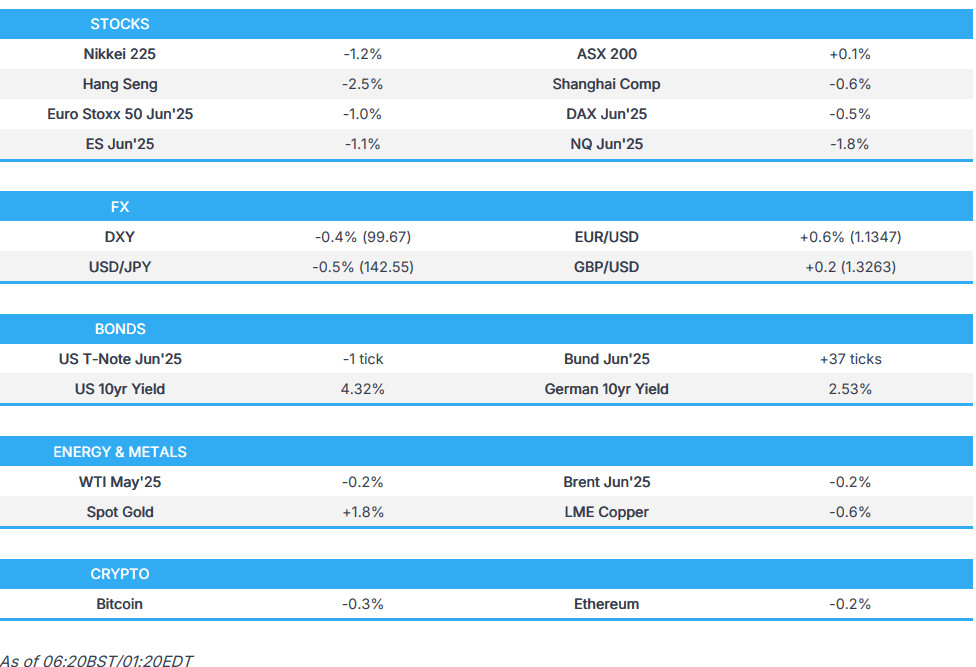

Risk aversion seen as markets react to NVIDIA export licence, ASML earnings, and tariff updates - Newsquawk Europe Market Open

- US bourses finished mixed with futures thereafter pressured after NVIDIA flagged 5.5bln of charges.

- White House said over 15 trade deal proposals are being considered and some could be announced soon.

- DXY gave back some of Tuesday's strength, EUR/USD back above 1.13 and Cable above 1.3250 into UK CPI.

- USTs paused for breath after gains sparked by Treasury officials, Bunds rebounded and JGBs retested 141.00

- Crude benchmarks lackluster, XAU hit another record high while base peers followed the risk tone lower

- Looking ahead, highlights include UK CPI, US Retail Sales, NZ CPI, BoC Policy Announcement, Speakers including Fed’s Powell, Cook, Hammack, Logan & Schmid, BoC's Macklem & Rogers, Supply from Germany & US.

- Earnings from ASML, Heineken, US Bancorp, Abbott, Progressive, Travelers, Prologis, Autliv, Citizens, First Horizon, Alcoa, Barratt Redrow, Moncler, Brunello Cucinelli & Lindt.

- Click for the Newsquawk Week Ahead.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 day

US TRADE

EQUITIES

- US stocks were mixed and the major indices finished mostly negative albeit within contained ranges amid mixed trade updates and data releases. In terms of the recent trade developments, the US implemented a review on pharmaceuticals and semiconductor imports ahead of Trump's planned tariff announcements on the separate sectors and reports suggested China has ordered a halt to Boeing jet deliveries, while the EU reportedly expects US tariffs to remain as talks made little progress and Canada provided a temporary six-month relief from counter-tariffs for goods imported from the US that are used in manufacturing, processing and food and beverage packaging. Furthermore, US data was mixed as the NY Fed Manufacturing headline was better than expected as were some of the internals, although prices paid rose back into expansionary territory and the 6-month economic outlook deteriorated.

- SPX -0.17% at 5,397, NDX +0.18% at 18,830, DJI -0.38% at 40,369, RUT +0.11% at 1,883.

- Click here for a detailed summary.

TARIFFS/TRADE

- US President Trump said the tariff pause was because it is a transition and came from the need for flexibility, while he said they may want countries to choose between the US or China and noted he is getting along well with Mexican President Sheinbaum.

- US President Trump posted on Truth Social that "The United States is taking in RECORD NUMBERS in Tariffs, with the cost of almost all products going down, including gasoline, groceries, and just about everything else. Likewise, INFLATION is down. Promises Made, Promises Kept!"

- White House said President Trump signed an order launching an investigation into national security risks posed by US reliance on imported processed critical minerals and their derivative products.

- White House Press Secretary stated over 15 trade deal proposals are actively being considered and they believe they can announce some very soon, while she noted that President Trump is maintaining his position on Canada. Furthermore, she said President Trump messaged that the ball is in China's court and that they don't have to make a deal with them but Trump is open to a deal with China.

- US intends to use tariff negotiations to isolate China with officials planning to use the negotiations of more than 70 nations to ask them to disallow China to ship goods through their countries, according to WSJ.

- US chip equipment makers calculated that Trump administration tariffs could cost them more than USD 1bln a year, with tariffs estimated to cost Applied Materials (AMAT), Lam Research (LRCX) and KLA Corp (KLAC) USD 350mln each annually, according to Reuters sources. It was also reported that NVIDIA (NVDA) expects USD 5.5bln in charges in Q1 FY2026 related to H20 products after the US informed the Co. it requires a licence to export those chips to China.

- Hong Kong Post suspended the postal service for items containing goods to the US and said for sending items to the US, the public in Hong Kong should be prepared to pay exorbitant and unreasonable fees due to the US's unreasonable and bullying acts.

- US Treasury Secretary Bessent underlined US opposition to digital services tax levied by Spain and other countries as well as other non-tariff barriers, according to the Treasury Department.

- UK Trade Secretary Jonathan Reynolds will travel to Beijing to revive a key trade dialogue with China months after saying it had been naive to allow Chinese investment in sensitive sectors, according to The Guardian.

- Sources told Sky News the UK was "in the foothills" of a deal, but it has not been straightforward, and there is some distance to go.

NOTABLE HEADLINES

- US President Trump signed a healthcare executive order seeking changes to the US Medicare drug price negotiation process and signed an order restoring common sense to federal procurement by simplifying the process, while the order aims to simplify and streamline federal acquisition regulation.

- White House said President Trump has not made a determination on raising the corporate tax rate.

APAC TRADE

EQUITIES

- APAC stocks were mostly subdued following the choppy and rangebound performance on Wall St. amid mixed data releases and as trade frictions lingered, while the mostly better-than-expected Chinese GDP and activity data failed to inspire a bid.

- ASX 200 clawed back losses amid strength in gold miners, consumer staples and financial but with gains limited by weakness in miners including Rio Tinto which reported a drop in quarterly iron production and shipments.

- Nikkei 225 trickled lower to beneath the 34,000 level amid the ongoing global trade war concerns and despite encouraging Machinery Orders.

- Hang Seng and Shanghai Comp underperformed amid US-China trade frictions the US said to intend to use tariff negotiations with other countries to isolate China and will also require a licence for NVIDIA to export H20 processors to China, while mostly better-than-expected GDP and activity data from China failed to inspire given that they were from a period before the US-China tariff escalation.

- US equity futures were pressured and NVIDIA shares fell over 6% overnight after it flagged USD 5.5bln charges related to H20 chips in Q1 FY2026 and revealed the US informed the Co. it needs a licence to export the chips to China.

- European equity futures indicate a lower cash market open with Euro Stoxx 50 futures down 0.7% after the cash market closed with gains of 1.2% on Tuesday.

FX

- DXY gave back some of the prior day's gains following the mixed trade-related headlines. Furthermore, the recent data releases stateside were mixed and participants now await US Retail Sales and comments from Fed Chair Powell.

- EUR/USD benefitted from the greenback's retreat and returned to the 1.1300 territory in a rebound from the prior day's selling pressure which had coincided with pessimism regarding EU-US trade talks and recent mixed data releases including weak German ZEW data.

- GBP/USD gained a firmer footing at the 1.3200 handle with recent upside facilitated by UK employment data and with the focus now turning to UK CPI data.

- USD/JPY retreated beneath the 143.00 level with mild flows into the yen amid the mostly downbeat risk tone and after Machinery Orders topped forecasts.

- Antipodeans were kept afloat in rangebound trade as the cautious mood offset tailwinds from the mostly better-than-expected Chinese GDP and activity data, while the PBoC resumed its weakening of the CNY reference rate.

- PBoC set USD/CNY mid-point at 7.2133 vs exp. 7.3272 (Prev. 7.2096).

FIXED INCOME

- 10yr UST futures took a breather after the prior day's advances which were facilitated by recent comments from Treasury officials, while the upside was restricted overnight ahead of several Fed speakers including Powell and with US supply also scheduled later.

- Bund futures rebounded from the prior day's trough and reverted to above the 131.00 level despite the looming EUR 2.5bln of Bund supply.

- 10yr JGB futures recouped some of this week's lost ground and retested the 141.00 level to the upside amid the cautious risk appetite.

COMMODITIES

- Crude futures were lacklustre amid the cautious risk tone and after mixed private sector inventory data.

- US Private Inventory Data (bbls): Crude +2.4mln (exp. +0.5mln), Distillate -3.2mln (exp. -1.2mln), Gasoline -3.0mln (exp. -1.6mln), Cushing -0.3mln.

- EIA Annual Energy Outlook noted that US crude oil output is expected to grow to 13.88mln BPD in 2030 and is expected to reach the peak of 14.00mln BPD in 2027, while US total product supply of petroleum is to rise to a post-pandemic peak of 20.52mln BPD in 2026.

- Spot gold notched another fresh record high amid a softer dollar and further bullish calls on the precious metal with ANZ raising its six-month forecast to USD 3,5000/oz from USD 3,200/oz and sees prices reaching USD 3,600/oz by year-end.

- Copper futures gradually retreated in tandem with the mostly negative risk tone and with China pressured as trade war tensions simmered.

CRYPTO

- Bitcoin traded uneventfully overnight in a relatively tight range on both sides of the USD 83,500 level.

NOTABLE ASIA-PAC HEADLINES

- China's MOFCOM issued an action plan to promote service consumption which covers areas including catering, tourism and leisure, while it will support the expansion of sectors including catering, accommodation, health, culture, entertainment and tourism. Furthermore, the plan will focus on coordinating domestic and international dual circulation and insist on exerting efforts on both supply and demand, as well as provide strong support for high-quality economic development.

- China's stats bureau deputy commissioner said the unfavourable impact of the international environment on China's economy is deepening, protectionism is rapidly rising globally and the world economic order has been severely damaged. The official said they resolutely oppose US tariffs which are against economic rules and WTO rules, as well as noted that high US tariffs will bring about some pressures on China's trade and economy. However, the deputy commissioner also commented that Q1 data underscores China's strong resilience and potential, while the official added that macroeconomic policies will become more proactive this year and that China has a rich policy toolkit to support the economy.

- Webull Global (BULL) is said to be the latest Co. to come under scrutiny by Congress as US lawmakers pressure regulators and exchanges to "delist" or remove China-based stocks if they violate US disclosure laws, according to FBN's Gasparino citing sources.

- BoJ Governor Ueda said they may need a policy response but will decide appropriately in line with changing developments when asked about a BoJ response if US tariff policy puts downward pressure on Japan's economy, while they will scrutinise without any preconception impact of US tariff policy on Japan's economy which is already affecting corporate and household confidence. Furthermore, Ueda said from February onwards, risks surrounding US tariff policy have moved closer towards the bad scenario the BoJ envisioned and noted the BoJ sees both upside and downside risks to the price outlook, according to Sankei.

DATA RECAP

- Chinese GDP QQ SA (Q1) 1.2% vs. Exp. 1.4% (Prev. 1.6%); GDP YY 5.4% vs. Exp. 5.1% (Prev. 5.4%)

- Chinese Industrial Output YY (Mar) 7.7% vs. Exp. 5.8% (Prev. 5.9%)

- Chinese Retail Sales YY (Mar) 5.9% vs. Exp. 4.2% (Prev. 4.0%)

- Chinese Unemployment Rate Urban Area (Mar) 5.20% (Prev. 5.40%)

- Chinese China House Prices MM (Mar) -0.08% (Prev. -0.10%); YY -4.5% (Prev. -4.8%)

- Japanese Machinery Orders MM (Feb) 4.3% vs. Exp. 0.8% (Prev. -3.5%)

- Japanese Machinery Orders YY (Feb) 1.5% vs. Exp. -1.4% (Prev. 4.4%)

GEOPOLITICS

MIDDLE EAST

- Israel's army said it bombed Hezbollah infrastructure in southern Lebanon, according to Sky News Arabia.

- US President Trump held a meeting on Tuesday morning in the White House situation room about the ongoing nuclear deal negotiations with Iran, according to two sources with direct knowledge cited by Axios.

RUSSIA-UKRAINE

- White House press secretary said President Trump believes Russia wants to end the war in Ukraine.