FOMC Minutes Confirm Fed Members Fear Trade Policy "Uncertainty", Support QT Taper

A lot - and we mean a lot - has happened since the last FOMC meeting on March 19th. Bonds, stocks, and commodites have colppased; gold has made solid gains and the dollar is unchanged as Trump's 'Liberation Day' malarkey smashed the punchbowl...

Source: Bloomberg

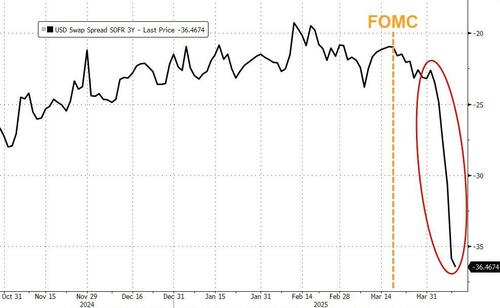

Funding markets are starting to break...

Source: Bloomberg

Rate-cut expectations have surged from around 2 cuts to 4-5 cuts this year...

Source: Bloomberg

In the three weeks since the FOMC meeting, hard data has improved significantly while soft data has crashed...

Source: Bloomberg

So, with all that in mind, and having heard multiple Fed speakers since (including the Chair himself) all singing from the same hymn-sheet - 'lots of uncertainty'... 'we have time to pause' etc... we will see what exactly The Fed wanted us to take from the last meeting...

Key Headlines include (via Newssquawk):

RATES

All participants viewed it appropriate to keep interest rates unchanged in light of elevated uncertainty around economic outlook

Participants remarked uncertainty about net effect of government policies on the outlook was high, making it appropriate to take a cautious approach

STANCE

A majority of participants noted potential for inflationary effects from various factors to be more persistent than they projected

Participants assessed fomc was well positioned to wait for more clarity on the outlook

INFLATION

Almost all participants viewed risk to inflation as tilted to the upside, risks to employment as tilted to the downside

Some participants observed fomc may face difficult tradeoffs if inflation proved more persistent while the outlook for growth and employment weakened

Several participants emphasized that elevated inflation could prove to be more persistent than expected

BALANCE SHEET

Almost all participants supported slowing pace of balance sheet runoff; several did not see a compelling case for a slower runoff pace

A few participants cautioned an abrupt repricing of risk in financial markets could exacerbate effects of any negative economic shocks

PROJECTIONS

Fed staff projection for real GDP growth was weaker than one prepared for January meeting

Read the full FOMC Minutes below: