markets

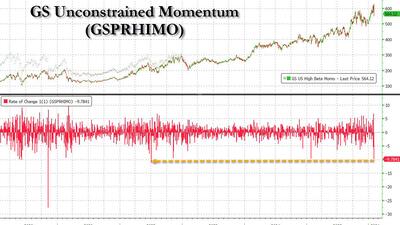

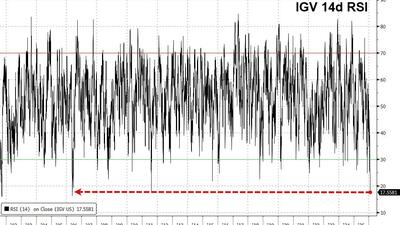

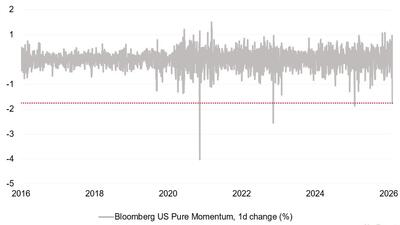

"Today’s session represents a clear escalation of the rotation and dispersion themes that surfaced yesterday - less about Software and more about a broader “re-risking to reversal” moment, where crowded Momentum exposure is being challenged aggressively" - Morgan Stanley

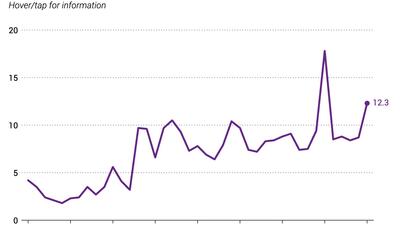

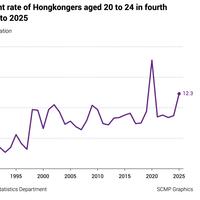

Recruiters say companies are now far more selective in their hiring.

...but “structural drivers remain intact and we continue to expect a rebuild to the upside.”

Estimate your earnings

oz

Calculate earnings

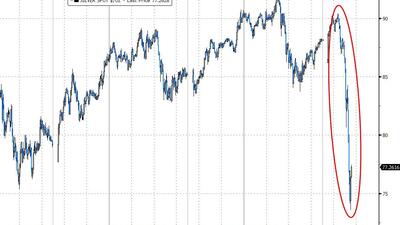

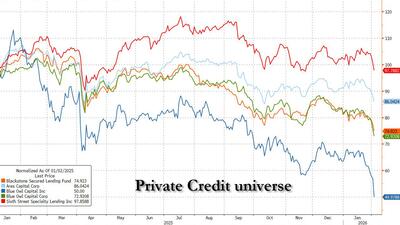

...trading is dominated by survival moves rather than fundamentals... as hedge funds were hammered...

Software stocks - secularly challenged but technically oversold - remain in the ‘too hard box’...

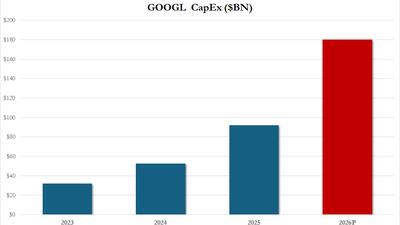

This capex number is... nuts.

"More of an unwind than rotation. More defense than offense. Retail is actually less active but also not supporting the tape. Buybacks are a at a seasonal low."

Perfection is priced in. Good luck getting anything more in this tape.

Japan's transition from a monetary- and fiscal-policy-dependent economy to a free-market economy could significantly affect a major source of global market liquidity...

“Until the dust settles, it’s a dangerous path to be standing in the way of AI.”

Who is most exposed, and how big are the projected losses?

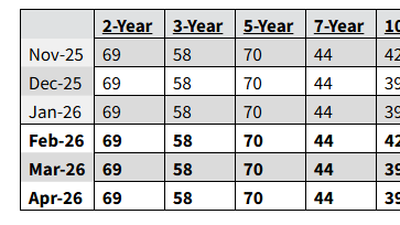

"Based on current projected borrowing needs, Treasury anticipates maintaining nominal coupon and FRN auction sizes for at least the next several quarters"

“I don’t think the market has fully resolved whether this move was based on fear or fundamentals. What’s clear is that we’ve had a confidence break, really, at the category level. Before convictions can be rebuilt at that really important company level, we are seeing this kind of indiscriminate selling.”

"Guidance is messy..."

The repeated desire of ECB President Christine Lagarde to centralize national gold reserves at the ECB vault is almost universally rejected by eurozone members. So much for the repeatedly touted integration of the euro system.