APAC stocks traded mostly higher after advances on Wall Street amid lack of trade & Ukraine updates - Newsquawk Europe Market Open

- APAC stocks were mostly higher after the advances on Wall Street with light catalysts otherwise light.

- Israel's military said it conducted extensive strikes and targets belonging to Hamas in Gaza.

- European equity futures indicate a positive cash market open with Euro Stoxx 50 futures up 0.4% after the cash market closed with gains of 0.8% on Monday.

- DXY is steady above the 103.50 mark, EUR/USD is back on a 1.09 handle, JPY lags again, Cable is eyeing 1.30.

- US President Trump’s administration is reportedly considering recognising Ukraine’s Crimea region as Russian territory, according to Semafor citing sources.

- Looking ahead, highlights include German/EZ ZEW, Canadian Inflation, US Industrial Production, Imports/Exports, Japanese Exports/Imports, German Bundestag third reading on fiscal reform (vote), US President Trump-Russian President Putin Call, Speakers including ECB’s Escriva & NVIDIA CEO Huang.

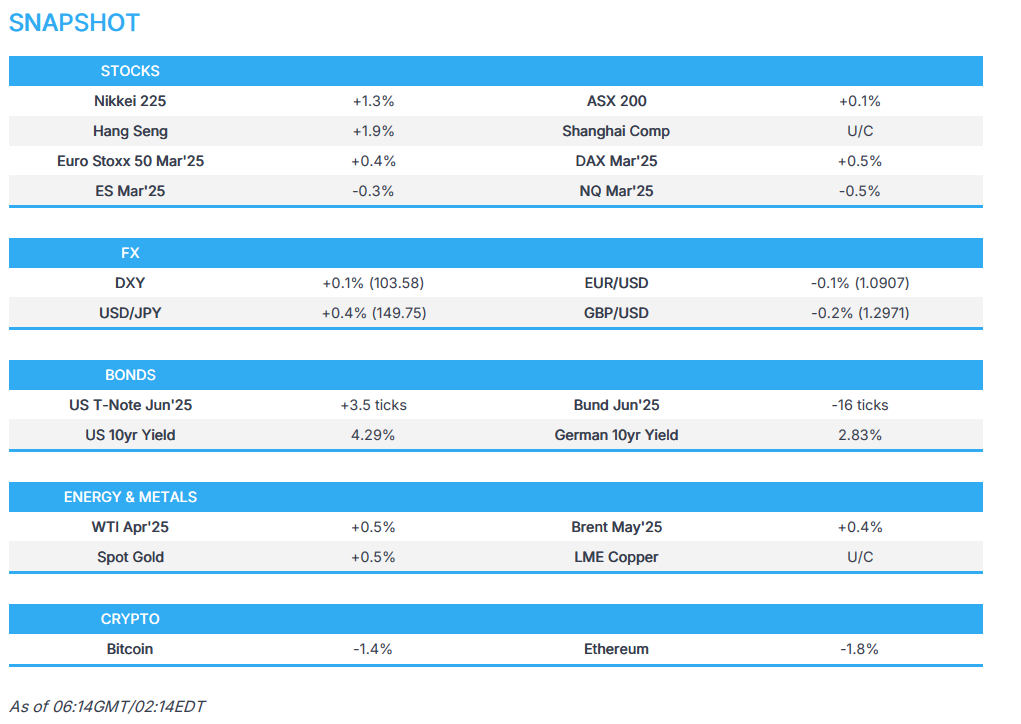

SNAPSHOT

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks caught a bid as the risk tone improved after recent turmoil with outperformance in Real Estate, Energy and Industrials, while nearly all sectors closed in green, aside from Consumer Discretionary. The focus of the day was on economic data including a mixed Retail Sales report and a dismal NY Fed Manufacturing survey, while there was a lack of fresh trade/tariff updates other than the White House repeating that reciprocal tariffs will come into effect from April 2nd.

- SPX +0.69% at 5,677, NDX +0.55% at 19,812, DJI +0.87% at 41,847, RUT +1.18% at 2,068.

- Click here for a detailed summary.

TARIFFS/TRADE

- White House said reciprocal tariffs will go into effect on April 2nd.

- US President Trump's team reportedly explored a simplified plan for reciprocal tariffs in which they recently debated sorting trading partners into one of three tiers instead of equalising tariff rates with every nation, although the proposal was said to have been ruled out, according to WSJ citing officials.

- USTR Greer is imposing a policy process on the reciprocal tariff plan in an attempt to inject order into new tariffs expected next month, after previous announcements roiled markets and fuelled business uncertainty.

- Canadian PM Carney said they are not trying to organise a coordinated retaliation against US tariffs and want a more comprehensive discussion and negotiation of their overall commercial and security relationship with the US. Carney also said that Trump's comments about Canada will need to stop before bilateral talks can start.

NOTABLE HEADLINES

- US President Trump posted on Truth that he is pleased to announce that Fed's Michelle Bowman will be the Federal Reserve’s new Vice Chair of Supervision.

- US President Trump is scheduled to sign executive orders at 15:30EDT/19:30GMT on Tuesday.

- US President Trump's administration is reportedly planning a 25% workforce reduction at the US IRS taxpayer help office, according to The Washington Post.

APAC TRADE

EQUITIES

- APAC stocks were mostly higher after the advances on Wall Street and with light catalysts heading into this week's central bank announcements, although some of the gains were capped as Israel resumed its bombardment of Gaza.

- ASX 200 was underpinned at the open but then pared the majority of its initial gains with strength in energy and defensives partially offset by losses in tech and consumer discretionary.

- Nikkei 225 coat-tailed on recent currency moves and retested the 38,000 level to the upside with strength in Japanese trading houses after Berkshire Hathaway boosted its stake in Japan's five largest trading houses.

- Hang Seng and Shanghai Comp were ultimately mixed with the Hong Kong benchmark significantly outperforming on tech strength and with Baidu leading the advances after its recent AI reasoning model launch, while the mainland struggled for firm direction in rangebound trade.

- US equity futures (ES -0.3%, NQ -0.5%) marginally retreated and took a breather following the prior day's rally.

- European equity futures indicate a positive cash market open with Euro Stoxx 50 futures up 0.4% after the cash market closed with gains of 0.8% on Monday.

FX

- DXY traded rangebound after softening yesterday amid the risk-on sentiment and ahead of a deluge of risk events including the FOMC on Wednesday, while recent data releases from the US were mixed and there was little fresh news on the tariff front aside from reiterations that reciprocal tariffs will take effect on April 2nd.

- EUR/USD mildly retreated after benefitting yesterday from dollar weakness to reclaim the 1.0900 status in a day void of currency-specific headlines and with participants looking ahead to the ZEW data and the German parliamentary vote on boosting spending for defence and infrastructure.

- GBP/USD gradually pulled back after recent upward momentum was stalled by resistance shy of the 1.3000 level.

- USD/JPY extended on gains alongside the constructive risk sentiment seen in stocks and as the BoJ kick-started its 2-day policy meeting with the central bank widely expected to keep rates unchanged after hiking at the last meeting.

- Antipodeans held on to most of the prior day's spoils which were facilitated by the positive risk environment.

- PBoC set USD/CNY mid-point at 7.1733 vs exp. 7.2364 (Prev. 7.1688).

FIXED INCOME

- 10yr UST futures eked mild gains after yesterday's choppy price action and mixed data releases, although the upside was capped ahead of looming supply and tomorrow's FOMC.

- Bund futures marginally softened after recent upward momentum was stalled by resistance around the 128.00 level, while participants now await German ZEW data and the Bundestag's voting on fiscal reform,

- 10yr JGB futures lacked demand amid strength in Japanese stocks and as the BoJ kick-started its two-day meeting.

COMMODITIES

- Crude futures remained afloat and held on to the prior day's marginal gains with mild tailwinds from recent geopolitical developments including US strikes against Houthis in Yemen and Israel's extensive strikes in Gaza.

- US President Trump posts on Truth that he is authorising his administration to "immediately begin producing Energy with BEAUTIFUL, CLEAN COAL"

- US Energy Secretary Wright said they expect to see a lot of pipelines getting built, according to Fox Business.

- Spot gold further extended on record highs after gradually ascending above the USD 3,000/oz level.

- Copper futures were underpinned in tandem with the mostly positive risk appetite across Asia-Pac.

CRYPTO

- Bitcoin retreated overnight and tested the USD 83,000 level to the downside.

NOTABLE ASIA-PAC HEADLINES

- US President Trump said Chinese President Xi will be coming "in the not too distant future".

GEOPOLITICS

MIDDLE EAST

- Israel's military said it conducted extensive strikes and targets belonging to Hamas in Gaza and the Israeli PM Netanyahu's office said the PM and Defence Minister directed the military to take strong actions against Hamas in Gaza following the group's persistent refusal to release hostages and rejections of the proposals it has received.

- Israeli military said Home Command ordered restrictions on civilian activity near the Gaza Strip following strikes against Hamas and Israeli media said the air attack included the assassination of military and political leaders in Hamas. Furthermore, President Trump reportedly gave Israel the green light to resume attacks after Hamas refused to release hostages, according to an Israeli official cited by WSJ.

- Israeli media quoted security sources that stated the aim of the resumption of fighting in Gaza is to pressure Hamas to return to the negotiating table and release as many hostages as possible, while security sources added if Hamas does not respond, the operation will expand and will not be limited to air activity only.

- Hamas said Israel resumed aggression against civilians in Gaza and is unilaterally ending the ceasefire agreement, while it also stated that Israeli PM Netanyahu and his government decided to overturn the ceasefire agreement, exposing hostages in Gaza to an unknown fate. It was also reported that Israeli strikes killed at least 310 people and senior Hamas security official Mahmoud Abu Watfa was killed in Israeli strikes on Gaza.

- US Secretary of State Rubio said without Iran there would be no Houthi threat of this magnitude and that Iran created this terrifying monster which they have to take responsibility for.

- Pentagon said regarding Yemen strikes that "this is not an endless offensive" and is not aimed at regime change, while it will use overwhelming lethal force until it achieves its objective in Yemen and noted the initial wave of US strikes in Yemen hit over 30 targets including Houthi training sites. Furthermore, the Pentagon said they are going after a much broader set of targets in Yemen than under Biden and that Houthis could stop US strikes by saying they will halt their attacks.

- US Central Command said its forces continued strikes against Iranian-backed Houthi terrorists, according to Sky News Arabia. It was separately reported that a US spy drone retreated from near Iranian airspace after encountering Iranian F-14 fighter jets and reconnaissance drones, according to NourNews.

- Iran rejected and condemned 'reckless, provocative' statements by US President Trump and said it has not violated the UN arms embargo on Yemen or engaged in destabilising activities in the region, according to a letter to the UN Security Council Furthermore, Iran said that the Houthis and Yemeni authorities operate independently in their decision-making and actions.

RUSSIA-UKRAINE

- US President Trump posted on Truth that he will be speaking to Russian President Putin concerning the war in Ukraine on Tuesday morning and many elements of a final agreement have been agreed to, but much remains.

- US President Trump’s administration is reportedly considering recognising Ukraine’s Crimea region as Russian territory as part of any future agreement to end Moscow’s war on Kyiv and admin officials have also discussed the possibility of having the US urge the UN to do the same, according to Semafor citing sources. However, Trump has not formally made any decisions and the possible Crimea moves are two of a multitude of options being floated as his administration pushes for an end to the war.

EU/UK

NOTABLE HEADLINES

- Top German court rejected additional attempts to stop the debt brake reform vote.