest China sources.

- Crude reverses losses on China sources, base metals hit on US' critical mineral investigation; gold tops USD 3,300/oz.

- Looking ahead, US Retail Sales, NZ CPI, BoC Policy Announcement, Speakers including Fed’s Powell, Cook, Hammack, Logan & Schmid, BoC's Macklem & Rogers, Supply from the US.

- Earnings from US Bancorp, Abbott, Progressive, Travelers, Prologis, Autoliv, Citizens, First Horizon, Alcoa.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 day

TARIFFS/TRADE

CHIPMAKERS

- NVIDIA (NVDA) expects USD 5.5bln in charges in Q1 FY2026 related to H20 products after the US informed the Co. it requires a licence to export those chips to China.

- NVIDIA (NVDA) reportedly did not inform some of its major customers about the new US export restrictions for China-focused H20 chip after the Co. received notice of them, via Reuters citing sources; received around USD 18bln of orders for H20 chips YTD.

- US chip equipment makers calculated that Trump administration tariffs could cost them more than USD 1bln a year, with tariffs estimated to cost Applied Materials (AMAT), Lam Research (LRCX) and KLA Corp (KLAC) USD 350mln each annually, according to Reuters sources.

CHINA

- China is said to be open to talks if US President Trump shows respect, via Bloomberg sources; China wants Trump to rein in cabinet members and show consistency; wants US talks to address concerns on Taiwan and sanctions "The most important precondition for any talks is that Chinese officials need to know such engagement will be conducted with respect" The source said Trump has been relatively dovish when speaking publicly about Chinese President Xi, but other members of his administration have been more hawkish, leaving officials in Beijing unsure of the States' position.

- US President Trump said, when talking on the tariff pause, that they may want countries to choose between the US or China.

- US intends to use tariff negotiations to isolate China with officials planning to use the negotiations of more than 70 nations to ask them to disallow China to ship goods through their countries, according to WSJ.

- White House Press Secretary said President Trump messaged that the ball is in China's court and that they don't have to make a deal with them but Trump is open to a deal with China.

US

- FT writes that Japan is set to be the first nation to have trade talks with the US, people familiar with the situation said the US had signalled priorities for the talks, including LNG imports, Boosting Market access to Ags and Japanese auto legislation.

- US President Trump said the tariff pause was because it is a transition and came from the need for flexibility

- US President Trump said he is getting along well with Mexican President Sheinbaum.

- US President Trump posted on Truth Social that "The United States is taking in RECORD NUMBERS in Tariffs, with the cost of almost all products going down, including gasoline, groceries, and just about everything else. Likewise, INFLATION is down. Promises Made, Promises Kept!"

- White House said President Trump signed an order launching an investigation into national security risks posed by US reliance on imported processed critical minerals and their derivative products.

- White House Press Secretary stated over 15 trade deal proposals are actively being considered and they believe they can announce some very soon, while she noted that President Trump is maintaining his position on Canada.

OTHER

- Pakistan may offer to buy more cotton and soybeans to appease US President Trump, according to Bloomberg

- Hong Kong Post suspended the postal service for items containing goods to the US and said for sending items to the US, the public in Hong Kong should be prepared to pay exorbitant and unreasonable fees due to the US's unreasonable and bullying acts.

- US Treasury Secretary Bessent underlined US opposition to digital services tax levied by Spain and other countries as well as other non-tariff barriers, according to the Treasury Department.

- Sources told Sky News the UK was "in the foothills" of a deal, but it has not been straightforward, and there is some distance to go.

EUROPEAN TRADE

EQUITIES

- European bourses (STOXX 600 -0.9%) opened on the backfoot, continuing the mostly subdued APAC session. A quiet significant pick-up off lows was seen following a Bloomberg report which noted that China is open to talks if US President Trump shows respect – nonetheless, indices still reside in the red.

- Sentiment today has been hit due to several factors; 1) US President Trump ordering investigations into critical minerals, 2) NVIDIA expecting USD 5.5bln hit amid US export controls, 3) Latest White House Fact Sheet suggested China now faces up to a 245% tariff on imports to the United States as a result of its retaliatory actions. (awaiting clarity), 4) poor ASML results.

- European sectors hold a defensive bias, in-fitting with the risk tone. Tech is by far the clear underperformer, with downside today driven by losses in post-earning losses in ASML and NVIDIA export control updates. Autos & Parts and Basic Resources are also on the backfoot given the risk tone.

- US equity futures (ES -0.6%, NQ -1.2%, RTY -0.2%) are entirely in the red, following the negative risk tone seen in European trade; the NQ underperforms, following the latest NVIDIA (-6.5%) updates. As mentioned above, US futures are off worst levels on those Bloomberg reports which suggested China is open to talks if US President Trump shows respect.

- ASML (ASML NA) Q1 (EUR) Net Income 2.36bln (exp. 2.28bln), Revenue 7.74bln (exp. 7.83bln), Bookings 3.94bln (exp. 4.82bln). Q2 Outlook: Gross Margin 50-52% (exp. 52.3%). FY Outlook confirmed, Raises annual dividend to EUR 6.40/shr, +4.9%. Commentary: Conversations so far with customers support the expectation that 2025 and 2026 will be growth years; AI continues to be a primary growth driver for the industry. Demand is strong. Raises annual dividend to EUR 6.40/shr, +4.9%.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- USD is softer across the board after a session of slight gains yesterday with the dollar struggling in the current risk environment. Focus remains on the trade war with the White House stating that over 15 trade deal proposals are being considered and some could be announced soon. In recent trade, the USD was provided a modest boost after a more conciliatory report from Bloomberg that China is said to be open to talks if US President Trump "shows respect". Ahead, US Retail Sales and commentary via Fed Chair Powell. DXY is back below the 100 mark and briefly slipped below Tuesday's low at 99.47.

- EUR is firmer vs. the USD and one of the better performers across G10 FX. Fresh macro drivers for the Eurozone have been lacking during today's session after Tuesday's saw woeful ZEW metrics and reports that there has been little progress in trade negotiations between the EU and US. EUR/USD briefly breached Tuesday's best at 1.1378 but ran out of steam ahead of 1.14, topping out at 1.1392.

- JPY has retreated beneath the 143.00 level with flows into the yen amid the downbeat risk tone and after Machinery Orders topped forecasts. Elsewhere, comments from BoJ Governor Ueda failed to have any material sway on the Yen with the policymaker noting the Bank may need a policy response but will decide appropriately in line with changing developments, adding that the BoJ sees both upside and downside risks to the price outlook. USD/JPY has delved as low as 142.05.

- Antipodeans are both firmer vs. the USD but to a lesser extent than peers considering the current risk tone and after a solid showing during Tuesday's European session. Support from better-than-expected Chinese GDP proved to be temporary given the consensus view that growth is set to slow in the coming months on account of the trade war with the US.

- CAD is firmer vs. the USD but to a lesser degree than peers. Yesterday saw softer-than-expected Canadian inflation data which failed to have a sustained impact on pricing for today's BoC rate decision which sees an unchanged rate at around 60% vs. a 25bps cut at 40%.

- Support from better-than-expected Chinese GDP proved to be fleeting for the Yuan with desks dismissing the data as stale and warning of further headwinds to come. In recent trade, USD/CNH was knocked lower by a report in Bloomberg that China is said to be open to talks if US President Trump "shows respect".

- PBoC set USD/CNY mid-point at 7.2133 vs exp. 7.3272 (Prev. 7.2096).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs incrementally firmer and deriving some haven demand from the NVIDIA & ASML updates. However, USTs are failing to benefit to the same degree as core peers across the pond. Most recently, USTs were knocked by around 10 ticks by a Bloomberg source report that China is open to trade talks with the US, but that they have a number of pre-conditions to this; full details on the feed. Whilst the risk-off mood continues to remain at play, the downside in USTs has continued to extend, and more recently has taken US paper to just above the unchanged mark. Ahead, US Retail Sales, Fed Chair Powell and US supply.

- Bunds began bid, as the risk tone has been chipped away by updates from NVIDIA & ASML. Developments specifically for the bloc have been a little light, final inflation data from Italy subject to a modest revision lower but spurred no reaction. Bunds trimmed roughly 30 ticks following the Bloomberg/China reporting, and extended lower into a 2052 & 2056 Bund auction - but no real move on it.

- Gilts initially firmer start to the session given the risk-off tone after NVIDIA’s update and exacerbated by ASML. Further bullish impetus for Gilts came from UK CPI. Altogether, this caused the benchmark to gap higher by 43 ticks and then extend 25 more to a 92.32 peak. The CPI series was cooler-than-expected overall and will be welcomed by those on Threadneedle St. and has seen the odds of a 25bps cut in May tick up to near-enough fully priced vs a c. 80% chance pre-release. Most recently, as outlined above, the risk tone has seen a marked recovery on the China-trade report. A recovery which weighed on Gilts back to the 92.00 mark though the benchmark remains well into the green and is the clear outperformer across the core space.

- Spread for the new Italian 7yr BTP set at +13bps, 30yr I/L set at +36bps, via Reuters citing leads.

- UK sells GBP 1.5bln 0.125% 2028 Gilt; b/c 3.84x, average yield 3.631%.

- Click for a detailed summary

COMMODITIES

- Crude spent most of the European session in the red, but those losses have since reversed after Bloomberg reported (citing sources) that China is said to be open to talks if US President Trump shows respect. Elsewhere, the mostly better-than-expected GDP and activity data from China failed to inspire given that they were from a period before the US-China tariff escalation. WTI resides in a USD 60.44-61.55/bbl range while its Brent counterpart trades in a USD 64.90-64.31/bbl parameter.

- Firm price action across spot gold and silver amid the risk aversion caused by the aforementioned factors - namely the worsening trade landscape. Spot gold mounted USD 3,300/oz for the first time ever, with momentum continuing - with today's range currently USD 3,230.68-3,317.92/oz.

- Base metals are softer across the board amid the overall downbeat sentiment across the markets amid the aforementioned reasons. 3M LME copper resides in a USD 9,030.00-9,125.15/t range.

- US Private Inventory Data (bbls): Crude +2.4mln (exp. +0.5mln), Distillate -3.2mln (exp. -1.2mln), Gasoline -3.0mln (exp. -1.6mln), Cushing -0.3mln.

- OPEC states that Russia has to compensate for 691k BPD of overproduction.

- Click for a detailed summary

NOTABLE DATA RECAP

- UK CPI YY (Mar) 2.6% vs. Exp. 2.7% (Prev. 2.8%); MM 0.3% vs. Exp. 0.4% (Prev. 0.4%)

- UK Core CPI YY (Mar) 3.4% vs. Exp. 3.4% (Prev. 3.5%); MM 0.5% vs. Exp. 0.5% (Prev. 0.4%)

- UK CPI Services YY (Mar) 4.70% vs. Exp. 4.80% (Prev. 5.00%); MM 0.40% vs. Exp. 0.50% (Prev. 0.50%)

- UK ONS House Prices YY (Mar) 5.4% (Prev. 4.9%)

- Italian CPI (EU Norm) Final MM (Mar) 1.6% vs. Exp. 1.6% (Prev. 1.6%); Consumer Prices Final YY (Mar) 1.9% vs. Exp. 2.0% (Prev. 2.0%); Consumer Prices Final MM (Mar) 0.3% vs. Exp. 0.4% (Prev. 0.4%); CPI (EU Norm) Final YY (Mar) 2.1% vs. Exp. 2.1% (Prev. 2.1%)

- EU Current Account SA, EUR (Feb) 34.3B (Prev. 35.4B); Current Account NSA,EUR (Feb) 33.1B (Prev. 13.2B)

- EU HICP Final YY (Mar) 2.2% vs. Exp. 2.2% (Prev. 2.2%); HICP Final MM (Mar) 0.6% vs. Exp. 0.6% (Prev. 0.4%)

NOTABLE EUROPEAN HEADLINES

- UK FCA set out further plans to bolster confidence and drive investments in the UK

NOTABLE US HEADLINES

- US President Trump signed a healthcare executive order seeking changes to the US Medicare drug price negotiation process and signed an order restoring common sense to federal procurement by simplifying the process, while the order aims to simplify and streamline federal acquisition regulation.

- A dozen US House GOP members have said no to big Medicaid cuts, according to Punchbowl News.

GEOPOLITICS

MIDDLE EAST

- Israel's army said it bombed Hezbollah infrastructure in southern Lebanon, according to Sky News Arabia.

- US President Trump held a meeting on Tuesday morning in the White House situation room about the ongoing nuclear deal negotiations with Iran, according to two sources with direct knowledge cited by Axios.

CRYPTO

- Bitcoin is on the backfoot and trading just shy of the USD 84k, with Ethereum also extending losses, in-fitting with the risk tone.

APAC TRADE

- APAC stocks were mostly subdued following the choppy and rangebound performance on Wall St. amid mixed data releases and as trade frictions lingered, while the mostly better-than-expected Chinese GDP and activity data failed to inspire a bid.

- ASX 200 clawed back losses amid strength in gold miners, consumer staples and financial but with gains limited by weakness in miners including Rio Tinto which reported a drop in quarterly iron production and shipments.

- Nikkei 225 trickled lower to beneath the 34,000 level amid the ongoing global trade war concerns and despite encouraging Machinery Orders.

- Hang Seng and Shanghai Comp underperformed amid US-China trade frictions the US said to intend to use tariff negotiations with other countries to isolate China and will also require a licence for NVIDIA to export H20 processors to China, while mostly better-than-expected GDP and activity data from China failed to inspire given that they were from a period before the US-China tariff escalation.

NOTABLE ASIA-PAC HEADLINES

- BoJ said to cut 2025 growth forecast in its quarterly Report, according to Reuters sources; no consensus within the BoJ on the extent of Trump tariff damage

- China's MOFCOM issued an action plan to promote service consumption which covers areas including catering, tourism and leisure, while it will support the expansion of sectors including catering, accommodation, health, culture, entertainment and tourism. Furthermore, the plan will focus on coordinating domestic and international dual circulation and insist on exerting efforts on both supply and demand, as well as provide strong support for high-quality economic development.

- China's stats bureau deputy commissioner said the unfavourable impact of the international environment on China's economy is deepening, protectionism is rapidly rising globally and the world economic order has been severely damaged. The official said they resolutely oppose US tariffs which are against economic rules and WTO rules, as well as noted that high US tariffs will bring about some pressures on China's trade and economy. However, the deputy commissioner also commented that Q1 data underscores China's strong resilience and potential, while the official added that macroeconomic policies will become more proactive this year and that China has a rich policy toolkit to support the economy.

- BoJ Governor Ueda said they may need a policy response but will decide appropriately in line with changing developments when asked about a BoJ response if US tariff policy puts downward pressure on Japan's economy, while they will scrutinise without any preconception impact of US tariff policy on Japan's economy which is already affecting corporate and household confidence. Furthermore, Ueda said from February onwards, risks surrounding US tariff policy have moved closer towards the bad scenario the BoJ envisioned and noted the BoJ sees both upside and downside risks to the price outlook, according to Sankei.

- Japan's NHK Spring (5991 JT) is to reconsider plans to cut auto parts production in the US, in response to tariffs, according to Nikkei.

DATA RECAP

- Chinese GDP QQ SA (Q1) 1.2% vs. Exp. 1.4% (Prev. 1.6%); GDP YY 5.4% vs. Exp. 5.1% (Prev. 5.4%)

- Chinese Industrial Output YY (Mar) 7.7% vs. Exp. 5.8% (Prev. 5.9%)

- Chinese Retail Sales YY (Mar) 5.9% vs. Exp. 4.2% (Prev. 4.0%)

- Chinese Unemployment Rate Urban Area (Mar) 5.20% (Prev. 5.40%)

- Chinese China House Prices MM (Mar) -0.08% (Prev. -0.10%); YY -4.5% (Prev. -4.8%)

- Japanese Machinery Orders MM (Feb) 4.3% vs. Exp. 0.8% (Prev. -3.5%)

- Japanese Machinery Orders YY (Feb) 1.5% vs. Exp. -1.4% (Prev. 4.4%)