NS

NSFed noted a lack of progress on inflation; marked USD/JPY moves - Newsquawk Europe Market Open

- Fed kept rates unchanged, noted a lack of progress on inflation and decided to slow the pace of its balance sheet runoff.

- US Stocks ended the session softer despite an initial dovish reaction, US yield curve bull-steepened.

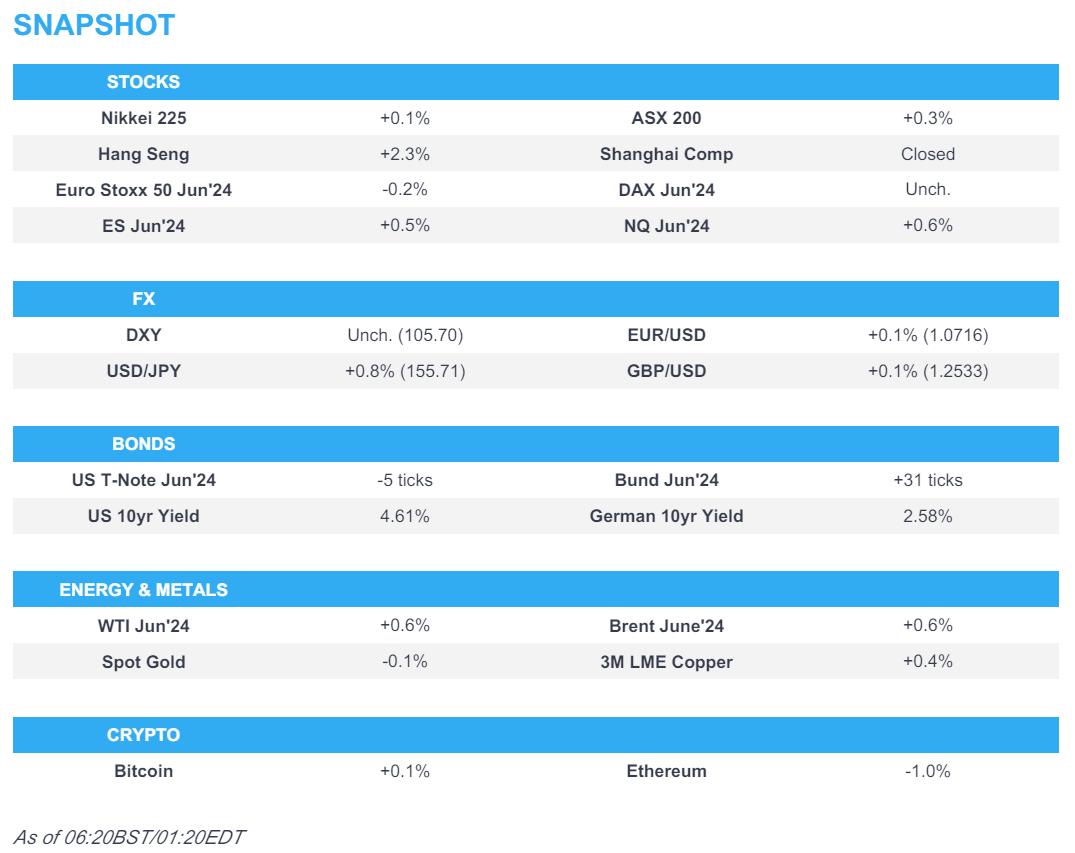

- European equity futures indicate a lacklustre open with the Euro Stoxx 50 future down 0.2%.

- USD/JPY dropped aggressively late in the US session amid suspected FX intervention; formed a trough near 153.

- Looking ahead, highlights include Swiss CPI, EZ Manufacturing PMI, US Challenger Layoffs, International Trade, IJC, CNB Policy Announcement, ECB’s Lane, BoC's Macklem & Rogers, Supply from France.

- Earnings from Standard Chartered, Shell, Smurfit Kappa, ING, Novo Nordisk, Pandora, Swisscom, Apple, Moody's, ConocoPhillips, Becton Dickinson, Linde, Amgen, Moderna, Motorola, Zoetis, Booking, Cigna, Cardinal Health & Peloton.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks finished mixed after having unwound the overall dovish reaction to the FOMC where the Fed left rates on hold as expected but announced to taper its QT run-off to just USD 25bln a month from USD 60bln which was slightly more dovish than the expected USD 30bln. The typical dovish reaction (upside in stocks, bonds, gold and downside in the Dollar) extended during Fed Chair Powell's press conference as he noted it was unlikely the next move would be a hike and the Fed is focused on how long to keep policy at its current level although he did admit several times that the recent inflation data does not boost the Fed's confidence in inflation returning to 2% but believes that policy is restrictive enough for that to occur. Nonetheless, after the dust settled, stocks then saw a large reversal heading into the close.

- SPX -0.34% at 5,018, NDX -0.70% at 17,318, DJIA +0.23% at 37,903, RUT +0.32% at 1,980.

- Click here for a detailed summary.

FOMC

- Fed kept its rates unchanged at 5.25-5.50% as expected and said it will slow the decline of the balance sheet by cutting the Treasury redemption cap by USD 35bln (exp. 30bln) to USD 25bln per month from USD 60bln from June 1st with its decision made unanimously. FOMC noted there has been a lack of further progress towards 2% inflation and it maintained its language that economic activity has continued to expand at a solid pace and job gains have remained strong, while the unemployment rate has remained low and inflation has eased over the past year but remains elevated. It also reiterated that the Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2% and it would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals. Furthermore, it said risks to achieving employment and inflation goals have moved toward better balance over the past year vs. "are moving into better balance" in March.

- Fed Chair Powell said during the press conference that the economy has made considerable progress towards its dual goals and inflation eased substantially over the past year but it is still too high and further progress is not assured with the path ahead uncertain. Powell said the Fed does not expect it will be appropriate to cut rates until they have greater confidence in moving towards 2% and so far this year inflation readings have not given the Fed that greater confidence, while he added gaining confidence to cut will take longer than thought and slowing the pace of QT does not mean the balance sheet will shrink less than it would otherwise, but it will ensure a smooth transition for money markets.

- Fed Chair Powell said during the Q&A that they are committed to retaining a restrictive stance of policy for as long as appropriate and it is unlikely the next policy move will be a rate hike, while the Fed is focused on how long to keep policy restrictive. Powell stated that for a hike, the Fed would need to see evidence policy is not sufficiently restrictive and that is not what they see. Powell said he thinks policy is well positioned to address different paths the economy might take and he responded that the Fed needs more confidence on inflation and he did not see progress in Q1 when asked about 3 cuts this year. Furthermore, he said it will take the Fed longer to get to sufficiently confident to change policy rate and there are paths to no cuts this year but also paths to cuts and it depends on the data, as well as noted that as inflation has come down to below 3%, the Fed's employment goal comes back into focus and he thinks the stance is appropriate for inflation to return to 2% over time.

NOTABLE HEADLINES

- US reportedly discussed finalising bank capital rules as soon as August, while the Fed, FDIC, and OCC won't completely redo the July 2023 proposal, according to Bloomberg.

APAC TRADE

EQUITIES

- APAC stocks traded mostly positive but with the upside for most bourses limited as the region reflected on the recent FOMC meeting and suspected Japanese currency intervention.

- ASX 200 was led higher by gold miners, financials and tech which benefitted from softer yields, while participants also digested earnings releases including from NAB and Woolworths.

- Nikkei 225 clawed back opening losses and returned to flat territory as effects of suspected intervention subsided.

- Hang Seng outperformed on return from the holiday closure despite the continued absence of mainland participants and Stock Connect flows with developers helped after China's Politburo pledged efforts to support the property sector, while tech rallied as the unlikelihood of a US rate hike also bodes well for Hong Kong stocks given the HKMA's requisite to move in lock-step with the Fed.

- US equity futures (ES +0.5%) gradually edged higher following the post-FOMC whipsawing.

- European equity futures indicate a lacklustre open with Euro Stoxx 50 futures down 0.2%.

FX

- DXY remained restrained after slipping yesterday in the aftermath of the FOMC and dovish press conference as the Fed's QT taper was larger than anticipated and Powell essentially ruled out another hike but also noted that he does not know how long it will take before the Fed can cut, while the dollar was also pressured late in the US session as USD/JPY dropped aggressively amid suspected FX intervention.

- EUR/USD took a breather after reclaiming the 1.0700 status on the back of recent dollar softness, while there was little newsflow from Europe amid the recent Labour Day closures and comments from ECB's de Cos also provided very little incrementally.

- GBP/USD climbed above its 100- and 200-DMAs after the FOMC and recent data, while the UK heads to the polls for local elections.

- USD/JPY continued its recovery from the latest speculated intervention and briefly returned to the 156.00 handle after bouncing back from an aggressive drop to a trough near 153.00, while officials have remained tight-lipped on whether they intervened.

- Antipodeans held on to post-FOMC spoils but with further upside capped after building approvals and trade balance data from Australia missed estimates.

FIXED INCOME

- 10-year UST futures pared some of their advances following yesterday's post-FOMC bull-steepening.

- Bund futures nursed some of this week's losses and reclaimed the 130.00 level on return from the holiday.

- 10-year JGB futures trickled lower from yesterday's peak with demand subdued after stale BoJ minutes and weaker demand at the enhanced-liquidity auction.

COMMODITIES

- Crude futures languished near the prior day's lows with WTI beneath the USD 80/bbl level after slumping on bearish inventory data.

- Ukrainian drones damaged energy infrastructure and caused power cuts in Russia's central Oryol region, while it was separately reported that Ukrainian drones tried to attack energy infrastructure in Russia's Smolensk region.

- Spot gold was steady but held onto post-FOMC gains after a less hawkish-than-feared Fed facilitated a return to above USD 2,300/oz.

- Copper futures were kept afloat by recent dollar weakness but with gains capped amid the mixed risk tone.

CRYPTO

- Bitcoin remained pressured overnight although found a floor around the USD 57,000 level.

NOTABLE ASIA-PAC HEADLINES

- HKMA maintained its base rate unchanged at 5.75%, as expected and in lock-step with the Fed.

- Senate Democrats reportedly urge the Biden administration to raise tariffs on China and warned that any cuts to Trump-era duties could hurt US workers, according to Politico.

- US FCC moved to tighten rules to bar Chinese telecoms Huawei, ZTE, and others from certifying wireless equipment, according to officials.

- BoJ March Meeting Minutes stated many members shared the view long-term rates should be set by markets and a few members said the BoJ should at some point in the future reduce bond buying amount and shrink its bond holdings, while a few members said the BoJ's March move is different from the monetary tightening phase experienced in US and Europe. Furthermore, one member said the impact of the rise in short-term rate to around 0.1% will likely be limited and one member said BoJ should slowly but steadily move towards policy normalisation with an eye on economic and price developments.

- RBNZ's Deputy Governor Hawkesby said the economy is evolving largely as they expected, while mortgage arrears have risen and are not projected to rise as far as they were, according to Reuters.

DATA RECAP

- Australian Building Approvals MM (Mar) 1.9% vs. Exp. 3.0% (Prev. -1.9%, Rev. -0.9%)

- Australian Trade Balance (AUD)(Mar) 5.0B vs. Exp. 7.3B (Prev. 7.3B)

- Australian Goods/Services Exports (Mar) 0.10% (Prev. -2.20%)

- Australian Goods/Services Imports (Mar) 4.20% (Prev. 4.80%)

GEOPOLITICS

MIDDLE EAST

- Israeli military chief Halevi said the offensive in Gaza will continue and Israel is preparing for an offensive in the north, according to Sky News Arabia.

- US Secretary of State Blinken said Israel has made very important compromises over the proposal for the hostage deal, while he added they have seen real and meaningful progress in recent weeks.

- Hamas official reportedly expressed opposition to latest hostage deal offer, but the group said talks continue, according to the Times of Israel via social media platform X.

- White House said there was no response from Hamas on the ceasefire and hostage release proposal.

OTHER

- US State Department said Russia breached the global chemical weapons ban in the Ukraine war.

- US imposed fresh Russia-related sanctions on hundreds of people and entities which target companies connected to Russia's Arctic LNG 2 project, according to the Treasury website. US issued sanctions on more than a dozen China and Hong Kong-based companies as part of Russia action, while it imposed sanctions on Russian air carrier Pobeda which is a subsidiary of Aeroflot.

- US, UK and Canadian cybersecurity agencies warned that pro-Russian “hacktivists” are attempting to compromise computer networks for critical industrial sectors of the economy in North America and Europe, according to Bloomberg.

EU/UK

NOTABLE HEADLINES

- ECB's de Cos said Eurozone inflation will fluctuate for the rest of 2024, then fall to the 2% target in mid-2025, while he noted risks to the inflation outlook are now balanced and transmission remains a downside risk to the growth outlook. De Cos also said the ECB has gained confidence in its forecasts after the latest inflation data.