markets

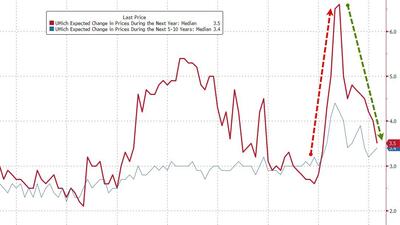

"Trump aggressive intervention to reduce price of energy, healthcare, credit, housing, electricity via Big Oil, Big Pharma, Big Banks, Big Tech means small & mid-cap best play for "boom" on Main St in run-up to US midterms" - Michael Hartnett, BofA

As of this writing, Takaichi's LDP is projected to reach around 300 seats or even higher, the highest percentage of seats in its history...

“These convenience stores were magnets for drug activity, and, in some cases, the stores were selling illegal drugs themselves...”

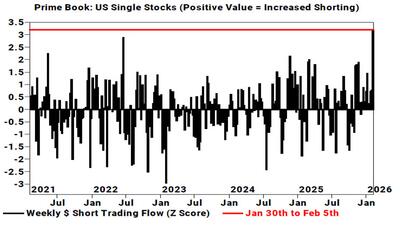

"This week’s notional short selling in US Single Stocks was the largest on our record" - Goldman Prime Brokerage

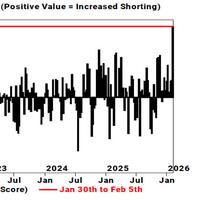

Bitcoin usually fakes its own death - but it truly could be different this time...

Estimate your earnings

oz

Calculate earnings

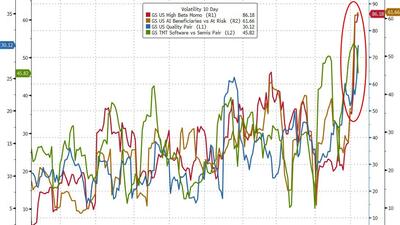

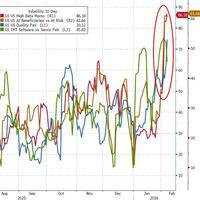

The var shock has indeed left a mark...

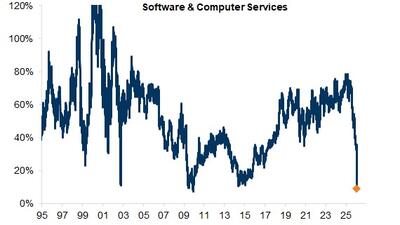

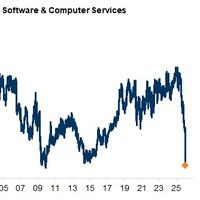

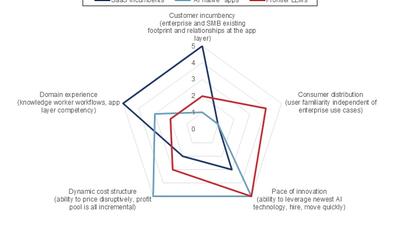

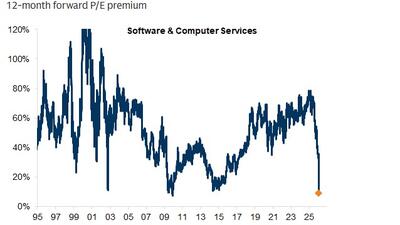

Bigger picture, the question is whether this cohort can convince investors that it’s not as fundamentally challenged as the recent de-rating would suggest it is...

"As a result, we have decided to stop offering access to this treatment. We remain committed..."

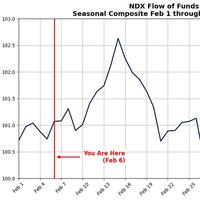

Dow record high, gold green on the week, tech wrecked but S&P unch, crypto dump-and-pump...

The bank’s 2024 bonus pool remained flat at $3.8 billion, defying an industry trend toward higher payouts. Some staff, particularly in corporate and institutional banking, were warned to expect lower awards.

"This week’s tape can only be categorized as adult swim... and then some..."

...expect it will take 2-3 quarters of stable fundamentals for investor sentiment to improve.

HGP Intelligent Energy is partnering with the Shaw Group to deploy U.S. Navy submarine and aircraft carrier nuclear reactors at the DOE's Paducah, Kentucky facility.

...one could argue that much of the risk is already reflected.

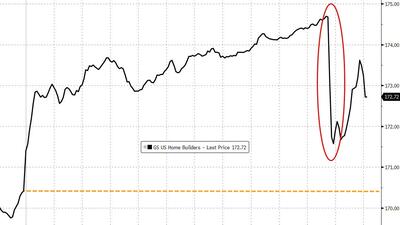

Trump admin is exploring opening an antitrust investigation into US homebuilders as the White House sharpens its focus on tackling the country’s housing affordability crisis...

“Now do we suffer the evils of prolonged peace; luxury, more ruthless than the sword, broods over us and avenges a conquered world.”

...as Democrats and Independents come to their senses.